Vietnam: What is the confirmation form for deferred tax payment in instalments if the guarantee letter is suspected to be illegal according to Circular 80?

Vietnam: What is the confirmation form for deferred tax payment in instalments if the guarantee letter is suspected to be illegal according to Circular 80?

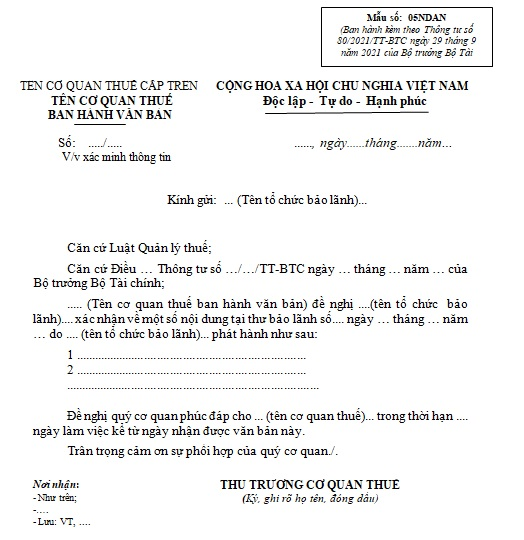

The confirmation form for deferred tax payment in instalments if the guarantee letter is suspected to be illegal is Form No. 05/NDAN as specified in Appendix II issued with Circular 80/2021/TT-BTC.

Download the confirmation form for Deferred tax payment in instalments if the guarantee letter is suspected to be illegal.

Vietnam: What is the confirmation form for deferred tax payment in instalments if the guarantee letter is suspected to be illegal according to Circular 80?

What are procedure for processing applicationd for deferred tax payment in instalments in Vietnam?

The processing of deferred tax payment in instalments applications as regulated in Clause 1, Article 66 of Circular 80/2021/TT-BTC proceeds as follows:

- The taxpayer submits an application for deferred tax payment in instalments as prescribed in Clause 2, Article 66 of Circular 80/2021/TT-BTC to the directly managing tax office.

- If the application for deferred tax payment in instalments is incomplete, within 3 working days from the date of receiving the application, the tax office must notify in writing using form No. 01/TB-BSTT-NNT issued with Decree 126/2020/ND-CP requesting the taxpayer to clarify or supplement the application.

+ If the application for deferred tax payment in instalments is complete, within 10 working days from the date of receiving the application, the tax office issues:

+ A notice of non-approval for deferred tax payment in instalments according to form No. 03/NDAN issued with Appendix I of Circular 80/2021/TT-BTC if finding indications of an unlawful guarantee letter. Concurrently, the tax office sends a document using form No. 05/NDAN issued with Appendix I of Circular 80/2021/TT-BTC to the guarantor for confirmation, and the guarantor sends confirmation results to the tax office within the legally prescribed timeline;

+ A decision on approving the deferred tax payment in instalments according to form No. 04/NDAN issued with Appendix I of Circular 80/2021/TT-BTC for cases eligible for deferred tax payment in instalments.

Note:

The application for deferred tax payment in instalments is stipulated in Clause 2, Article 66 of Circular 80/2021/TT-BTC as follows:

- A written request for deferred tax payment in instalments;

- A guarantee letter conformable to the laws on guarantees including a commitment from the guarantor to pay on behalf of the taxpayer if the taxpayer fails to meet the deadline for deferred tax payment in instalments;

- An enforcement decision for executing an administrative decision on tax management (if any).

What is the time limit for tax payment in instalments in Vietnam?

According to Clause 4, Article 66 of Circular 80/2021/TT-BTC, the time limit for tax payment in instalments is as follows:

Deferred tax payment in instalments

....

3. Number of Installments and Amount of Deferred tax payment in instalments

a) The deferred tax debt amount is the tax debt calculated up to the time the taxpayer requests deferral but not exceeding the guaranteed tax debt amount by the credit institution.

b) The taxpayer may defer tax payment in instalments for no more than 12 months and within the validity period of the guarantee letter.

c) The taxpayer may defer the tax debt amount monthly, ensuring the deferred tax payment in instalments per installment is not less than the average monthly deferred tax debt. The taxpayer must determine the accrued late payment amount to pay along with the deferred tax debt.

4. Deadline for Deferred tax payment in instalments

The deadline for deferred tax payment in instalments is the last day of the month at the latest. If it surpasses the committed monthly deferred tax payment deadline that the taxpayer does not pay or pays insufficiently, or the guarantor has not yet performed the obligation to pay on behalf, within 5 working days from the end of the deferred tax payment deadline under the commitment, the tax office issues a document using form No. 02/NDAN issued with Appendix I of this Circular to the guarantor requesting to perform the guarantee obligation according to the law and notifies the taxpayer at the same time.

The taxpayer may defer tax payment in instalments for no more than 12 months and within the validity period of the guarantee letter.

Note:

- The deferred tax debt amount is the tax debt calculated up to the time the taxpayer requests deferral but not exceeding the guaranteed tax debt amount by the credit institution.

- The taxpayer may defer the tax debt amount monthly, ensuring the deferred tax payment in instalments per installment is not less than the average monthly deferred tax debt. The taxpayer must determine the accrued late payment amount to pay along with the deferred tax debt.

- The deadline for deferred tax payment in instalments is the last day of the month.

- If it surpasses the committed monthly deferred tax payment deadline that the taxpayer does not pay or pays insufficiently, or the guarantor has not yet performed the obligation to pay on behalf, within 5 working days from the end of the deferred tax payment deadline under the commitment, the tax office issues a document to the guarantor requesting to perform the guarantee obligation according to the law and notifies the taxpayer at the same time.