Vietnam: What are the instructions for looking up TINs of individuals?

What are the instructions for looking up the TINs of individuals in Vietnam?

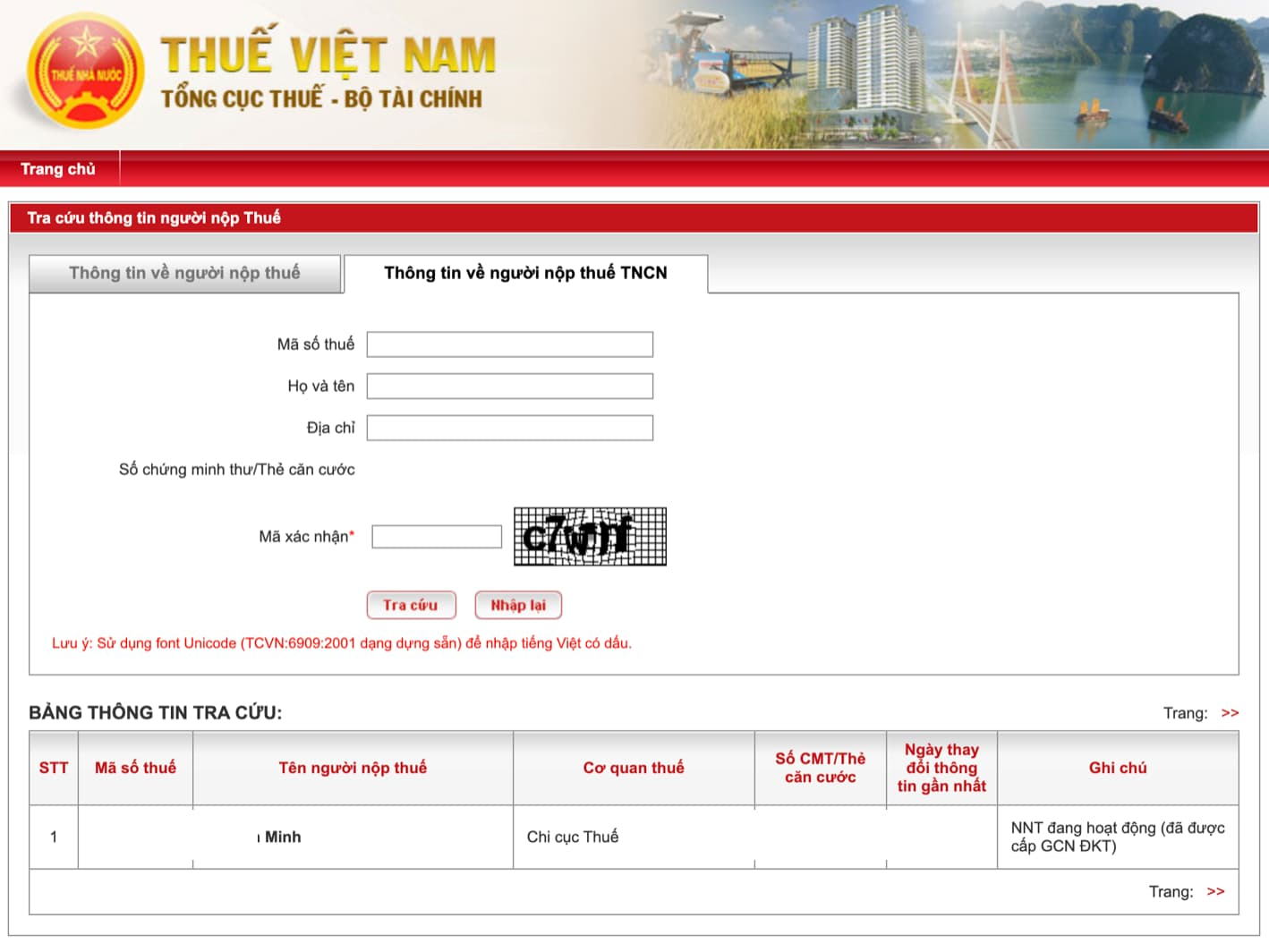

Below are the instructions for looking up the TINs of individuals in Vietnam on the General Department of Taxation's electronic information portal.

Step 1: Access https://tracuunnt.gdt.gov.vn/tcnnt/mstcn.jsp.

Step 2: Enter one of the following pieces of information:

- TIN- Full name- Address- ID card/Citizen ID card number

Enter the verification code and search.

Step 3: Click on the taxpayer's name to view details and check the taxpayer's information.

What are the instructions for looking up the TINs of individuals in Vietnam? (Image from the Internet)

What are the regulations on use of TINs in Vietnam?

According to Article 35 of the Tax Administration Law 2019 stipulating the use of TINs as follows:

- Taxpayers must include their TINs in invoices, records and/or materials when making business transactions; opening deposit accounts at commercial banks and/or other credit institutions; declaring tax, pay tax, applying for tax exemption, tax reduction, tax refund and/or tax cancellation; filing customs declarations and making other tax-related transactions for all amounts payable to the state budget, including the case where taxpayers’ businesses operate across different locations.

- Taxpayers must provide their TINs to relevant agencies and/or organizations or include their TINs in their applications when following administrative procedures of tax authorities via the interlinked single-window system.

- Tax authorities, the State Treasury and commercial banks and other organizations authorized by tax authorities to collect tax shall use TINs of taxpayers for tax administration and tax collection.

- Commercial banks and other credit institutions must include TINs in the taxpayers’ applications for opening accounts and in records of transactions via accounts.

- Other organizations and individuals participating in tax administration shall use TINs of taxpayers when providing information related to the determination of tax liabilities.

- When a Vietnamese party makes a payment to an organization/individual whose cross-border business is based on a digital intermediary platform outside of Vietnamese territories, it must use the TIN assigned to this organization/individual to deduct and pay tax on behalf of such organization/individual.

- Personal identification numbers shall replace TINs when they are issued to the whole population.

What are the instructions for registering the TINs of individuals at tax authorities in Vietnam?

According to sub-clause b.1 point b clause 9 Article 7 of Circular 105/2020/TT-BTC and Decision 2589/QD-BTC in 2021, individuals paying personal income tax not through income-paying agencies or not authorizing the income-paying agency for taxpayer registration must submit a taxpayer registration application to the tax authority to obtain a TIN registration. The process can be conducted as follows:

Step 1: Prepare the application

The registration application depends on each case and each subject:

(1) For resident individuals with income from salary and remuneration paid by international organizations, embassies, consulates in Vietnam but these organizations have not yet deducted tax. The taxpayer registration application includes:

- Taxpayer registration form No. 05-DK-TCT issued with the accompanying form.

- A copy of the valid Citizen ID card or the valid ID card for individuals with Vietnamese nationality; a copy of the valid Passport for individuals with foreign nationality or Vietnamese nationality living abroad.

(2) For individuals with income from salary and remuneration paid by organizations or individuals from abroad. The taxpayer registration application includes:

- Taxpayer registration form No. 05-DK-TCT issued with the accompanying form.

- A copy of the valid Citizen ID card or the valid ID card for individuals with Vietnamese nationality; a copy of the valid Passport for individuals with foreign nationality or Vietnamese nationality living abroad.

- A copy of the appointment letter from the employing organization in the case of non-resident foreign individuals sent to work in Vietnam but receiving income abroad under personal income tax law.

(3) At the Tax Sub-Department or the Regional Tax Sub-Department where individuals have obligations to the state budget for taxpayer registration through a tax declaration dossier (individuals with non-agricultural land use tax obligations without a TIN; individuals involved in real estate transfers without a TIN; individuals having obligations to pay to the state budget for irregularly occurring revenues including: registration fees, capital transfers, and other irregular revenues without a TIN).

The initial taxpayer registration application is the tax declaration dossier according to tax administration law. If the tax declaration dossier lacks copies of the valid documents of individuals (including a Citizen ID card or ID card for individuals with Vietnamese nationality; a Passport for individuals with foreign nationality or Vietnamese nationality living abroad), taxpayers must submit one of these documents with the tax declaration dossier.

If the tax authority and state management agency have interconnected operations, the tax authority will base on the Information Transfer Form from the state management agency if there is no tax declaration dossier.

(4) Other cases processed at the Tax Sub-Department or the Regional Tax Sub-Department where individuals reside (permanent or temporary residence), the taxpayer registration application includes:

- Taxpayer registration form No. 05-DK-TCT issued with the accompanying form.

- A copy of the valid Citizen ID card or the valid ID card for individuals with Vietnamese nationality;

- A copy of the valid Passport for individuals with foreign nationality or Vietnamese nationality living abroad.

Step 2: The tax authority receives the application

- The tax officer receives and stamps the taxpayer registration application, specifying the date of receipt, the number of documents according to the application content list for applications submitted directly to the tax authority. The tax officer issues a receipt note for the return date of the results and the processing time for the received application;

- For applications sent via postal service: The tax officer stamps the reception date on the application and records the tax authority’s incoming correspondence number;

The tax officer reviews the taxpayer registration application. If the application is incomplete and requires explanation or additional information, the tax authority notifies the taxpayer using form No. 01/TB-BSTT-NNT in Appendix 2 issued with Decree 126/2020/ND-CP dated October 19, 2020, of the Government of Vietnam within 2 (two) working days from the date of receipt of the application.

Step 3: Return the Results

The tax officer issues a receipt note for the result return date for applications where the tax authority must return results to the taxpayer, indicating the processing time for each type of received application.