Vietnam: What does the the tax finalization dossier for corporate income tax (CIT) by revenue-cost method include?

Vietnam: What does the the tax finalization dossier for corporate income tax (CIT) by revenue-cost method include?

Based on sub-item 7.2.a, Section 7, stipulated in Appendix I - List of Tax Declaration Dossiers issued with Decree 126/2020/ND-CP, the components of the CIT finalization dossier by the revenue-cost method include:

| Form 03/TNDN | Corporate income tax finalization declaration (applied to the revenue-cost method) |

| Form 03-1A/TNDN | Appendix of production and business operation results (applicable to manufacturing, trading, services industries, except security and defense companies) |

| Form 03-1B/TNDN | Appendix of production and business operation results (applicable to banking, credit industries) |

| Form 03-1C/TNDN | Appendix of production and business operation results (applicable to securities companies, fund management companies managing securities investment funds) |

| Form 03-2/TNDN | Appendix of loss carryforward |

| Form 03-3A/TNDN | Appendix of incentives for income from new investment projects, income of enterprises entitled to corporate income tax incentives |

| Form 03-3B/TNDN | Appendix of incentives for business entities investing in expansion projects, increasing production capacity, and technology renewal (expansion investment projects) |

| Form 03-3C/TNDN | Appendix of incentives for enterprises utilizing employees who are ethnic minorities or enterprises engaged in production, construction, and transport utilizing a large number of female workers |

| Form 03-3D/TNDN | Appendix of incentives for science and technology enterprises or enterprises conducting technology transfer in prioritized areas |

| Form 03-4/TNDN | Appendix of corporate income tax paid abroad |

| Form 03-5/TNDN | Appendix of corporate income tax related to real estate transfer activities |

| Form 03-6/TNDN | Appendix of report on the establishment and use of science and technology funds |

| Form 03-8/TNDN | Appendix table on the allocation of corporate income tax payable to localities entitled to revenue sources for production establishments |

| Form 03-8A/TNDN | Appendix table on the allocation of corporate income tax payable to localities entitled to revenue sources for real estate transfer activities |

| Form 03-8B/TNDN | Appendix table on the allocation of corporate income tax payable to localities entitled to revenue sources for hydropower production activities |

| Form 03-8C/TNDN | Appendix table on the allocation of corporate income tax payable to localities entitled to revenue sources for computerized lottery business activities |

| Form 03-9/TNDN | Appendix on a list of documents on temporary payment of corporate income tax for real estate transfer activities with payments according to progress not yet delivered within the year |

| Annual financial statements in accordance with laws on accounting and independent auditing (except for cases not required to prepare financial statements) | |

| In the case where enterprises have investment projects abroad, in addition to the dossiers mentioned above, enterprises must supplement dossiers and documents as guided by the Ministry of Finance on corporate income tax. |

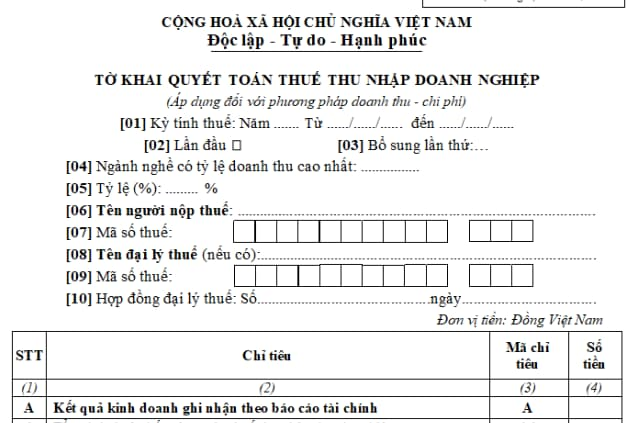

Where to download Form 03/TNDN - CIT finalization declaration by revenue-cost method in Vietnam?

The CIT finalization declaration by the revenue-cost method (Form 03/TNDN) is stipulated in Section VI of Appendix II issued with Circular 80/2021/TT-BTC.

Download Form 03/TNDN CIT Finalization Declaration applicable to the revenue-cost method:Here

What are instructions for preparing Form 03/TNDN - CIT finalization declaration by revenue-cost method in Vietnam?

Based on the guidance for Form 03/TNDN - CIT Finalization Declaration by Revenue-Cost Method stipulated in Section VI of Appendix II issued with Circular 80/2021/TT-BTC, as follows:

[1] TNDN: Corporate Income; BDS: Real Estate;

[2] Indicators G1, G3: Taxpayers declare the overpaid CIT of the previous period to offset against the payable CIT of the current period.

[3] Indicators D11, G2, G4, G5: Taxpayers declare the provisional CIT paid into the state budget up to the deadline for submitting the finalization declaration.

Example: If the taxpayer has a tax period from January 1, 2021, to December 31, 2021, the provisional CIT paid during the year is the CIT paid for the tax period of 2021 calculated from January 1, 2021, to the end of March 31, 2022.

[4] In the case of taxpayers who are lottery enterprises with other production and business activities outside of lottery business operations, they declare the payable CIT of lottery business operations in indicator E1, and the payable CIT of other production and business operations in indicators E2, E3.

[5] Indicators E, G: Taxpayers do not declare the payable and provisional CIT of activities enjoying incentives in other provinces, already declared separately.

[6] Indicators E4, G5, H3: Taxpayers declare the payable and provisional CIT of infrastructure transfer operations and housing handed over this period and have advanced payments from customers according to the progress (including amounts collected from previous periods and the current period).