Vietnam: How to finalize personal income tax when an individual has two sources of income in a year?

Vietnam: How to finalize personal income tax when an individual has two sources of income in a year?

According to the provisions at sub-point d.2 and sub-point d.3, point d, clause 6, Article 8 of Decree 126/2020/ND-CP by the Government of Vietnam, employees who do not fall into the category of authorized individuals for personal income tax finalization must directly finalize their personal income tax.

Types of taxes declared monthly, quarterly, annually, separately, and annual tax finalization

...

6. Types of taxes, receipts for annual finalization, and finalization up to the time of dissolution, bankruptcy, termination of activity, contract termination, or reorganization of the enterprise. In the case of conversion of the type of enterprise (excluding equitized state enterprises), if the converting enterprise inherits all tax obligations of the converted enterprise, tax finalization is not required until a decision on enterprise conversion is made; the enterprise finalizes when the year ends. Specifically: as follows:

...

d) Personal income tax for organizations and individuals paying income liable to personal Income tax from salaries, wages; individuals with income from salaries, wages authorizing tax finalization to the organization, individual paying income; individuals with income from salaries, wages directly finalizing tax with tax agencies. Specifically: as follows:

...

d.2) Residents with income from salaries, wages authorize tax finalization to the organization, individual paying income. Specifically:

Individuals with income from salaries, wages signing labor contracts of 3 months or more at a place and actually working there at the time the organization or individual paying income performs tax finalization, even if not working for a full 12 months in the year. In the case of an individual being transferred from an old organization to a new one as stipulated at point d.1 of this paragraph, the individual can authorize tax finalization to the new organization.

Individuals with income from salaries, wages signing labor contracts of 3 months or more at a place and actually working there at the time the organization or individual paying income finalizes taxes, even if not working for a full 12 months in the year; and simultaneously having casual income elsewhere with a monthly average not exceeding 10 million VND and having personal income tax deducted at a rate of 10% if there is no tax finalization request for this income.

d.3) Residents with income from salaries, wages directly declare personal Income tax finalization with tax agencies in the following cases:

Having additional tax payable or having overpaid tax requesting reimbursement or offset against the next tax filing period, excluding the following cases: individuals with additional tax payable after annual finalization not exceeding 50,000 VND; individuals with payable tax less than the temporarily paid tax who do not request reimbursement or offset against the next tax period; individuals with income from salaries, wages signing labor contracts of 3 months or more with a unit and having casual income elsewhere with a monthly average not exceeding 10 million VND and having personal income tax deducted at a rate of 10% if there is no request for tax finalization for this income; individuals whose employers buy life insurance (excluding voluntary retirement insurance), other non-compulsory insurance with accumulated insurance fees and the employer or insurer has deducted personal income tax at a rate of 10% on the insurance fee corresponding to the part purchased or contributed by the employer for the employee, the employee does not have to finalize personal income tax on this income.

Individuals present in Vietnam for less than 183 days in the first calendar year, but from 183 days onwards in the 12 consecutive months from the first day present in Vietnam.

Foreign individuals concluding a work contract in Vietnam shall declare tax finalization with the tax agency before departure. If an individual has not completed tax finalization procedures with the tax agency, authorization to the income-paying organization or another organization, individual to finalize taxes is performed as per tax finalization regulations for individuals. If the income-paying organization or another organization, individual receives authorization to finalize, they must bear responsibility for any additional personal income tax payable or for the reimbursement of overpaid tax to the individual.

Residents with income from salaries, wages, eligible for tax reduction due to natural disasters, fires, accidents, or severe illness affecting the ability to pay tax shall not authorize income-paying organizations or individuals for tax finalization but must directly declare tax finalization with the tax agency as regulated.

...

Simultaneously, according to Official Dispatch 801/TCT-TNCN dated March 2, 2016, from the General Department of Taxation regarding guidelines for personal income tax finalization in 2015 and the issuance of dependent Tax identification numbers (TINs), the regulation for finalizing personal Income tax when there is income from 2 or more places is stipulated as follows:

- Organizations paying income from salaries, wages, irrespective of whether tax deduction occurs or not, are responsible for declaring and finalizing taxes on behalf of individuals who have authorized them.

- In case the organization does not pay income from salaries, wages in 2015, they are not required to declare personal income tax finalization.

Thus, according to the above provisions, personal Income tax finalization when an individual has two sources of income in a year is as follows:

- The income-paying organization must finalize personal income tax for employees who have authorized them (whether or not tax deduction occurs).

- Individuals with income from salaries, wages who have signed labor contracts for 3 months or more at an income-paying organization, and simultaneously have casual income elsewhere with a monthly average not exceeding 10 million VND, and for which tax has been deducted at a rate of 10%:

+ If there is no tax finalization request for this casual income, authorization for finalization at the income-paying organization where the labor contract of 3 months or more is signed is permitted.

+ If there is a request for tax finalization for this casual income, the individual must directly finalize with the tax agency.

- Individuals with income from salaries, wages who have signed labor contracts for 3 months or more at a unit, and simultaneously have casual income without tax deduction, must self-finalize their personal Income tax.

Vietnam: How to finalize personal income tax when an individual has two sources of income in a year?? (Image from the Internet)

What is the deadline for persons finalizing tax directly in Vietnam?

Based on Section 5 of Official Dispatch 883/TCT-DNNCN in 2022, the regulation is as follows:

Based on points a and b, Clause 2, Article 44 of the Law on Tax Administration No. 38/2019/QH14 by the National Assembly stipulating the deadline for filing and payment of personal income tax finalization dossiers as follows:

- For income-paying organizations: The deadline for submitting tax finalization dossiers is no later than the last day of the third month from the end of the calendar year.

- For persons finalizing tax directly: The deadline for submitting tax finalization dossiers is no later than the last day of the fourth month from the end of the calendar year. In cases where individuals arise personal income tax refunds but delay submitting tax finalizations as regulated, penalties for late submission of tax finalizations will not be applied.

- In cases where the tax finalization dossier submission deadline coincides with a prescribed holiday, the deadline is extended to the next business day following the holiday as per the Civil Code provisions.

VI. RESPONSIBILITY FOR RECEIVING AND PROCESSING personal Income tax FINALIZATION DOSSIERS BY THE TAX AUTHORITY

- The tax authority is responsible for propagating, guiding, and urging taxpayers to execute tax finalization, and pay taxes conformably to avoid taxpayers being held liable for violations as per the law.

- To promote the usage of electronic tax filing services by individuals (as guided by Official Dispatch No. 535/TCT-DNNCN dated March 3, 2021, of the General Department of Taxation) and electronic tax payment services for individuals via mobile devices (as guided in Official Dispatch No. 4899/TCT-CNTT dated December 14, 2021, of the General Department of Taxation regarding the implementation of the eTax Mobile 1.0 application), the General Department of Taxation requests from the Tax Department/Branch that further efforts be made to issue electronic tax transaction accounts to individuals to facilitate their tax finalization process, concurrently, publicizing the benefits of using tax electronic transaction accounts issued by the tax agency such as: finalizing tax, paying tax electronically (via the website https://canhan.gdt.gov.vn, “Electronic Tax” application on smart devices) will make the individual's tax finalization, payment process more convenient, quick, prompt, and effective without needing to submit paper finalization dossiers to the tax agency.

- The tax authority is to provide guidance for individuals to pay taxes electronically through the Electronic Tax application on mobile devices as outlined in Appendix II, Electronic Tax Payment Process for Individuals, attached to Official Dispatch No. 4899/TCT-CNTT dated December 14, 2021 of the General Department of Taxation.

- The tax authority is to organize the reception of personal Income tax finalization dossiers in a way that facilitates the location, staffing, and time for dossier reception, ensuring all personal Income tax finalization dossiers are received within the stipulated time frame.

- After accepting personal income tax finalization dossiers, the Tax Agency is to review and process tax finalizations not yet recognized on the sector’s IT system; process dossiers as regulated without returning tax finalization dossiers if individuals do not request adjustment by the tax finalization agency.

The above is the guidance from the General Department of Taxation on some points related to personal income tax finalization as per the current personal income tax law regulation. During implementation, if there are any hurdles, the Tax Departments are requested to report to the General Department of Taxation for prompt guidance./.

Thus, it is observed that for persons finalizing tax directlyes, the deadline for submitting tax finalization dossiers is no later than the last day of the fourth month from the end of the calendar year. For example, the tax finalization submission deadline for December 2024 is no later than April 30, 2025.

*Note: In cases where individuals arise personal income tax refunds but delay submitting tax finalizations as regulated, penalties for administrative violations on late tax finalization submissions will not be applied.

What is the personal Income tax finalization form in Vietnam as per Circular 80?

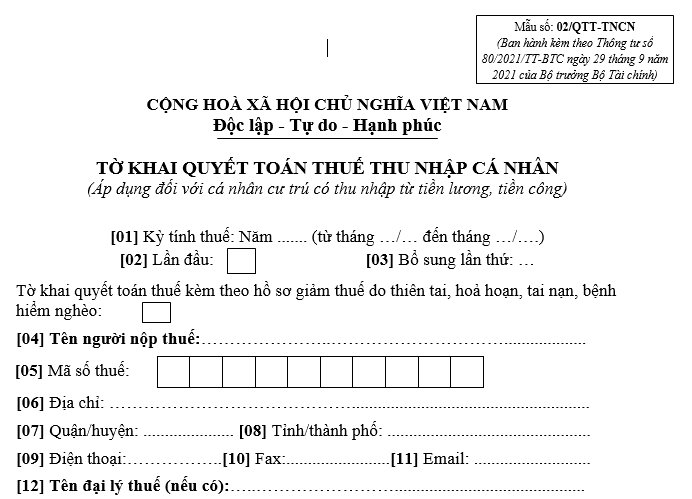

The personal Income tax finalization Form applicable to individuals with income from salaries and wages is form 02/QTT-TNCN issued under Circular 80/2021/TT-BTC, specifically:

>>> Download personal Income tax finalization Form applicable to individuals with income from salaries and wages.