Vietnam: What does the duty reduction dossier for imports and exports include?

Vietnam: What does the duty reduction dossier for imports and exports include?

Based on Article 15 of Circular 06/2021/TT-BTC, the duty reduction dossier for imports and exports eligible for duty reduction includes:

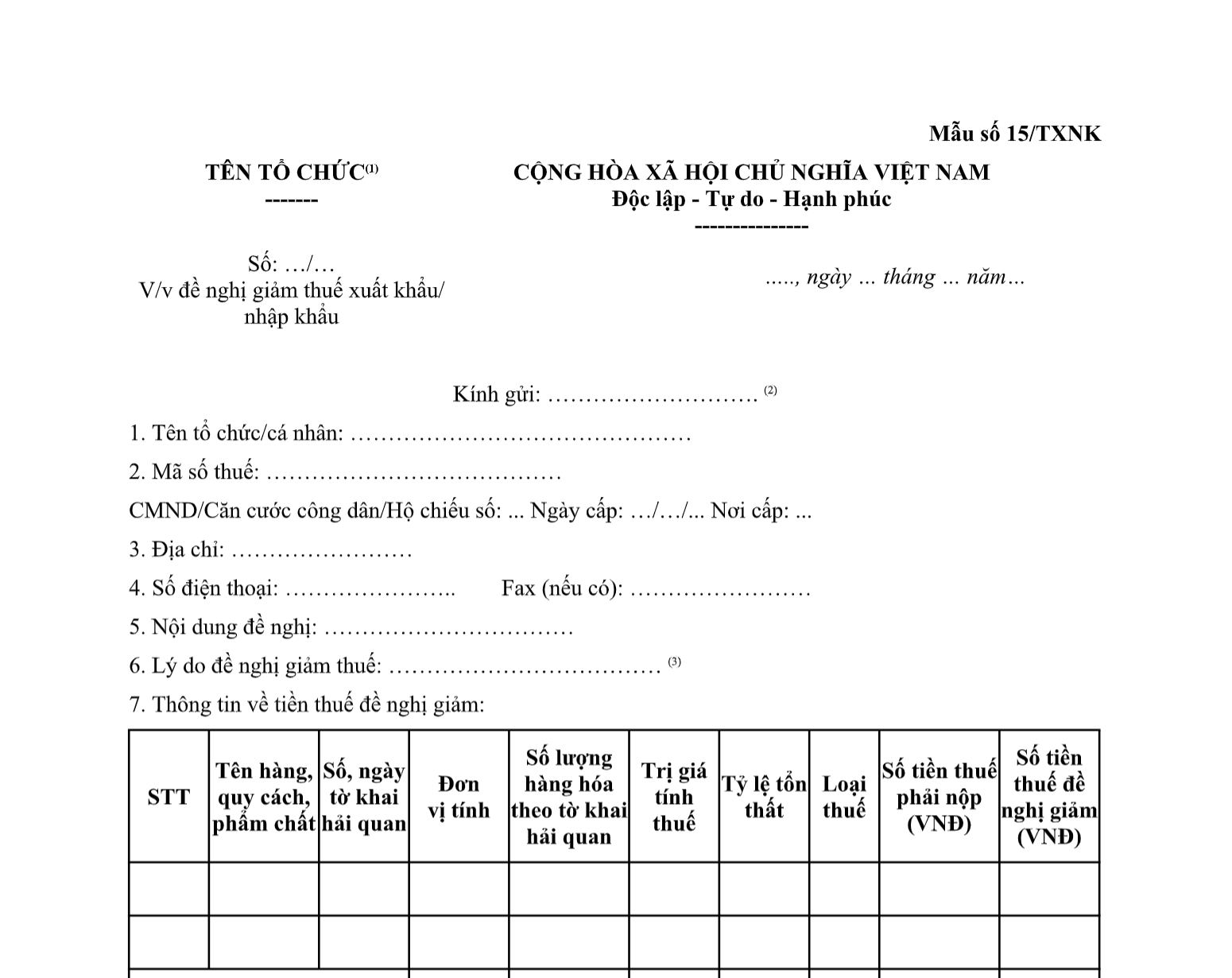

- An Official Dispatch requesting duty reduction, clearly stating the type of tax requested for reduction, the reason for the duty reduction, and the amount of tax requested for reduction as stipulated at point a, clause 2 of Article 80 of the Law on Tax Administration 2019, sent via the System according to Form No. 7 Appendix 2 issued with Circular 06/2021/TT-BTC, or in case of paper dossiers, following Form No. 15/TXNK Appendix 1 issued with Circular 06/2021/TT-BTC: 1 original copy.

- Insurance contract, insurance payout notification from the indemnifying organization (if applicable). If the insurance contract does not include tax indemnity, a confirmation from the insurance organization is required. In cases of damage caused by the carrier, a contract or indemnity agreement from the carrier is also required (if applicable): 1 photocopy with a certification stamp from the duty reduction requesting authority.

- Documents and minutes certifying the cause of damage from the competent authorities at the locale where the damage occurred:

+ Confirmation document from one of the following authorities or organizations: Commune-level Police; Commune People's Committee; Management Boards of Industrial Zones, Export Processing Zones, Economic Zones; Management Boards of Border Gates; Aviation Port Authorities; Maritime Port Authorities where the force majeure event of natural disaster, disaster, epidemic, or accident causing damage to imported raw materials, machinery, equipment occurred: 1 original copy.

+ Minutes confirming the fire incident from the local fire prevention and fighting police agency where the fire incident occurred: 1 original copy.

- Inspection Certificate from a commercial inspection service provider concerning the quantity of lost goods or the actual loss rate of goods: 1 original copy.

Vietnam: What does the duty reduction dossier for imports and exports include? (Image from the Internet)

What are the procedures and authorities for import-export duty reduction in Vietnam?

According to clause 3, Article 32 of Decree 134/2016/ND-CP, as amended by clause 16, Article 1 of Decree 18/2021/ND-CP, the procedures and authorities for import-export duty reduction are as follows:

- The taxpayer submits the dossier to the Customs Sub-department where customs procedures are carried out at the time of customs clearance or no later than 30 working days from the date of receiving a confirmation document of the damage, loss, or harm levels;

- If the dossier is submitted at the time of customs clearance, the Customs Sub-department checks the dossier, inspects the goods, verifies the conditions for duty reduction, and implements the duty reduction within the customs clearance timeframe as stipulated in Article 23 of the Customs Law 2014;

- If the dossier is submitted after the time of customs clearance:

Within 30 days from the receipt of a complete dossier, the Provincial or Municipal Customs Department is responsible for preparing the dossier, verifying the information, assessing the accuracy and completeness of the dossier, and deciding on the duty reduction according to Form No. 12 Appendix 7 issued with Decree 18/2021/ND-CP or notifying the taxpayer of the reasons for non-eligibility for duty reduction and the amount of tax to be paid.

If the dossier is incomplete, the customs authority notifies the taxpayer within 3 working days from the date of receipt of the dossier.

If it is necessary to inspect the actual goods after customs supervision to have sufficient grounds for duty reduction, a decision on post-clearance inspection at the taxpayer's office is issued, and the tasks under this clause are carried out within a maximum of 40 days from the receipt of the complete dossier.

What are cases of imports and exports obtain duty reductions in Vietnam?

According to Article 18 of the Law on Export-Import Taxes 2016 governing import-export duty reduction:

duty reduction

- Exported or imported goods under the supervision of customs authorities, if damaged or lost and certified by a competent agency or organization, shall receive duty reduction.

The duty reduction amount corresponds to the actual loss rate of the goods. In the event that the entire consignment is damaged or lost, no tax shall be payable.

- duty reduction procedures are implemented according to the provisions of tax administration law.

Thus, exported or imported goods under the supervision of customs authorities, if damaged or lost and certified by a competent agency or organization, shall receive import-export duty reduction.

The rate of import-export duty reduction corresponds to the actual loss rate of the goods.

What is the request form for import-export duty reduction in Vietnam?

The request form for import-export duty reduction is Form No. 15/TXNK Appendix 1 issued with Circular 06/2021/TT-BTC.

Download the request form for import-export duty reduction here.