Vietnam: What is eTax Mobile? How to Install the eTax Mobile application?

Vietnam: What is eTax Mobile? How to Install the eTax Mobile application?

What is eTax Mobile?

eTax Mobile is an electronic Tax application installed on smartphones that allows individuals, business individuals, and business households to access taxpayer registration declarations anytime, anywhere on a device with a 3G/4G/Wifi/GPRS connection.

Currently, eTax Mobile allows users to log in using one of the three methods: Password, Fingerprint, or FaceID.

The main function groups of the eTax Mobile application are: Tax payment; Tax obligation lookup; Tax notification lookup; Utilities; Support.

Vietnam: What is eTax Mobile? How to install the eTax Mobile application? (Image from the Internet)

How to install the eTax Mobile application?

The General Department of Taxation provides guidance on installing eTax Mobile and paying taxes using a mobile phone as follows:

Step 1: Download the eTax Mobile application

- Users access the following links:

iOS - click here to download the application

Android - click here to download the application

- Or users can go to the App Store and search for "Electronic Tax" or "eTax Mobile" (for iOS operating system), go to Google Play (for Android operating system) and then download and install the app.

Step 2: Log in to the application or register if you don't have an account

(1) LOGIN:

To log into the application, users click on the application's "State Tax" logo icon to access the service.

The homepage screen will appear. Users choose the login method: enter Username and password, Fingerprint, or FaceID.

(2) Register:

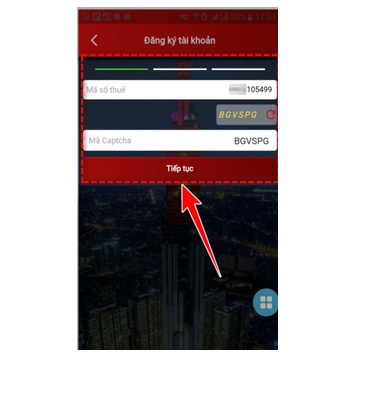

Users enter their tax identification number, click the captcha, then select "Continue."

+ Then enter all the required information, including: tax identification number, personal name, province/city of residence, tax authority issuing the tax identification number, phone number, email, and verification code.

+ Users enter the verification code if they have an issued verification code from the tax authority in the cover letter; if they do not have a verification code, they leave it blank.

Receive a message confirming successful registration from the General Department of Taxation along with the login account and password.

Step 2: After successfully logging in, select “Pay Taxes”

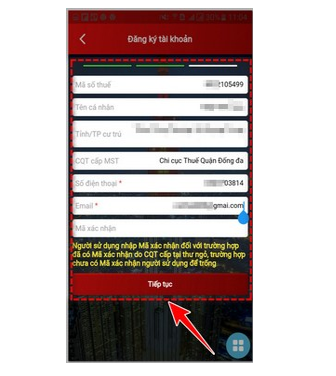

- In the "Select type of tax to pay" bar, if:

+ Paying personal income tax: choose "Individual Tax" and then click on Lookup

+ Paying vehicle registration fee: enter the dossier number, then click on Lookup

Step 3: After clicking on Lookup, the system will display the taxes to be paid

- For individual taxes, users can choose one or multiple payments for the same Tax agency, then click Continue

- For vehicle registration fee: after finding the tax dossier, click Continue

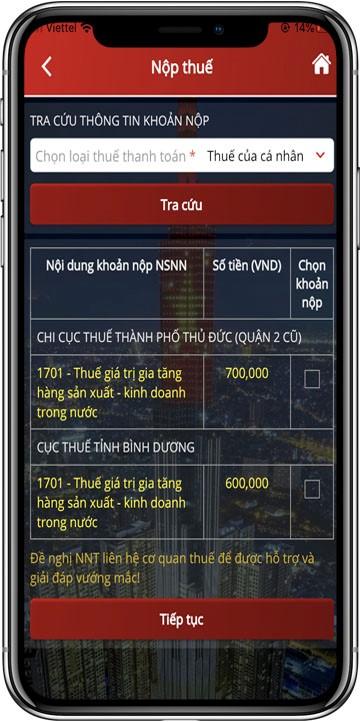

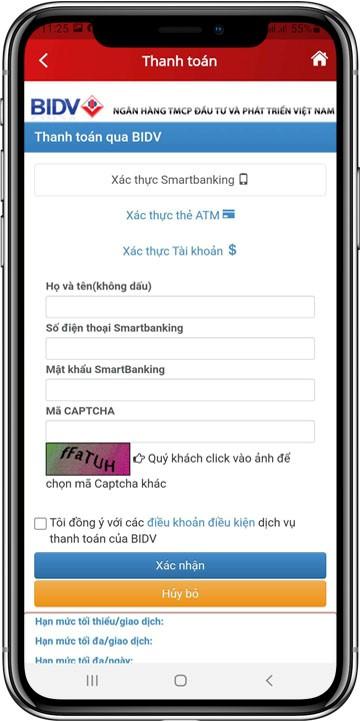

Step 4: Fill in the information in the payment section, then select Payment to pay the tax

What features are supported in the eTax Mobile application?

According to Official Dispatch 3890/CTTBI-TTHT 2024 Download here from the Department of Taxation of Thai Binh Province, the features supported in the eTax Mobile application are as follows:

The eTax Mobile application has been implemented by the Tax sector since 2022 with useful features. By 2024, more functions have been added: digital map of business households, comprehensive tax settlement lookup, detailed income sources lookup, projection of excess tax to be paid, tax obligation after settlement, dependent lookup. Specifically, the functions are as follows:

- Account registration: this is the transaction setup step between the electronic taxpayer and the tax authority.

- Lookup tax obligations to be paid: personal taxes, including agriculture land use tax; non-agricultural land use tax; personal income tax; taxes, fees, and charges for business households, business individuals (including business households, individuals renting out assets); fines for administrative violations in the tax domain, late payment charges, and other charges according to the law; financial obligations regarding land; vehicle registration fee.

- Notification lookup: document processing notification; vehicle registration fee notification for cars, motorbikes.

- Dossier lookup: tax filing dossiers; tax settlement dossiers; taxpayer registration dossiers; vehicle registration fee for cars, motorbikes.

- Tax payment: online tax payment or paying tax on behalf, payment voucher lookup, account linking.

- Digital map function for business households: lookup business households; lookup business sector content, address, revenue, tax amount to be paid and provide feedback through the user's eTax Mobile account to enhance the transparency of business household information as per the Tax Management Law.

- Other functions supporting taxpayers such as: lookup dependent information; taxpayer information lookup; personal income tax calculator tool; vehicle registration fee price table lookup; delegated collection bank lookup; online tax payment bank lookup; tax authority address lookup; news.

- Account management: change of registered account information.

- Personal setup and support: the application's features continuously updated to better support taxpayers.

What are the benefits of using the eTax Mobile application?

According to Official Dispatch 3890/CTTBI-TTHT 2024 from the Department of Taxation of Thai Binh Province Download here, the benefits of using the eTax Mobile application include eTax Mobile providing excellent support for taxpayers in fulfilling tax obligations (taxpayer registration, declaration, payment, tax obligation lookup) anytime, anywhere with an internet connection; safe for users through password setup, simple operation with utility features; saves time and costs by not needing to go to the Tax agency or Bank.