Vietnam: What is iTaxViewer? What is the Guide to download the latest iTaxViewer software 2024?

Vietnam: What is iTaxViewer?

The iTaxViewer software is an application that supports reading and verifying tax declarations and notifications in XML format issued by the General Department of Taxation of Vietnam. It aids in reading individual income tax finalization declarations, corporate income tax finalization declarations, invoice reports, financial statements, monthly and quarterly declarations, and tax payment notifications.

The General Department of Taxation of Vietnam recommends taxpayers use the XML format when filing taxes electronically to help reduce storage capacity, control data, increase system speed, and avoid network congestion.

Additionally, the iTaxViewer software can assist users in reviewing the content of declarations and e-signatures.

Vietnam: Guide to download the latest 2024 iTaxViewer software

Step 1: Visit the e-tax link: http://thuedientu.gdt.gov.vn and select the "Enterprise" section

Step 2: Click on the "XML Tax Declaration Reader Application – iTaxViewer" section to begin downloading iTaxViewer onto your computer

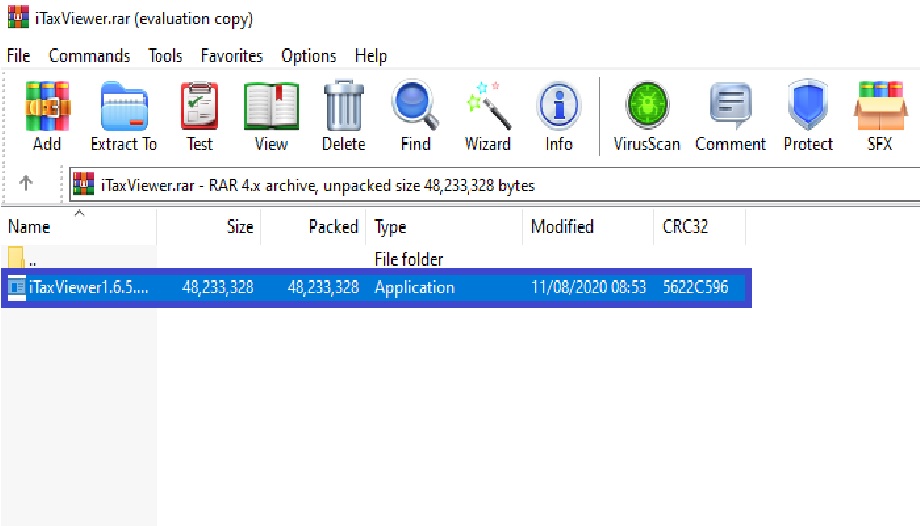

Step 3: Double-click the iTaxViewer.rar file downloaded to start the application installation process.

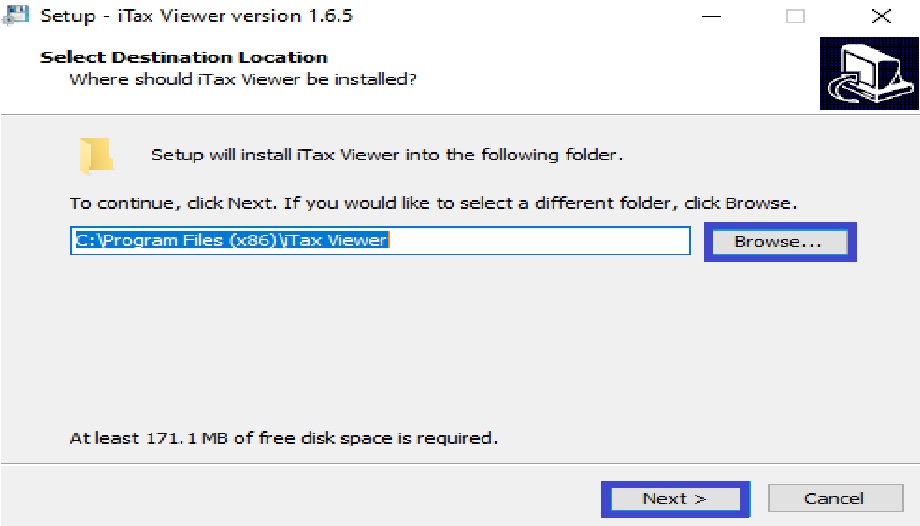

Step 4: The default installation directory is saved in the Program Files folder. If there's no need to change the default directory, click “Next”; to change the directory, press the “Browse” button, then select the saving location and click “Next”.

Step 5: Click “Next” to continue the download process of the iTaxViewer application

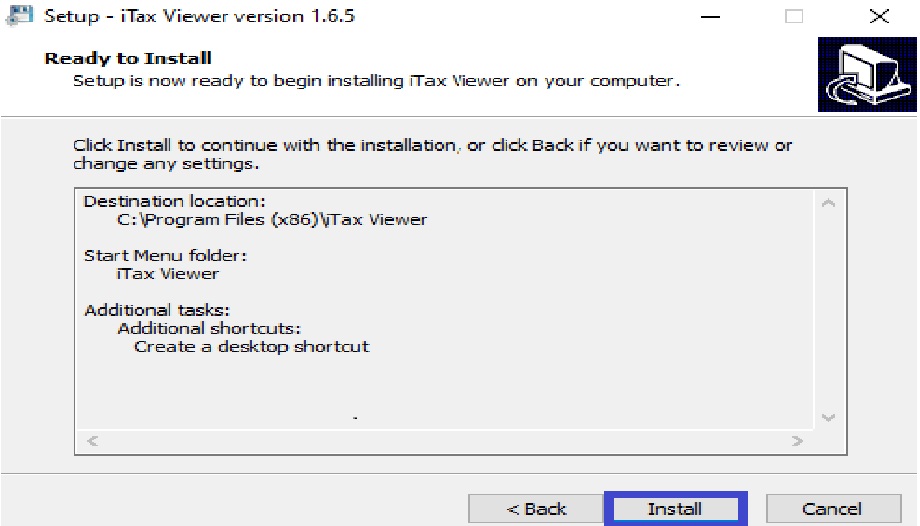

Step 6: Click “Install” to begin the application installation process

Step 7: Wait for the installation to complete and click “Finish” to complete the installation process.

That completes the iTaxViewer application installation. When conducting e-tax declaration procedures, files generated in XML format downloaded onto the computer with this application installed can be opened and read accurately by double-clicking the file name.

Note: This information is for reference only!

Vietnam: What is iTaxViewer? What is the Guide to download the latest iTaxViewer software 2024? (Image from the Internet)

When is it possible to submit e-tax documents in Vietnam?

Based on Article 8 of Circular 19/2021/TT-BTC, regulations regarding the time for submitting e-tax documents are as follows:

- Taxpayers are permitted to conduct e-tax transactions 24 hours a day (from 00:00:00 to 23:59:59) and 7 days a week, including weekends, holidays, and Tet. The time for submitting documents is considered within the day if the document is successfully signed and submitted between 00:00:00 and 23:59:59.

- The time of confirmation for e-tax document submission is defined as follows:

+ For e-taxpayer registration documents: the date the tax authority's system receives the document, as indicated in the Notification of Receipt of e-Taxpayer Registration Documents issued by the tax authority to the taxpayer (according to form No. 01-1/TB-TDT issued with Circular 19/2021/TT-BTC).

+ For tax declaration documents (except for those where the tax management agency calculates the tax and notifies tax payment following Article 13 of Decree 126/2020/ND-CP): the date the tax authority's system receives the document, as indicated in the Notification of Receipt of e-Tax Declaration Documents issued by the tax authority to the taxpayer (according to form No. 01-1/TB-TDT issued with Circular 19/2021/TT-BTC), if the tax authority accepts the tax declaration in the Notification of Acceptance of e-Tax Declaration Documents issued by the tax authority to the taxpayer (according to form No. 01-2/TB-TDT issued with Circular 19/2021/TT-BTC).

For tax declaration documents containing accompanying documents submitted directly or by post: The submission time is based on the day the taxpayer completes the full submission as required.

+ For documents not covered under points b.1 and b.2 above: the date the tax authority's system receives the document and is indicated in the Notification of Acceptance of e-Documents issued by the tax authority to the taxpayer (according to form No. 01-2/TB-TDT issued with Circular 19/2021/TT-BTC).

+ The time of confirmation for e-tax document submission mentioned in this clause serves as a basis for the tax authorities to determine the timing of tax document submission; assess late document submission period, or calculate the time to resolve tax documents in accordance with the Law on Tax Administration, accompanying implementation guidance documents, and the regulations of this Circular.

+ The e-tax payment date is defined according to clause 1, Article 58 of the Law on Tax Administration 2019.

- The time tax authorities send notifications, decisions, or documents to taxpayers is considered within the day if the document is successfully signed and submitted between 00:00:00 and 23:59:59 of that day.

Is a tax declaration a tax declaration dossier in Vietnam?

According to clause 1, Article 7 of Decree 126/2020/ND-CP regarding tax declaration dossiers:

Tax Declaration Dossiers

- A tax declaration dossier is the tax declaration and related documents and evidence serving as the basis to determine a taxpayer's tax obligations with the state budget, prepared and submitted by the taxpayer to the tax management authority electronically or in paper form. Taxpayers must declare tax returns, lists, and appendices (if any) in accordance with the format prescribed by the Minister of Finance and are responsible before the law for the accuracy, truthfulness, and completeness of the contents in the tax return, list, and appendices; complete submission of the documents required in the tax declaration dossier to the tax management authority. For certain documents in the tax declaration dossier for which the Ministry of Finance does not issue forms but the related law stipulates a form, the procedures in the related law apply.

...

Thus, according to the above provisions, a tax declaration is part of the tax declaration dossier and not the entire dossier.