Vietnam: What does the application for VAT refund include?

Vietnam: What does the application for VAT refund include?

Based on the regulations stipulated in Article 28 of Circular 80/2021/TT-BTC (as amended by Article 2 of Circular 13/2023/TT-BTC), the application for VAT refund includes:

(1) Application for refund of state budget revenues according to Form No. 01/HT issued together with Appendix I of Circular 80/2021/TT-BTC.

(2) Relevant documents according to the respective VAT refund cases. Specifically:

- In the case of investment project VAT refund:

+ A copy of the Investment Registration Certificate or Investment Certificate or Investment License in cases where investment registration certification procedures are required;

+ For projects with construction works: A copy of the Land Use Right Certificate, land allocation decision, or land lease contract issued by the competent authority; construction permit;

+ A copy of the Charter Capital Contribution Proof;

+ For investment projects of business establishments in conditional business lines during the investment phase, as prescribed by investment law and specialized laws that have been granted business licenses in conditional business lines by the competent state authority under Clause 3, Article 1 of Decree 49/2022/ND-CP: A copy of one of the forms of License or Certificate or Confirmation, approval document regarding business activities in conditional business lines.

+ Detailed invoice and goods and service purchase vouchers list according to Form No. 01-1/HT issued together with Appendix I of this Circular, except for cases where the taxpayer has submitted electronic invoices to the tax authorities;

+ Decision to establish the Project Management Unit, Decision to assign the management of the investment project by the investment project owner, the Organizational and Operational Regulation of the branch or Project Management Unit (if the branch or Project Management Unit applies for tax refunds).

- In the case of VAT refunds for exported goods and services:

+ Detailed invoice and goods and service purchase vouchers list according to Form No. 01-1/HT issued together with Appendix I of Circular 80/2021/TT-BTC, except for cases where the taxpayer has submitted electronic invoices to the tax authorities;

+ List of customs declarations that have been cleared according to Form No. 01-2/HT issued together with Appendix I of Circular 80/2021/TT-BTC for goods exported and cleared according to customs law provisions.

- In the case of VAT refunds for programs and projects using non-refundable Official Development Assistance (ODA) funds:

+ For non-refundable ODA managed and implemented directly by the program/project owner:

++ A copy of the international treaty or ODA agreement or exchange document committing and accepting the non-refundable ODA; a copy of the Decision approving the Project Dossier, non-project or Investment Decision for the program and project dossier, or approved Feasibility Study Report.

++ Application for confirmation of appropriate spending for non-business funds and payment request for investment funds of the project owner according to regulations.

++ Detailed invoice and goods, and service purchase vouchers list according to Form No. 01-1/HT issued together with Appendix I of this Circular.

++ A copy of the confirmation document from the program/project management agency regarding the provision of the non-refundable ODA program/project subject to VAT refund and the non-allocation of counterpart funds from the state budget to pay VAT.

++ If the program/project owner assigns part or all of the program/project to another unit or organization for management and implementation according to regulations on non-refundable ODA management and use, but this content is not stated in documents specified at points c.1.1, c.1.4, Clause 2, Article 28 of Circular 80/2021/TT-BTC, supplementary documents should include:

++ A copy of the document assigning the management and implementation of the non-refundable ODA program/project to the unit/organization requesting the tax refund.

++ If the main contractor files the VAT refund application, additional documents such as a copy of the contract signed between the project owner and the main contractor showing the payment price according to the bid result without VAT must be included.

The taxpayer only needs to submit documents as specified at points c.1.1, c.1.4, c.1.5, c.1.6 in Clause 2, Article 28 of Circular 80/2021/TT-BTC for the first-time tax refund application or upon changes and supplements.

+ For non-refundable ODA managed and implemented directly by the donor:

++ Documents specified at points c.1.1, c.1.3, Clause 2, Article 28 of Circular 80/2021/TT-BTC;

++ If the donor appoints a Representative Office or organization to manage and implement the program/project (except for cases stipulated at point c.2.3, Clause 2, Article 28 of Circular 80/2021/TT-BTC) but this content is not stated in documents specified at point c.1.1, Clause 2, Article 28 of Circular 80/2021/TT-BTC, additional documents should include:

+++ A copy of the document assigning management and implementation of the non-refundable ODA program/project to the Representative Office or organization appointed by the donor;

+++ A copy of the document of the competent authority establishing the Representative Office of the donor or the organization appointed by the donor.

++ If the main contractor files the VAT refund application, additional documents such as a copy of the contract signed between the donor and the main contractor or a contract summary confirmed by the donor that includes contract information: contract number, contract signing date, contract duration, scope of work, contract value, payment method, the bid result price excluding VAT must be included.

The taxpayer only needs to submit documents as specified at points c.1.1, c.2.2, c.2.3, Clause 2, Article 28 of Circular 80/2021/TT-BTC for the first-time tax refund application or upon changes and supplements.

- In the case of a VAT refund for domestically purchased goods and services using non-refundable grant funds not falling under official development assistance:

+ A copy of the Decision approving the program/project documentation, non-project assistance, and program/project documentation, non-project documentation under point a, Clause 2, Article 24 of Decree 80/2020/ND-CP;

+ Request for confirmation of appropriate spending for non-business funds and payment request for investment funds of the project owner (in cases receiving non-refundable grants under the state budget revenue) according to point b, Clause 2, Article 24 of Decree 80/2020/ND-CP and point a, Clause 10, Article 10 of Decree 11/2020/ND-CP.

+ Detailed invoice and goods, and service purchase vouchers list according to Form No. 01-1/HT issued together with Appendix I of Circular 80/2021/TT-BTC.

The taxpayer only needs to submit documents specified at point d.1 of this clause for the first-time tax refund application or upon changes and supplements.

- In the case of VAT refunds for domestically purchased goods and services using emergency international aid funds for disaster relief and recovery in Vietnam:

+ A copy of the Decision approving emergency aid for relief (in the case of emergency international aid for relief) or the Decision approving the emergency international aid reception policy for disaster recovery and the emergency international aid documentation for disaster recovery (in the case of emergency international aid for disaster recovery) according to regulations.

+ Detailed invoice and goods and service purchase vouchers list according to Form No. 01-1/HT issued together with Appendix I of Circular 80/2021/TT-BTC.

The taxpayer only needs to submit documents specified at point đ.1 of this clause for the first-time tax refund application or upon changes and supplements.

- In the case of diplomatic tax refund privileges:

+ VAT invoice list for goods and services purchased for diplomatic representative agencies according to Form No. 01-3a/HT issued together with Appendix I of Circular 80/2021/TT-BTC with confirmation from the State Protocol Department under the Ministry of Foreign Affairs that input costs are subject to diplomatic privileges for tax refund purposes.

+ List of diplomatic public employees eligible for VAT refunds according to Form No. 01-3b/HT issued together with Appendix I of Circular 80/2021/TT-BTC.

- VAT refund for commercial banks acting as agents reimbursing VAT for departing foreigners:

List of VAT refund documents for departing foreign individuals according to Form No. 01-4/HT issued together with Appendix I of Circular 80/2021/TT-BTC.

- In the case of VAT refunds as per the decision of a competent authority according to legal regulations: The decision of the competent authority.

Note: VAT refunds pursuant to international treaties or VAT input deduction refunds while transferring ownership, converting enterprises, consolidating, merging, splitting, dissolving, bankrupting, terminating activities shall follow the regulations in Articles 30 and 31 of Circular 80/2021/TT-BTC.

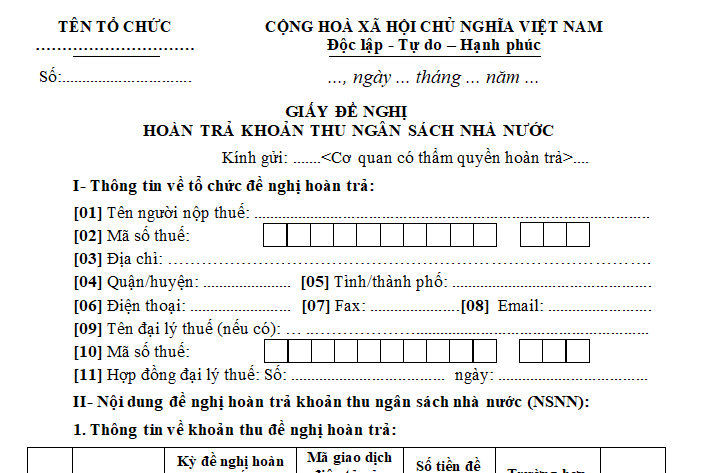

Vietnam: What does the application for VAT refund include? (Image from the Internet)

What is Form 01/HT on application for VAT refund in Vietnam according to Circular 80?

Form No. 01/HT issued together with Appendix I Circular 80/2021/TT-BTC is as follows:

Download Form 01/HT on application for VAT refund here.

Vietnam: What does the application for VAT refund according to the decision of competent authorities according to legal regulations include?

According to sub-item 22, Item I, Administrative Procedures promulgated with Decision 1462/QD-BTC in 2022, the application for VAT refund according to the decision of competent authorities according to legal regulations includes:

- Application for refund of state budget revenues according to Form No. 01/HT issued together with Appendix I issued with Circular 80/2021/TT-BTC;

- Decision of the competent authority.