Vietnam: How much personal income tax is payable on lottery winning of 2 billion VND?

Is income from lottery winning of 2 billion VND subject to personal income tax in Vietnam?

Based on point a, clause 6, Article 3 of the Law on Personal Income Tax 2007 as amended by clause 2, Article 2 of the Law Amending Various Tax Laws 2014, the taxable income concerning lottery winning of 2 billion VND VND is as follows:

Taxable Income

Taxable personal income includes the following types of income, except for the income exempt from tax as stipulated in Article 4 of this Law:

...

6. Income from winnings, including:

a) Lottery winnings;

b) Prize winnings from promotional programs;

c) Winnings from betting activities;

d) Winnings from games, contests with prizes, and other forms of winning.

7. Income from royalties, including:

a) Income from the transfer, transfer of use rights to intellectual property subjects;

b) Income from technology transfer.

8. Income from franchise rights.

9. Income from receiving inheritance in the form of securities, capital shares in economic organizations, business establishments, real estate, and other assets subject to ownership registration or use registration.

10. Income from receiving gifts in the form of securities, capital shares in economic organizations, business establishments, real estate, and other assets subject to ownership registration or use registration.

the Government of Vietnam stipulates in detail and guides the implementation of this Article.

Thus, lottery winnings qualify as taxable personal income, so upon lottery winning of 2 billion VND, the individual is required to pay personal income tax.

Vietnam: How much personal income tax is payable on lottery winning of 2 billion VND?

According to clause 1, Article 15 of Circular 111/2013/TT-BTC, the calculation of personal income tax on winnings for resident individuals is specified as follows:

(1) Taxable Income

- Taxable income from winnings is the value of the prize exceeding 10 million VND received per each time the prize is won, regardless of the number of times the prize is received.

- In cases where a prize is won by multiple individuals, the taxable income is divided among the winners. The winners must provide legal proof. If no legal proof is available, the winnings are calculated for one individual. In cases where an individual wins multiple prizes in one game, the taxable income is based on the total value of the prizes.

- For lottery winnings, it is the total value of the prize exceeding 10 million VND per lottery ticket received in one draw, with no deductions for any costs.

(2) Tax Rate

The personal income tax rate for income from winnings is applied under the whole tax schedule at a rate of 10%.

(3) Timing for Determining Taxable Income

The timing for determining taxable income for winnings is the time when the organization or individual awards the prize to the winner.

(4) Calculation Formula

Personal income tax payable = Taxable income x 10% Tax rate

Based on point a, clause 2, Article 23 of Circular 111/2013/TT-BTC, the method for calculating tax on winnings for non-resident individuals is as follows:

(1) Taxable Income

- Taxable income from winnings for non-resident individuals is the value of the prize exceeding 10 million VND per each victory in Vietnam.

- Income from winnings for non-resident individuals is determined similarly to resident individuals as guided in clause 1, Article 15 of Circular 111/2013/TT-BTC

(2) Calculation Formula

Personal income tax for winnings of non-resident individuals is determined by taxable income (×) with a tax rate of 10%:

Personal income tax payable = Taxable income x 10% Tax rate

(3) Timing for Determining Taxable Income

For income from winnings: the timing for determining taxable income is the time the organization or individual in Vietnam pays the prize to the non-resident individual.

From the above regulations, it can be seen that when winning a special lottery, each winning ticket will incur personal income tax in the amount of: (Prize amount - 10 million) x 10%.

Thus, for a 2 billion VND lottery prize, the personal income tax to be paid is: (2,000,000,000 - 10,000,000) x 10% = 199,000,000 VND (199 million VND).

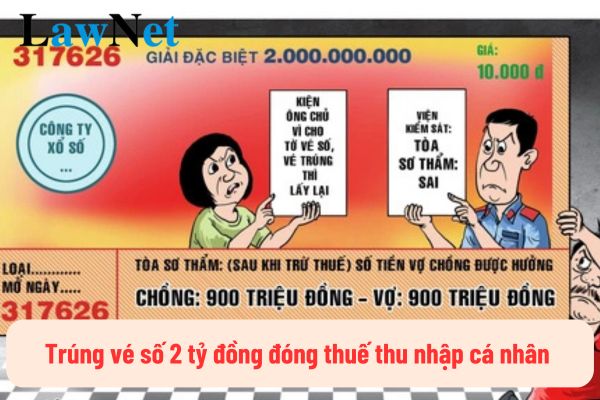

Is income from lottery winning of 2 billion VND subject to personal income tax in Vietnam? (Image from the Internet)

How is the personal income tax period determined in Vietnam?

Based on Article 7 of the Law on Personal Income Tax 2007 as amended by clause 3, Article 1 of the Amended Law on Personal Income Tax 2012, the personal income tax period is defined as follows:

- The annual tax assessment period applies to income from business; income from wages and salaries.

+ The tax assessment period for each income arises shall apply to income derived from capital investment; income from capital transfer, except for income from securities transfer; income from real estate transfer; income from winnings; income from royalties; income from franchise rights; income from inheritance; and income from gifts.

+ The tax assessment period is per each transaction or annually for income from securities transfer.

- The tax assessment period for non-resident individuals is calculated per each income occurrence applicable to all taxable income.