Vietnam: What is the customs declaration form - Form HQ/2015/XK? What are the instructions for filling in the customs declaration form - Form HQ/2015/XK?

What is the customs declaration form - Form HQ/2015/XK in Vietnam?

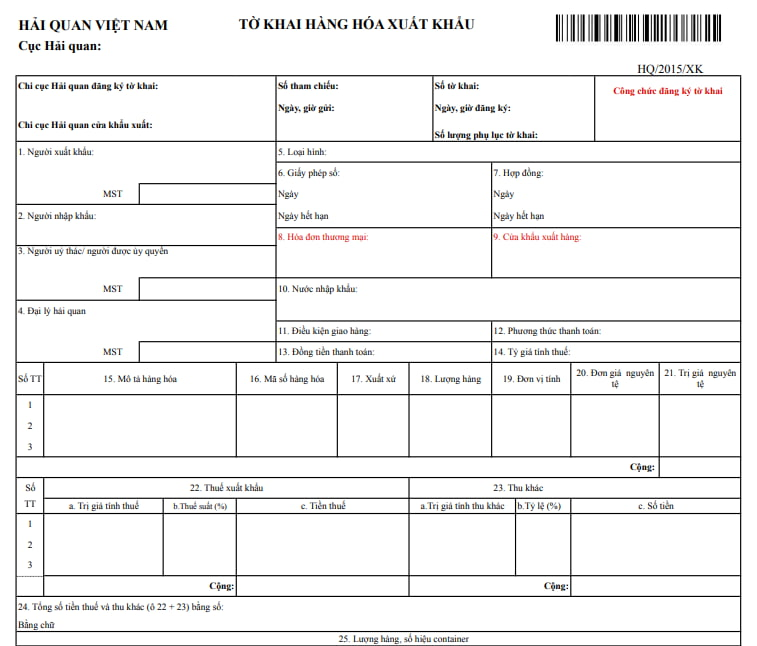

Currently, the customs declaration form for exports is Form HQ/2015/XK, as stipulated in Appendix 5 issued together with Circular 38/2015/TT-BTC.

Form HQ/2015/XK: DOWNLOAD

What is the customs declaration form - Form HQ/2015/XK in Vietnam? What are the instructions for filling in the customs declaration form - Form HQ/2015/XK? (Image from Internet)

What are the instructions for filling in the customs declaration form - Form HQ/2015/XK in Vietnam?

According to Appendix 4 issued together with Circular 38/2015/TT-BTC, the the instructions for filling in the customs declaration form are specified as follows:

| Entry | Specific content |

| Top left corner | The declarant writes the name of the Customs Sub-Department where the declaration is registered, the Customs Sub-Department at the export checkpoint; |

| Middle part of the declaration | * Declaration number, registration date and time: is the serial number of the daily registration number of the export declaration at each Customs Sub-department in the order: Declaration number/XK/type/unit registering the declaration and the number of declaration appendices. * Number of declaration appendices: is the number of appendices of the declaration (in case the shipment has 4 or more items) |

| Top right corner | The customs officer receiving the registration of the export declaration signs and affixes the official seal. |

| A- Section for customs declarant to declare and calculate tax | |

| Box 1 | Exporter: The declarant writes the full name, address, telephone number, fax number, and tax code of the Vietnamese merchant selling goods to the foreign buyer (as shown on the sales contract); ID card or passport (if individual). |

| Box 2 | Importer: The declarant writes the full name, address, telephone number, fax number, and code (if any) of the importing merchant. |

| Box 3 | Principal or authorized person: The declarant writes the full name, address, telephone number, fax number, and tax code of the merchant authorizing the exporter or the full name, address, telephone number, fax number, and tax code of the person authorized to declare customs; ID card or passport (if the authorized person is an individual). |

| Box 4 | Customs broker: The declarant writes the full name, address, telephone number, fax number, and tax code of the customs broker; Number, date of the customs brokerage contract. |

| Box 5 | Type of export: The declarant clearly states the corresponding type of export. |

| Box 6 | License/Date/Expiration Date: The declarant writes the number, day, month, year of the license from the specialized management agencies for export goods and the day, month, year of the license's expiration (if any). |

| Box 7 | Contract/Date/Expiration Date: The declarant writes the number, day, month, year of the contract's signing and the day, month, year of expiration (if any) of the contract or contract addendum (if any). |

| Box 8 | Commercial invoice: The declarant writes the number, day, month, year of the commercial invoice (if any). |

| Box 9 | Export checkpoint: Write the name of the port, location (agreed upon in the commercial contract) from which the goods are loaded onto the transport means for export. |

| Box 10 | Importing country: The declarant writes the name of the country or territory where the goods will ultimately be transported, not considering the countries or territories the goods will transit through. Apply ISO 3166 country and territory codes. |

| Box 11 | Delivery terms: The declarant clearly states the delivery terms agreed upon in the commercial contract. |

| Box 12 | Payment method: The declarant clearly states the payment method agreed upon in the commercial contract (e.g., L/C, DA, DP, TTR, or bartering, etc.) (if any). |

| Box 13 | Payment currency: The declarant writes the code of the currency used for payment (foreign currency) agreed upon in the commercial contract. Apply the currency code per ISO 4217 (e.g., US dollar is USD). (if any). |

| Box 14 | Tax rate: The declarant writes the exchange rate between the foreign currency unit and Vietnamese Dong applied to calculate the tax (according to current regulations at the time of customs declaration registration) in Vietnamese Dong. (if any). |

| Box 15 | Goods description: The declarant clearly specifies the name of the product, quality specifications according to the commercial contract and other documents related to the shipment. * In case the shipment has 4 or more items, the recording in this box is as follows: - On the customs declaration: write "according to the declaration appendix". - On the declaration appendix: specify the name, quality specifications of each item. * For shipments classified under one code but have multiple parts or items (e.g., complete equipment, synchronous equipment), the enterprise writes the general name of the shipment on the declaration and is allowed to compile a detailed inventory (not required to declare in the appendix). |

| Box 16 | Product code: The declarant writes the code classified according to the list of exported and imported goods issued by the Minister of Finance. * In case the shipment has 4 or more items, the recording in this box is as follows: - On the customs declaration: do not record anything. - On the declaration appendix: specify the codes of each item. |

| Box 17 | Origin: The declarant writes the name of the country or territory where the goods are manufactured based on the origin certification documents or other relevant documents related to the shipment. Apply the country code specified in ISO. * In case the shipment has 4 or more items, the recording is similar to Box 16. |

| Box 18 | Quantity: The declarant writes the quantity, mass, or weight of each item in the shipment matching the unit at Box 19. * In case the shipment has 4 or more items, the recording is similar to Box 16. |

| Box 19 | Unit: The declarant writes the unit of each item (e.g., meter, kg, etc.) according to the list of exported and imported goods issued by the Ministry of Finance or as per the actual transaction. * In case the shipment has 4 or more items, the recording is similar to Box 16. |

| Box 20 | Unit price (foreign currency): The declarant writes the price of one unit of goods in the currency stated in Box 13, based on the agreement in the commercial contract, invoice, L/C, or other documents related to the shipment. * In case the shipment has 4 or more items, the recording is similar to Box 16. |

| Box 21 | Value (foreign currency): The declarant writes the foreign currency value of each exported item, being the result of the multiplication (X) between “Quantity (Box 18) and “Unit price (Box 20)”. * In case the shipment has 4 or more items, the recording in this box is as follows: - On the customs declaration: write the total foreign currency value of the items declared on the declaration appendix. - On the declaration appendix: write the foreign currency value for each item. |

| Box 22 | Export tax, the declarant writes: a. Taxable value: Write the taxable value of each item in Vietnamese currency. b. Tax rate (%): Write the tax rate corresponding to the determined code in Box 16 according to the Export Tariff. c. Write the export tax payable for each item. * In case the shipment has 4 or more items, the recording in this box is as follows: - On the customs declaration: write the total payable export tax in the box "total". - On the declaration appendix: specify taxable value, tax rate, payable export tax for each item. |

| Box 23 | Other fees, the declarant writes: - Taxable value: Write the amount to calculate other fees. - Percentage (%): Write the percentage for other fees as per regulations. - Amount: Write the amount payable. * In case the shipment has 4 or more items, the recording is similar to Box 22. |

| Box 24 | Total payable amount of tax and other fees (Box 22 + 23), the declarant writes: total payable amount of export tax, other fees, both in numbers and words. |

| Box 25 | Quantity, container number: The declarant, when transporting export goods by container, writes as follows: - Container number: Write the number of each container; - Number of items in the container: Write the number of items in each container; - Weight of goods in the container: Write the weight of the goods in each container and finally total the weight of the shipment; - Loading location: Write the place where the export goods are loaded into the container; * In case there are 4 or more containers, the customs declarant records specific information on the declaration appendix and does not record on the declaration. |

| Box 26 | Accompanying documents: The declarant lists the documents accompanying the export goods declaration. |

| Box 27 | The declarant writes the day, month, year of declaration, signs, confirms, states the full name, title, and affixes the stamp on the declaration. |

| B. Section for Customs authorities | |

| Box 28 | The head of the Sub-department where the customs declaration is registered writes the clearance results on the export goods declaration. |

| Box 29 | Other notes: For customs officers in various operational stages to record necessary content that cannot be recorded elsewhere, such as minutes numbers, decision numbers for fines, handling, etc. |

| Box 30 | Clearance confirmation: The assigned official confirms on the system/on the declaration printed by the enterprise. |

| Box 31 | Supervision confirmation: The custom official overseeing the export goods records in this section. |

| C. Cases not required to declare in the corresponding boxes as stipulated in the declaration | |

| Boxes: 7, 8, 9, 10, 11, 12 | 1. Goods are relocating assets. 2. Checked luggage of outbound, inbound persons. 3. Goods are means of containing goods for cyclic temporary import, re-export. 4. Goods for temporary import - re-export, temporary export - re-import for a certain period to serve work. 5. Goods for temporary import - re-export, temporary export - re-import for warranty and repair. 6. Goods are gifts given by Vietnamese organizations and individuals to organizations and individuals abroad. |

When does the customs authority in Vietnam charge duty on exports?

According to Clause 10, Article 13 of Decree 126/2020/ND-CP, the customs authorities shall calculate and notify tax on exports and imports in the following cases::

- Tax liability shall be imposed by customs authorities in the cases specified in Article 52 of the Tax Administration Law 2019, Article 17 of Decree 126/2020/ND-CP.

- A taxpayer’s business is shut down, not operating at the registered address, dissolved or bankrupt before fulfillment of tax obligations, in which case the tax authority shall calculate tax and send a tax notice to relevant organizations and individuals.

- A competent authority requests the customs authority to determine tax on confiscated exports or imports.

- Imports on which taxes are not paid during the import process, distrained and put up for auction by a competent authority, in which case the customs authority shall calculate tax and inform it to the authority collecting auction payments.

- The taxpayer incurs administrative penalties for tax offences, in which case the fine varies according to the tax arrears or tax avoided.

- The imports are exempt from tax or pledged by the declarant as collateral for loans; Collateral is liquidated to recover debts but the taxpayer has not prepared a new customs declaration, has not fully paid tax in accordance with customs laws, in which case the customs authority shall calculate the tax payable and inform it to the credit institution.

- Customs fees; fees on goods, luggage, transiting vehicles.