Vietnam: What is the customs declaration form - Form HQ/2015/NK? What are the instructions for filling in the customs declaration form - Form HQ/2015/NK?

What is the customs declaration form - Form HQ/2015/NK in Vietnam?

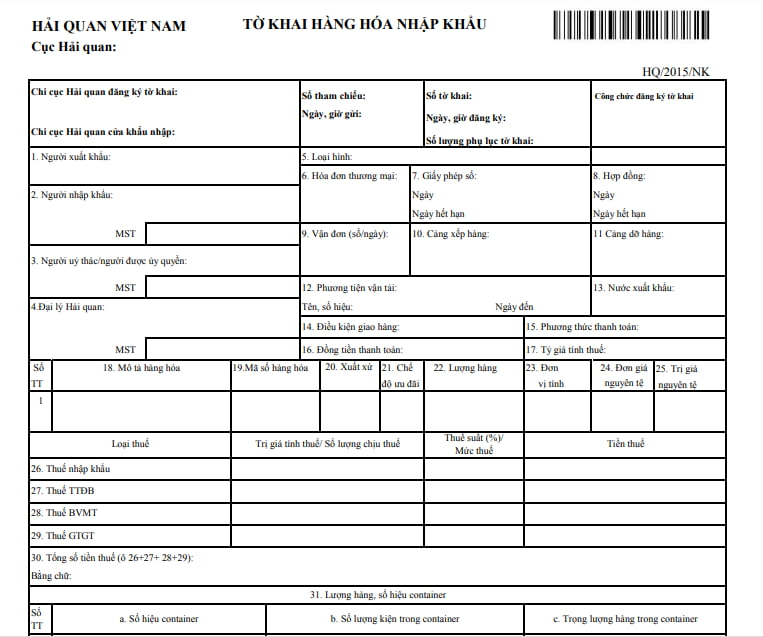

Currently, the customs declaration form for imports is Form HQ/2015/NK as stipulated in Appendix 5 issued together with Circular 38/2015/TT-BTC. To be specific:

Form HQ/2015/NK: DOWNLOAD

What is the customs declaration form - Form HQ/2015/NK in Vietnam? What are the instructions for filling in the customs declaration form - Form HQ/2015/NK? (Image from the Internet)

What are the instructions for filling in the customs declaration form - Form HQ/2015/NK in Vietnam?

According to Appendix 4 issued together with Circular 38/2015/TT-BTC, the filling in the customs declaration form - Form HQ/2015/NK are as follows:

|

Entry |

Specific content |

|

Upper left corner of the declaration |

The customs declarant shall write the name of the Sub-Department of Customs where the declaration is registered, the Sub-Department of Customs at the border gate of import. |

|

The middle part of the declaration |

* Declaration number, date and time of registration: is the ordinal number of the daily declaration registration number for each type of import at each Sub-Department of Customs in order: Declaration number/importer/type/unit registering the declaration and the number of declaration appendices. * Number of declaration appendices: is the number of declaration appendices (in case the shipment has 2 or more items) |

|

Upper right corner of the declaration |

The customs officer receiving the registration of the import declaration shall sign and affix the official's seal. |

|

A/ The section reserved for customs declarants to declare and calculate taxes |

|

|

Box No. 1 |

Exporter: The customs declarant shall write the full name, address, telephone number, fax number and code (if any) of the overseas seller selling goods to Vietnamese traders (as shown in the goods purchase and sale contract) |

|

Box No. 2 |

Importer: The customs declarant shall write the full name, address, telephone number, fax number and tax identification number of the importing trader; ID card or passport (if individual). |

|

Box No. 3 |

Entrustee/authorized person: The customs declarant shall write the full name, address, telephone number, fax number and tax identification number of the entrusting trader to the importer or the full name, address, telephone number, fax number and tax identification number of the person authorized to make customs declaration; ID card or passport (if the authorized person is an individual). |

|

Box No. 4 |

Customs agent: The customs declarant shall write the full name, address, telephone number, fax number and tax identification number of the customs agent; the number and date of the customs agent contract. In case of sending bonded warehouses, declare the names of bonded warehouses. |

|

Box 5 |

Type: The customs declarant shall specify the corresponding type of import. |

|

Box No. 6 |

Commercial invoices: The customs declarant shall write the number, date, month and year of the commercial invoice (if any). |

|

Box 7 |

License/day/expiration date: The customs declarant shall write the number, date, month and year of the license of the specialized management agency for imports and the expiration date, month and year of the license (if any). |

|

Box No. 8 |

Contract/day/expiration date: The customs declarant shall write the number of days, months and years of signing the contract and the expiration date (if any) of the contract or the contract annex (if any). |

|

Box No. 9 |

Bill of lading: The customs declarant shall write the number, date, month and year of the bill of lading or a valid transport document issued by the carrier in lieu of the bill of lading (if any). |

|

Box No. 10 |

Port of loading: The customs declarant shall write the name of the port and place (agreed upon in the commercial contract or on the bill of lading) from where the goods are loaded onto the means of transport for transfer to Vietnam. |

|

Box No. 11 |

Port of unloading: The customs declarant shall write the name of the port/border gate where the goods are unloaded from the means of transport (inscribed on the bill of lading or other transport documents). In case the port/border gate of unloading goods is different from the place where the goods are handed over to the customs declarant, the port of unloading/delivery place shall be inscribed. Example: imports are unloaded at Hai Phong port and delivered to the consignee at Gia Thuy ICD, the person who declares Hai Phong/Gia Thuy |

|

Box No. 12 |

Means of transport: The customs declarant shall write the name of the ship, flight number, train number, number and date of arrival of the means of transport carrying goods imported from abroad into Vietnam by sea, air, railway and road transport. |

|

Box 13 |

Exporting country: The customs declarant shall write the name of the country or territory from which the goods are transferred to Vietnam (where the goods are finally sold to Vietnam). Apply ISO 3166 water code. (do not write the name of the country or territory through which the goods are transited). |

|

Box 14 |

Delivery conditions: The customs declarant specifies the delivery conditions agreed upon by the two parties to the purchase and sale in the commercial contract. |

|

Box No. 15 |

Payment method: The customs declarant shall specify the payment method agreed upon in the commercial contract (e.g. L/C, DA, DP, TTR or barter, etc.). (if any). |

|

Box 16 |

Payment currency: The customs declarant shall write the code of the currency used for payment (the original currency) agreed upon in the commercial contract. Adopt a currency code that conforms to ISO 4217 (e.g., the US dollar is USD). (if any). |

|

Box No. 17 |

Tax calculation rate: The customs declarant shall write the exchange rate between the original currency and the Vietnamese currency applicable for tax calculation (according to current regulations at the time of registration of the customs declaration) in Vietnam dong. (if any). |

|

Box No. 18 |

Description of goods: The customs declarant shall clearly state the name of the goods, the specifications and quality of the goods under the commercial contract or other documents related to the goods lot. * In case the shipment has 2 or more items, the method of recording in this criterion is as follows: - On the customs declaration, it is written: "according to the appendix to the declaration". - On the appendix of the declaration: clearly state the name, specifications and quality of each item. * For a shipment that is applied to 1 code but has many details and many items in the shipment (e.g. whole equipment, synchronous equipment), the enterprise shall write the common name of the shipment on the declaration and is allowed to make a detailed list (not required to declare in the appendix). |

|

Box No. 19 |

Goods codes: Customs declarants shall write classification codes according to the list of Vietnamese exports and imports promulgated by the Minister of Finance. * In case the shipment has 2 or more items, the method of recording in this criterion is as follows: - On the customs declaration: do not write anything. - On the appendix of the declaration: clearly indicate the code of each item. |

|

Box 20 |

Origin: The customs declarant shall write the name of the country or territory where the goods are manufactured (produced) (based on the certificate of origin or other documents related to the shipment). Apply the water code specified in ISO 3166. * In case the shipment has 2 or more items, the same method is written in box No. 19. |

|

Box No. 21 |

Preferential regime: Write the name of the C/O form issued to the shipment of free trade agreements to which Vietnam is a signatory. |

|

Box No. 22 |

Quantity of goods: The customs declarant shall write the quantity, volume or weight of each item in the goods lot in the customs declaration being declared in accordance with the unit of calculation in box No. 23. * In case the shipment has 2 or more items, the same method is written in box No. 19. |

|

Box No. 23 |

Unit of calculation: The customs declarant shall write the name of the unit of calculation of each item (e.g. meters, kg, etc.) according to the provisions of the List of exports and imports promulgated by the Ministry of Finance or actual transactions. * In case the shipment has 2 or more items, the same method is written in box No. 19. |

|

Box 24 |

Unit price in raw currency: The customs declarant shall write the price of a unit of goods (according to the unit in box 23) in the currency inscribed in box 16, based on the agreement in the commercial contract, invoice, L/C or other documents related to the goods lot. For a commercial contract by the method of late payment and the purchase price and sale price stated in the contract, including the interest rate payable, the unit price shall be determined by the purchase price and sale price minus (-) the interest rate payable under the commercial contract. * In case the shipment has 2 or more items, the same method is written in box No. 20. |

|

Box 25 |

Original currency value: The customs declarant shall write the value of the original currency of each imported item, which is the result of multiplication (x) between "Volume of goods (box No. 22) and "Unit price of raw currency (box No. 24)". * In case the shipment has 2 or more items, the method of writing in this box is as follows: - On the customs declaration: write the total value of the original currency of the declared goods items in the appendix to the declaration. - On the appendix to the declaration: Write the value of the original currency for each item. |

|

Box 26 |

Import tax, the customs declarant shall record: a. Taxable value: Write the dutiable value of each item in Vietnam dong. b. Tax rate (%): Write the tax rate corresponding to the code determined in box 19 according to the applicable tariff (Preferential tariff, special preferential tariff, etc.) effective at the time of registration of the declaration c/ Write the payable import tax amount of each item. * In case the shipment has 2 or more items, the method of writing in this box is as follows: - On the customs declaration, write the total payable import tax amount in the corresponding "tax amount" box. - The appendix to the declaration clearly states the dutiable value, tax rate and payable import tax amount for each item2 |

|

Box No. 27 |

For special consumption tax (SCT), the customs declarant shall record: a. The dutiable value of SCT is the sum of the calculated value of import tax and the payable import tax of each commodity b. Tax rate %: Write the SCT rate corresponding to the commodity code for which the goods code is determined in box 19 according to the SCT schedule. c/ Tax amount: Write the payable SCT amount of each commodity * In case the shipment has 2 or more items, the method of writing is similar to box 26. |

|

Box No. 28 |

Environmental protection tax (EPT), the customs declarant shall record: a. The quantity subject to environmental protection tax of imports is the quantity of goods according to the unit specified in the schedule of environmental protection tax rates. b. The environmental protection tax rate of imports shall comply with the provisions of the schedule of environmental protection tax rates. c. Tax: Write the payable environmental protection tax amount of each item. * In case the shipment has 2 or more items, the method of writing is similar to box 26. |

|

Box No. 29 |

For value-added tax (VAT), the customs declarant shall write: a. The dutiable value of VAT is the import tax price at the border gate plus the import tax (if any) plus the SCT (if any) plus the environmental protection tax (if any). Import prices at border gates are determined according to regulations on taxable prices of imports. b. Tax rate %: Write the VAT rate corresponding to the goods code for which the goods code is determined in box No. 19 according to the VAT schedule. c/ Tax amount: Write the payable VAT amount of each item * In case the shipment has 2 or more items, the method of writing is similar to box 26. |

|

Box 30 |

The total tax amount (box 26 + 27 + 28 + 29), the customs declarant shall record: the total amount of import tax, SCT, environmental protection and VAT; in words. |

|

Box No. 31 |

Quantity of goods and container number: The customs declarant declares when transporting goods imported by container, stating as follows: - Container number: Write the number of each container; - Number of bales in the container: Write the number of bales in each container; - Weight of goods in containers: Write the weight of the goods contained in each corresponding container and finally add up the total weight of the shipment; * In case there are 4 containers or more, the person who specifies the information in the appendix to the customs declaration is not written on the declaration. |

|

Box 32 |

Accompanying documents: The customs declarant shall list the accompanying documents of the import declaration. |

|

Box 33 |

The customs declarant shall write the date/month/year of declaration, sign for certification, clearly write the full name, title and stamp on the declaration. |

|

B. Section for customs authorities |

|

|

Box No. 34 |

The leader of the Sub-Department where the customs declaration is registered shall record the result of channeling on the import declaration. |

|

Box 35 |

Other records: For customs officers at all stages of recording necessary contents that cannot be recorded elsewhere such as record numbers, numbers of sanctioning and handling decisions, etc. |

|

Box 36 |

Certification of customs supervision: The part of the record of the customs officer supervising the imports. |

|

Box No. 37 |

Certification of goods release/goods for preservation/border-gate transfer: The customs officer shall write a summary of the customs office's decision on the release/preservation of goods or goods transferred to the border gate. |

|

Box No. 38 |

Confirmation of customs clearance: The assigned civil servant confirms on the system/on the declaration printed by the enterprise. |

|

C. Cases that are not required to be declared in the corresponding boxes specified in the declaration form |

|

|

Number tiles: 6, 8, 13, 14, 15 |

1. Goods are movable assets 2. Checked baggage of entrants. 3. Goods are means of storing goods by the mode of temporary import or re-export rotation 4. Goods temporarily imported for re-export, temporarily exported for re-import in service of work within a certain time limit. 5. Goods temporarily imported for re-export, temporarily exported for re-import for warranty and repair 6. Goods are gifts donated by foreign organizations or individuals to Vietnamese organizations and individuals. 7. Goods of diplomatic missions and international organizations in Vietnam and persons working at these agencies and organizations. 8. Sample goods do not pay. |

|

Box No. 9, No. 10, No. 11 |

1. Baggage exceeding the duty-free norm specified in Article 61 of Decree No. 08/2015/ND-CP carrying persons on exit or entry. 2. Goods temporarily imported for re-export, temporarily exported for re-import to serve work within a certain period specified in Article 55 of Decree No. 08/2015/ND-CP carried by persons on exit or entry. 3. Other goods carried by persons on exit or entry. |

|

Boxes 15, 16, 17, 21, 26, 27, 28, 29, 30 |

Goods stored in bonded warehouses |

When is the time for calculating customs duty in Vietnam?

Under Clause 2, Article 8 of the Law on Export and Import Duties 2016:

Taxable value and time for tax calculation

...

2. The time for calculating export or import duty is the time of registration of the customs declaration.

In case of exports or imports that are not subject to taxation, exempt from export or import duties, or applying in-quota duty rates or fixed duty but then the eligibility for tax exemption or in-quota duties is changed as prescribed by law, the time for tax calculation is the time of registration of the new customs declaration.

The time of registration of the customs declaration shall comply with regulations of law on customs.

Therefore, the time for calculating customs duty in Vietnam is the time of registration of the customs declaration.

*Note: In case of exports or imports that are not subject to taxation, exempt from export or import duties, or applying in-quota duty rates or fixed duty but then the eligibility for tax exemption or in-quota duties is changed as prescribed by law, the time for tax calculation is the time of registration of the new customs declaration.

The time of registration of the customs declaration shall comply with regulations of law on customs.