Vietnam: What is the corporate income tax declaration form for Q4 2024?

Vietnam: What is the corporate income tax declaration form for Q4 2024?

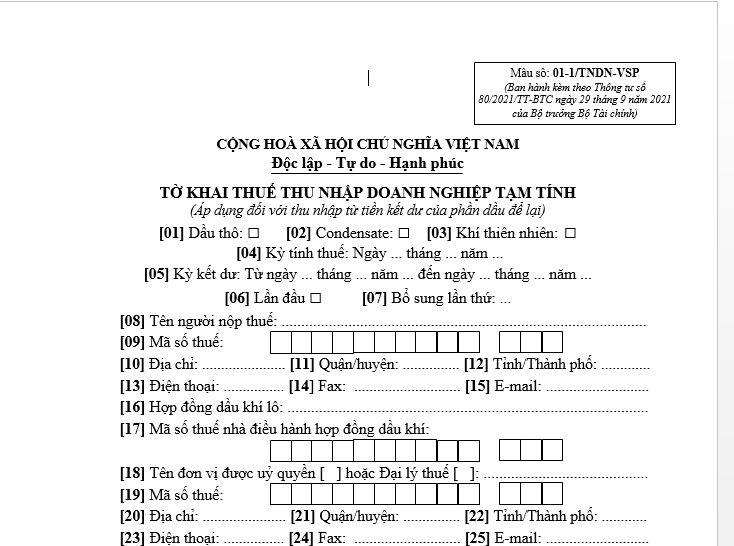

The corporate income tax declaration form for 2024 is Form 01-1/TNDN-VSP as stipulated in Appendix 2 issued with Circular 80/2021/TT-BTC.

The corporate income tax declaration template for the fourth quarter of 2024 is as follows:

Download the 2024 corporate income tax declaration template here...Download

Vietnam: What is the corporate income tax declaration form for Q4 2024? (Image from the Internet)

Vietnam: What is the minimum corporate income tax for 04 quarters?

According to the provisions at point b clause 6 Article 8 Decree 126/2020/ND-CP, amended by clause 3 Article 1 of Decree 91/2022/ND-CP, regulating taxes that are declared monthly, quarterly, annually, per occurrence of tax obligation, and for tax settlement are as follows:

Taxes declared monthly, quarterly, annually, per occurrence, and tax settlement

........

- Taxes and revenues for annual tax settlement and settlement upon dissolution, bankruptcy, termination of operation, termination of contracts, or business reorganization. In cases of conversion of business type (excluding state-owned enterprises equitized) where the converting enterprise inherits all tax obligations of the converted enterprise, there is no need for tax settlement declaration before the decision on enterprise conversion, settlement is declared at the end of the year. Specifically:

a) Resource tax.

b) Corporate income tax (excluding corporate income tax from capital transfer of foreign contractors; corporate income tax declared according to the turnover ratio method per occurrence or monthly as stipulated at point đ clause 4 of this Article). Taxpayers must determine the provisional quarterly corporate income tax themselves (including temporary allocation of corporate income tax for provinces where dependent units, business locations, or transferred real estate are located, other than where the main office is located) and deduct the provisional tax already paid from the annual tax settlement.

.......

Taxpayers not required to prepare quarterly financial statements according to accounting law should base on quarterly production and business results and tax laws to determine corporate income tax.

The total corporate income tax of 04 quarters must not be less than 80% of the corporate income tax payable according to the annual settlement. If the taxpayer underpays compared to the amount required for 04 quarters, late payment interest must be paid on the shortfall from the date immediately after the deadline for paying the fourth quarter corporate income tax to the day before the date the outstanding tax is paid to the state budget.

......

Furthermore, clause 2 of Article 59 of the Law on Tax Administration 2019 prescribes the handling of late tax payments as follows:

Handling of late tax payments

......

- The calculation rate for late payment interest and the timing thereof are stipulated as follows:

a) The late payment interest rate is 0.03%/day on the overdue tax amount;

b) The late payment interest calculation period runs continuously from the day after the occurrence of the overdue tax specified in clause 1 of this Article to the day before the overdue tax, refunded tax, additional tax, imposed tax, or delayed transfer tax is paid into the state budget.

......

Thus, the minimum corporate income tax for 04 quarters must equal at least 80% of the annual corporate income tax payable upon settlement.

If the enterprise underpays compared to the required provisional tax for 04 quarters, late payment interest must be paid on the shortfall from the day immediately after the deadline for the fourth quarter corporate income tax payment to the day before the outstanding tax is submitted to the state budget.

Late payment interest rate = 0.03%/day x Overdue tax amount.

*Note: Enterprises must self-determine the provisional quarterly corporate income tax and can deduct the provisional tax already paid from the annual tax settlement.

(This includes temporarily allocating the corporate income tax for provinces where dependent units, business locations, or transferred real estate are located, other than where the main office is situated.)

What are the methods for paying corporate income tax in Vietnam?

According to Article 56 of the Law on Tax Administration 2019, on locations and methods of tax payment, it is specified as follows:

Locations and methods of tax payment

- Taxpayers remit tax to the state budget according to the following provisions:

a) At the State Treasury;

b) At the tax authority where the tax declaration dossier is submitted;

c) Through an organization authorized by the tax administration agency to collect taxes;

d) Through commercial banks, other credit institutions, and service organizations in accordance with legal provisions.

- The State Treasury, commercial banks, other credit institutions, and service organizations must arrange venues, means, officials, and staff to collect taxes, ensuring convenience for taxpayers to make tax payments promptly to the state budget.

- Agencies and organizations receiving tax payments or withholding tax must issue the payer with a tax collection receipt.

In addition, Article 12 of the Law on Corporate Income Tax 2008 stipulates the place of tax payment as follows:

Place of Tax Payment

Enterprises pay tax at their main office. If an enterprise has a dependent production facility operating in a province or centrally managed city different from the main office's location, tax is calculated and paid based on the cost ratio between the location of the production facility and the main office. Allocation, management, and use of revenue are conducted according to the State Budget Law.

the Government of Vietnam stipulates details and guides implementation of this Article.

Thus, enterprises can pay corporate income tax to the state budget through the following methods:

- At the State Treasury.

- At the tax administration agency where the tax declaration dossier is submitted and at the main office location.

- Through an organization authorized by the tax administration agency to collect taxes.

- Through commercial banks, other credit institutions, and service organizations as prescribed by law.