Vietnam: How to line break in the latest HTKK software?

How to line break in the latest HTKK software?

The HTKK software is a utility software that supports online tax declaration for taxpayers, specifically known as tax declaration support software.

HTKK software is released free of charge by the General Department of Taxation for enterprises to use to create tax declaration forms which will include a barcode when printing is required.

To add a line to enter employee information, press F5 (or press the key combination Fn+F5), to delete a line, press F6 (or press the key combination Fn+F6).

Information is for reference purposes only!

How to line break in the latest HTKK software? (Image from the Internet)

What to do when HTKK reports a declaration error?

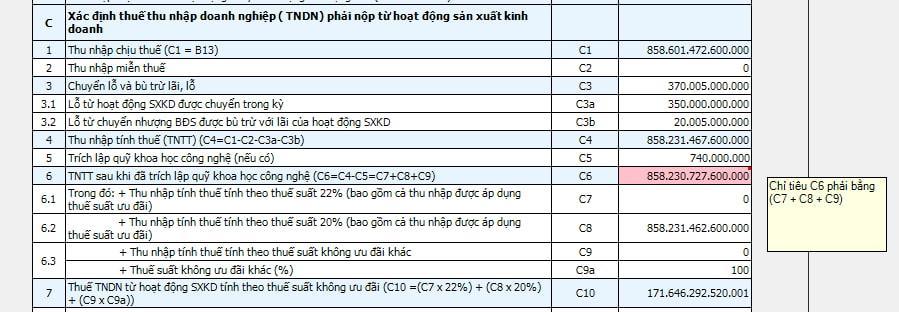

According to the guidance of the General Department of Taxation when using HTKK, if an incorrect declaration is made, the system will notify of a declaration error, and all erroneous declaration fields will be displayed with a pink background and a red mark in the top right corner. When hovering the mouse over this red mark, the system will automatically show the error content and instructions for correction.

The system automatically jumps to the first error field. Below is an example of an error notification.

Taxpayers should perform the following steps to correct the errors:

Step 1: Hover the mouse over the red mark for the system to display the content and guidance for correcting the error.

Step 2: Correct the error, press F1 if detailed guidance is needed for this declaration item.

Step 3: Click the "Save" or "Print" or "Export" button for the system to recheck the data after correction.

Step 4: Repeat steps 1 to 3 until the system no longer displays an error notification.

What are the tax administration principles according to the Law on Tax Administration of Vietnam?

According to the provisions of Article 5 of the Law on Tax Administration 2019 (amended by Clause 1, Article 6 of the Law amending the Law on Securities, Law on Accounting, Law on Independent Audit, Law on State Budget, Law on Management, Use of Public Assets, Law on Tax Administration, Law on Personal Income Tax, Law on National Reserve, Law on Handling Administrative Violations 2024) the provisions are as follows:

- All organizations, households, business households, and individuals have the obligation to pay tax according to the law.

- Tax administration authorities and other State authorities assigned with the task of revenue administration shall perform tax administration according to the provisions of this Law and other relevant legal provisions, ensuring transparency, fairness, and protecting the legal rights and interests of taxpayers.

tax administration officers are responsible for handling tax documents within the scope of the documents, materials, and information provided by the taxpayer, the database of the tax administration authority, information provided by competent state authorities related to the taxpayer, the results of applying risk management in tax administration, ensuring according to the correct responsibilities and tasks, complying with the legal provisions on tax administration and other related tax legal provisions.

- Agencies, organizations, and individuals have the responsibility to participate in tax administration as prescribed by law.

- Implement administrative procedure reform and apply modern information technology in tax administration; apply international tax administration principles, including the principle that the substance of activities and transactions determines tax obligations, risk management principles in tax administration, and other principles suitable to Vietnam's conditions.

- Apply priority measures when implementing tax procedures for export, import goods according to the law on customs and regulations of the Government of Vietnam.

What does tax dossier mean as per the Law on Tax Administration of Vietnam?

Based on Article 3 of the Law on Tax Administration 2019, the provisions are as follows:

Definitions

...

4. The headquarters of the taxpayer is the location where the taxpayer conducts a part or all of their business activities, including the head office, branch, store, production location, place to keep goods, place to keep assets for production, business; place of residence or place where tax obligations arise.

5. Tax identification number is a series of 10 digits or 13 digits and other characters issued by the tax authority to a taxpayer to manage taxes.

6. Tax calculation period is the period to determine the amount of tax payable to the state budget according to tax law.

7. Tax return is a document in the prescribed form by the Minister of Finance used by taxpayers to declare information to determine the amount of tax payable.

8. Customs declaration is a document in the prescribed form by the Minister of Finance used as a tax return for export and import goods.

9. Tax dossier is a dossier of taxpayer registration, tax declaration, tax refund, tax exemption, tax reduction, exemption from late payment interest, non-calculation of late payment interest, extension of tax payment, installment tax debt payment, non-collection of tax; customs dossier; dossier of tax debt rescheduling; dossier for tax debt, late payment interest, and fine waiver.

10. Final tax declaration is the determination of the amount of tax payable for the tax year or the period from the beginning of the tax year until the cessation of activities causing tax obligations or the period from occurrence to the cessation of activities causing tax obligations as prescribed by law.

A tax dossier is understood as the following documents:

- Dossier for taxpayer registration, tax declaration, tax refund, tax exemption, tax reduction, exemption from late payment, non-calculation of late payment, extension of tax payment, installment payment of tax debt, non-collection of tax;

- Customs dossier;

- Dossier for tax debt rescheduling;

- Dossier for waiving tax debt, late payment interest, and fines.