Vietnam: What day is the December 21st of the lunar calender? Does the deadline for submitting the VAT return for December 2024 fall in January 20, 2025?

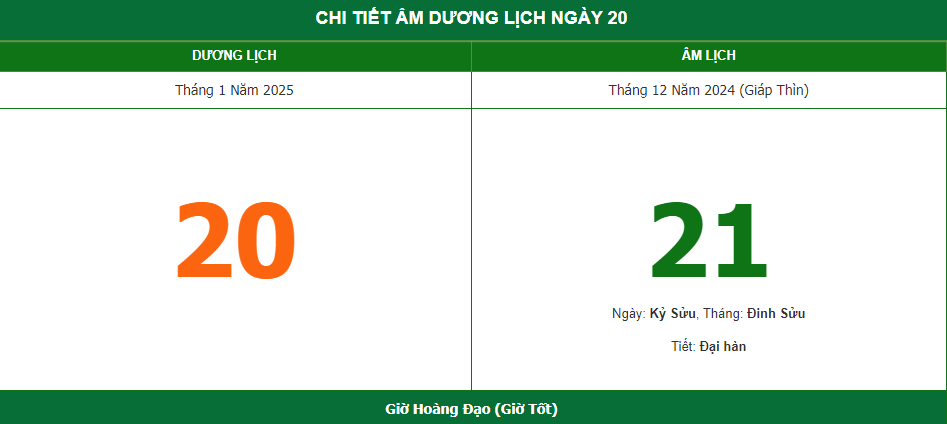

What day is the December 21st of the lunar calender?

The 21st of December in the lunar calender will be Monday, January 20, 2025.

The Lunar New Year of 2025 will be the Year of the Snake.

Note: Information regarding what day and date the 21st of December in the lunar calender will be in 2025 is for reference only!

Vietnam: Does the deadline for submitting the VAT return for December 2024 fall in January 20, 2025?

Based on Clause 1, Article 44 of the Law on Tax Administration 2019, the specified timeline for submitting tax returns is as follows:

Deadline for submitting tax returns

- The deadline for submitting tax returns for taxes declared monthly or quarterly is prescribed as follows:

a) No later than the 20th day of the following month for monthly declarations and payments;

b) No later than the last day of the first month of the following quarter for quarterly declarations and payments.

- The deadline for submitting tax returns for taxes calculated annually is prescribed as follows:

a) No later than the last day of the third month after the end of the calendar year or fiscal year for annual tax settlement dossiers; no later than the last day of the first month of the calendar year or fiscal year for annual tax returns;

b) No later than the last day of the fourth month after the end of the calendar year for individual income tax settlement dossiers by individuals who directly settle taxes;

c) No later than December 15 of the preceding year for tax returns of household businesses, individual businesses paying taxes by the presumptive method; in cases where a household business, individual business newly starts, the deadline for submitting tax returns is no later than 10 days from the start of business.

...

According to these regulations, the exact deadline for submitting the VAT return for December 2024 is January 20, 2025.

Vietnam: What day is the December 21st of the lunar calender? Does the deadline for submitting the VAT return for December 2024 fall in January 20, 2025? (Image from the Internet)

What are regulations on VAT deferral in Vietnam?

According to Clause 1, Article 4 of Decree 64/2024/ND-CP, the extension is specifically regulated as follows:

- For value-added tax (excluding value-added tax at the import stage)

+ The deadline for VAT payment on tax amounts payable (including tax apportioned to other provincial localities where the taxpayer has the main office, and tax paid for each arising instance) for tax periods from May to September 2024 (for monthly VAT returns) and for the second quarter of 2024, the third quarter of 2024 (for quarterly VAT returns) of enterprises and organizations mentioned in Article 3 of this Decree is extended. The extension period is 5 months for VAT of May 2024, June 2024, and the second quarter of 2024; 4 months for July 2024; 3 months for August 2024; and 2 months for September 2024 and the third quarter of 2024. The extension timeline mentioned here is counted from the due date for VAT payment as per tax administration laws.

- Eligible enterprises and organizations shall submit monthly and quarterly VAT returns in accordance with current laws, but do not have to pay the VAT payable as declared. The extended deadline for VAT payment is as follows:

+ The VAT payment deadline for the tax period of May 2024 is no later than November 20, 2024.

+ The VAT payment deadline for the tax period of June 2024 is no later than December 20, 2024.

+ The VAT payment deadline for the tax period of July 2024 is no later than December 20, 2024.

+ The VAT payment deadline for the tax period of August 2024 is no later than December 20, 2024.

+ The VAT payment deadline for the tax period of September 2024 is no later than December 20, 2024.

+ The VAT payment deadline for the second quarter of 2024 is no later than December 31, 2024.

+ The VAT payment deadline for the third quarter of 2024 is no later than December 31, 2024.

- In cases where an enterprise, organization referred to in Article 3 of Decree 64/2024/ND-CP has branches or affiliated units that submit separate VAT returns to the tax authority directly managing those branches or units, these branches or affiliated units are also eligible for a VAT payment extension.

- In cases where the branches or affiliated units of the enterprises, organizations referred to in Clauses 1, 2, and 3 of Article 3 of Decree 64/2024/ND-CP do not engage in production and business activities in economic sectors or fields eligible for the extension, those branches or affiliated units are not eligible for a VAT payment extension.