Vietnam: What does the application for duty refund for re-imported exports in 2024 include?

Vietnam: What does the application for duty refund for re-imported exports in 2024 include?

Based on Clause 2, Article 33 of Decree 134/2016/ND-CP (amended and supplemented by Clauses 18 and 20, Article 1 of Decree 18/2021/ND-CP), the application for duty refund for re-imported exports includes:

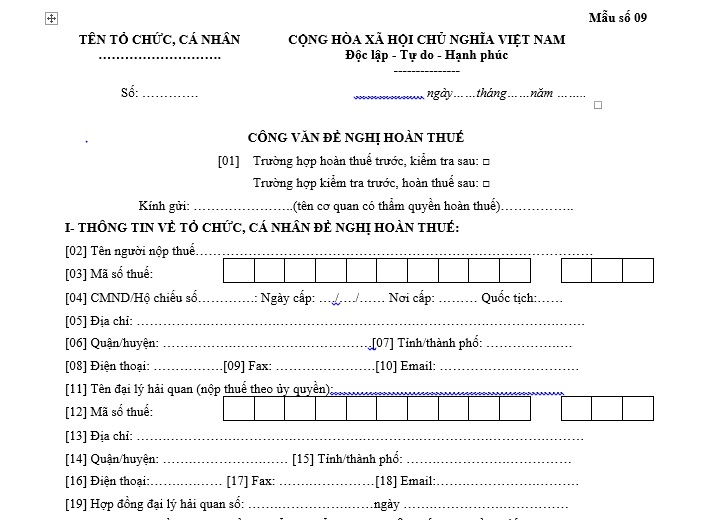

- Official Dispatch requesting a refund of export or import duty for exported or imported goods sent via the electronic data processing system of the customs authority according to the information criteria in Form No. 01, Appendix 7, or the official document requesting export, import duty refund according to Form No. 09 of Appendix 7 issued together with Decree 134/2016/ND-CP: 01 original copy.

- Payment documents for exported, imported goods in case of payment: 01 photocopy.

- Export, import contracts and invoices according to export, import contracts for the sale and purchase of goods; entrusted export, import contracts if in the form of entrusted export, import (if available): 01 photocopy.

- For goods that must be re-imported because foreign customers refuse to accept them or there is no one to receive the goods according to the carrier's notice, an additional notice from the foreign customer or a written agreement with the foreign customer on taking back the goods or a notice from the carrier about the absence of a recipient stating the reason, quantity, and type of goods returned in cases of returned goods: 01 photocopy.

In cases of force majeure or self-discovery of errors by the taxpayer resulting in re-import, this document is not required but the reason for re-importing the returned goods must be clearly stated in the tax refund request document;

- For exported, imported goods mentioned at Point b, Clause 1 of this Article, an additional notification from the postal enterprise or international courier service regarding non-delivery to the recipient must be submitted: 01 photocopy.

Vietnam: What does the application for duty refund for re-imported exports in 2024 include? (Image from Internet)

What types of exports that have paid export duty but need to be re-imported are eligible for export duty refunds and exempt from import duty in Vietnam?

According to Clause 1, Article 33 of Decree 134/2016/ND-CP, the regulations on refund of duties on re-imported exports are as follows:

- Goods that have been exported but must be re-imported to Vietnam;

- Goods exported by organizations, individuals in Vietnam sent to organizations, individuals abroad via postal and international courier services that have paid taxes but could not be delivered to the recipient and must be re-imported.

Taxpayers are responsible for accurately and honestly declaring on the customs declaration for re-imported goods that are previously exports; information regarding the contract number, contract date, and the name of the purchasing partner for cases involving purchase contracts.

Customs authorities are responsible for checking the declaration content of the taxpayer and documenting the inspection results to facilitate the tax refund process.

What is the application form for import-export duty refund in Vietnam?

The current application form for import-export duty refund is prescribed in Form No. 09, Appendix 9 issued together with Decree 18/2021/ND-CP. To be specific:

Download the latest application form for import-export duty refund...Download

What cases are eligible for import-export duty refunds in Vietnam?

Based on Clause 1, Article 19 of the Law on Export and Import Duties 2016 which stipulates the cases eligible for tax refunds. To be specific:

- Taxpayers who have paid import, export duties but have no imported, exports or have imported, exported fewer goods than those for which import, export duties were paid;

- Taxpayers who have paid export duty but the exports must be re-imported are eligible for export duty refunds and are exempt from import duty;

- Taxpayers who have paid import duty but the imported goods must be re-exported are eligible for import duty refunds and are exempt from export duty;

- Taxpayers who have paid taxes for imported goods for production, business but have used them in the production of exports and have exported the products;

- Taxpayers who have paid taxes for machinery, equipment, tools, and vehicles of organizations, individuals permitted for temporary import for re-export, except for rentals to implement investment projects, construction, installation works, and production purposes, when re-exported abroad or exported to non-tariff zones.

The amount of import duty refunded is determined based on the remaining use value of the goods when re-exported calculated according to the usage duration, retention in Vietnam. Goods with no remaining use value will not have the paid import duty refunded.

No refund is given for tax amounts below the minimum level as stipulated by the Government.