Vietnam: What is the guidance on looking up PIT payment history on eTax Mobile application?

What is the guidance on looking up PIT payment history on the eTax Mobile application in Vietnam?

Currently, taxpayers can look up their PIT payment history and submitted tax declarations on the eTax Mobile application by following these instructions:

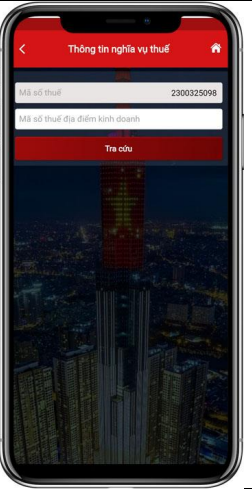

Step 1: Log in to your account on the eTax Mobile Application.

After successfully logging into the system, select the function Tax Obligation Lookup > All Tax Obligations.

- "TIN" Information: Displays the logged-in TIN, not editable.

- "Business Location TIN" Information: Leave blank. Taxpayers enter the business location TIN to look up the tax obligation handling status of the business location. Note: Displayed only if logged in with a 10-digit TIN.

Step 2:

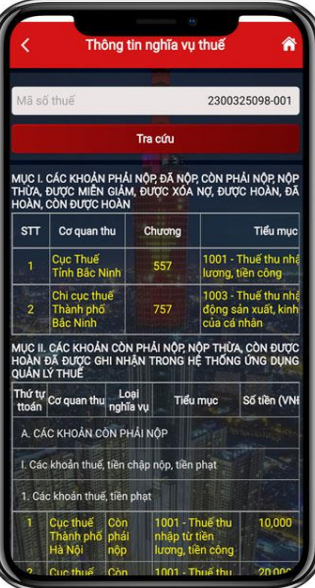

Taxpayers click "Lookup," the system will display the tax obligation lookup result screen with the following information:

- Section I: Amounts payable, paid, outstanding, overpaid, exempted, debt cleared, refundable, refunded, and yet to be refunded.- Section II: Outstanding, overpaid, and refundable amounts recorded in the tax management system.

Step 3:

In Section I, the system will display the following information: Collecting Agency, Program, Sub-item.

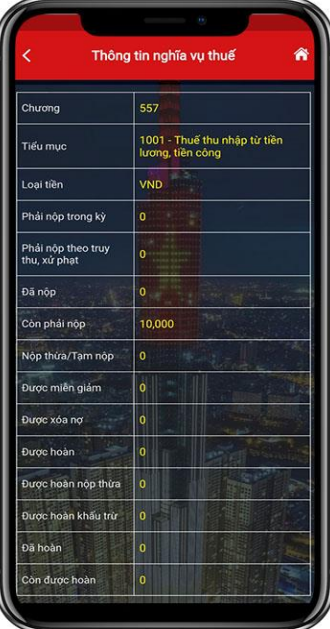

Taxpayers click on the icon to view detailed information. The system will display a detailed information screen including:

- Program

- Sub-item

- Currency

- Payable amount

- Payable amount according to arrears, fines

- Paid amount

- Outstanding

- Overpaid/Temporary payment

- Exempted amount

- Debt cleared

- Refundable

- Overpaid refund

- Deductible refund

- Refunded amount

- The remaining amount to be refunded

Step 4:

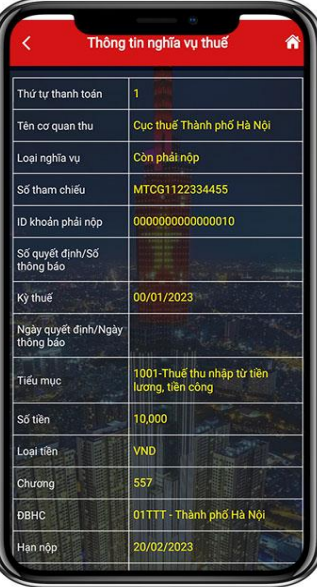

In Section II, the system displays the following information: payment order, collecting agency, obligation type, sub-item, amount, and handling suggestions.

Taxpayers click on the icon to see detailed information. The system will display a detailed information screen including:

- Payment order

- Name of the collecting agency

- Obligation type

- Reference number

- Payable ID

- Decision number/Notification number

- Tax period

- Decision date/Notification date

- Sub-item

- Amount

- Currency

- Program

- Administrative unit code

- Payment deadline

- Amount paid at commercial bank

- Status

What is the guidance on looking up PIT payment history on the eTax Mobile application in Vietnam? (Image from the Internet)

What is the deadline for the PIT finalization declaration in Vietnam?

According to Article 28 of Decree 65/2013/ND-CP, employees will be organized to declare provisional payments based on their income from salaries and remunerations.

Under Clause 1, Article 55 of the Tax Administration Law 2019, it is stipulated as follows:

Tax payment deadlines

1. In case tax is calculated by the taxpayer, the tax payment deadline is the deadline for submission of the tax declaration dossier. In case of submission of supplementary tax documents, the tax payment deadline is the deadline for submission of the erroneous tax declaration dossier.

The deadline for paying corporate income tax, which is paid quarterly, is the 30th of the first month of the next quarter.

The deadline for paying resource royalty and corporate income tax on crude oil is 35 days from the date of selling domestically or the date of customs clearance in case of export.

Resource royalty and corporate income tax on natural gas shall be paid monthly.

...

Furthermore, according to Clause 2, Article 44 of the Tax Administration Law 2019, the deadline for the PIT finalization declaration filing is stipulated as follows:

Deadlines for submission of tax declaration dossiers

...

2. For taxes declared annually:

a) For annual tax statement dossiers: the last day of the 3rd month from the end of the calendar year or fiscal year. For annual tax declaration dossiers: the last day of the first month from the end of the calendar year or fiscal year

b) For annual personal income tax statements prepared by income earners: the last day of the 4th month from the end of the calendar year;

c) For presumptive tax declarations prepared by household businesses and individual businesses: the 15th of December of the preceding year. For new household businesses and individual businesses: within 10 days from the date of commencement of the business.

...

Thus, the deadline for the PIT finalization declaration is divided into two timing points for two cases as follows:

- No later than the last day of the third month from the end of the calendar year or fiscal year for tax finalization declarations made by enterprises on behalf of employees.

- No later than the last day of the fourth month from the end of the calendar year for personal finalization tax declarations of individuals directly finalizing tax.

How to calculate the late payment fine of PIT in Vietnam?

According to Clause 2, Article 59 of the Tax Administration Law 2019, it is stipulated as follows:

Handling for Late Tax Payment

...

2. The calculation of late payment interest and the time to calculate late payment interest are stipulated as follows:

a) The late payment interest is 0.03%/day on the overdue tax amount;

b) The time to calculate late payment interest is continuously from the day following the day of overdue tax as stipulated in Clause 1 of this Article until the day before the overdue tax, refunded tax, additional tax, and assessed tax are paid to the state budget.

...

Thus, the calculation for late PIT payment is:

Late payment interest = 0.03% x Overdue tax amount.