Vietnam: Is there a period according to the form 20DK on dependant registration under Circular 105?

Vietnam: Is there a deduction period according to the form 20DK on dependant registration under Circular 105?

Based on Clause 9, Article 7 of Circular 105/2020/TT-BTC, the guidelines are as follows:

Location to submit and first-time taxpayer registration documentation

...

9. For individual taxpayers as stipulated in Points k, n of Clause 2, Article 4 of this Circular.

a) Individuals paying personal income tax through income-paying agencies and authorizing those agencies for taxpayer registration should submit their taxpayer registration documentation at the income-paying agency. In the case of paying personal income tax at multiple agencies within the same tax period, individuals should authorize one agency for taxpayer registration to obtain a taxpayer identification number. Individuals must inform other income-paying agencies of their taxpayer identification number for tax declaration and payment purposes.

The taxpayer registration documentation for individuals includes: authorization document and one of the individual's documents (a copy of the National ID Card or a copy of the valid Personal ID Card for Vietnamese nationals; a copy of a valid Passport for foreigners or Vietnamese nationals living abroad).

The income-paying agency is responsible for consolidating the individual's taxpayer registration information into the taxpayer registration declaration form No. 05-DK-TH-TCT issued alongside this Circular and sending it to the tax authority directly managing the income-paying agency.

b) Individuals paying personal income tax outside the income-paying agency or not authorizing the income-paying agency for taxpayer registration, should submit their taxpayer registration documentation to the tax authority as follows:

b.1) At the Tax Department where the individual works for resident individuals with income from wages paid by International organizations, embassies, consulates in Vietnam, but those organizations have not conducted tax deduction. The taxpayer registration documentation includes:

- Taxpayer registration declaration form No. 05-DK-TCT issued alongside this Circular;

- A copy of the National ID Card or a copy of the valid Personal ID Card for Vietnamese nationals; a copy of a valid Passport for foreigners or Vietnamese nationals living abroad.

b.2) At the Tax Department where the work arises in Vietnam for individuals with income from wages paid from abroad.

Taxpayer registration documentation as stipulated in Point b.1 of this clause, supplemented by a copy of the appointment letter from the employing organization in case of non-resident foreigners in Vietnam under the law on personal income tax sent to work in Vietnam but receive income abroad.

b.3) At the Tax Sub-department, regional Tax Sub-department where individuals have obligations to the state budget for those registering taxpayer information through tax declaration documentation (individuals with tax obligations on non-agricultural land use without a taxpayer identification number; individuals transferring real estate without a taxpayer identification number; individuals obligated to pay to the state budget for extraordinary revenue without a taxpayer identification number).

First-time taxpayer registration documentation is tax declaration documentation as per the law on tax management. If the tax declaration documentation lacks a copy of valid individual documents (including: National ID Card or Personal ID Card for Vietnamese nationals; Passport for foreigners or Vietnamese nationals living abroad), the taxpayer must attach one of these documents along with the tax declaration documentation.

Should the tax authority and state management agency implement interconnectivity, the tax authority will rely on the Information Transfer Sheet from the state management agency in the absence of tax declaration documentation.

b.4) At the Tax Sub-department, regional Tax Sub-department where individuals reside (permanent or temporary registration) for other cases. Taxpayer registration documentation as stipulated in Point b.1 of this clause.

10. For dependants as regulated in Point l, Clause 2, Article 4 of this Circular, first-time taxpayer registration submission is as follows:

a) In cases where individuals authorize the income-paying agency for taxpayer registration for their dependants, the registration documentation is submitted at the income-paying agency.

The taxpayer registration documentation for dependants includes: Authorization document and dependant's documents (a copy of a National ID Card or a copy of a valid Personal ID Card for dependants who are Vietnamese nationals aged 14 and over; a copy of a Birth Certificate or a valid Passport for dependants who are Vietnamese nationals under 14; a valid Passport for dependants who are foreigners or Vietnamese nationals living abroad).

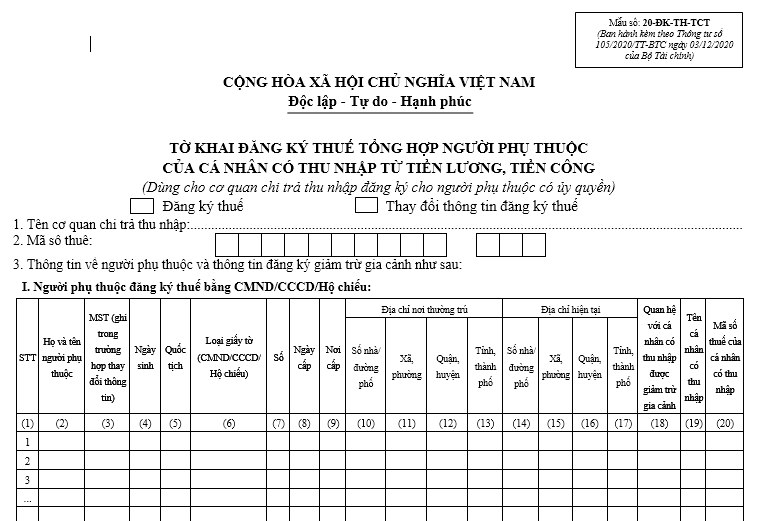

The income-paying agency consolidates and sends the Taxpayer registration declaration form No. 20-DK-TH-TCT issued alongside this Circular to the tax authority managing the income-paying agency.

b) In cases where individuals do not authorize the income-paying agency for taxpayer registration for dependants, the registration documentation should be submitted to the corresponding tax authority as stipulated in Clause 9 of this Article. The taxpayer registration documentation includes:

- Taxpayer registration declaration form No. 20-DK-TCT issued alongside this Circular;

- A copy of the National ID Card or a copy of a valid Personal ID Card for dependants who are Vietnamese nationals aged 14 and over; a copy of a Birth Certificate or Passport for dependants who are Vietnamese nationals under 14; a valid Passport for dependants who are foreigners or Vietnamese nationals living abroad.

In cases where individuals who are subject to personal income tax have submitted dependant registration documentation before the effective date of Circular No. 95/2016/TT-BTC on June 28, 2016, but have not registered taxpayer information for dependants, they must submit taxpayer registration documentation as stipulated in this clause to obtain a taxpayer identification number for the dependant.

The dependant registration form is form No. 20-DK-TCT Download Circular 105 as follows:

>> Accordingly, according to the form 20DK on dependant registration under Circular 105, there is no recorded deduction period.

Vietnam: Is there a deduction period according to the form 20DK on dependant registration under Circular 105? (Image from the Internet)

How many times can a person be registered as a dependant in Vietnam?

Based on point c, clause 1, Article 9 of Circular 111/2013/TT-BTC stipulates:

Reduction amounts

1. personal exemption

c) Principles for calculating personal exemption

c.2) personal exemption for dependants

c.2.1) Taxpayers can calculate a personal exemption for dependants if they have registered as taxpayers and received a taxpayer identification number.

c.2.2) When taxpayers register for a personal exemption for dependants, the tax authority will issue a taxpayer identification number for the dependants and calculate a provisional personal exemption in the year from registration. For dependants already registered for personal exemption before the effective date of this Circular, deductions will continue until they receive a taxpayer identification number.

c.2.3) If taxpayers have not calculated personal exemptions for dependants in the tax year, they may calculate them from the month the obligation for support arose when finalizing taxes and registering the personal exemption for dependants. For other dependants as guided in sub-point d.4, point d, clause 1, this Article, the deadline for registering for personal exemptions is December 31 of the tax year, beyond which no deductions will be calculated for that tax year.

c.2.4) Each dependant can only have the deduction calculated once into one taxpayer for the tax year. If multiple taxpayers have a common dependant to support, they must agree to register the personal exemption with one taxpayer.

Thus, when registering dependants, each dependant can only be calculated for deduction once into one taxpayer for the tax year.

*Note: there is no rule restricting the maximum number of dependants a person can have when considering personal exemptions in personal income tax.

What to do if the taxpayer has not calculated the personal exemption?

Based on sub-point 2, Section 3 of Official Dispatch 883/TCT-DNNCN in 2022 stipulates as follows:

dependant reductions

To calculate deductions for dependants, the taxpayer must register for deductions for dependants as per regulations.

If the taxpayer has not calculated personal exemptions for dependants in the tax year, they may calculate them from the month the obligation for support arose when finalizing taxes and registering the personal exemption for dependants.

For other dependants as guided in sub-point d.4, point d, clause 1, Article 9 of Circular 111/2013/TT-BTC, the deadline for registering personal exemptions is December 31 of the tax year; beyond this time, deductions cannot be calculated for that tax year.

If the taxpayer is subject to authorized finalization and has not calculated personal exemptions for dependants in the tax year, deductions may be calculated from the month the obligation for support arose when finalizing the authorization and registering the personal exemption for dependants through the income-paying organization.

Employees working at dependant units or business locations and receiving income from salaries from the main office in another province may register for personal exemptions for dependants at the tax authority managing the main office or dependant unit, business location.

If employees register personal exemptions for dependants at the dependant unit or business location, the dependant unit or business location is responsible for transferring the documentation proving dependants to the main office.

The main office has the responsibility to review, retain documentation proving dependants as per regulations and present it when tax authorities conduct inspections or audits.

If individuals change workplaces, they must still register and submit documentation proving dependants as guided in sub-point h.2.1.1.1, point h, clause 1, Article 9 of Circular 111/2013/TT-BTC.

Thus, if the taxpayer has not calculated the personal exemption, they can calculate deductions for dependants from the month the obligation for support arose when finalizing taxes and registering the personal exemption for dependants.