Vietnam: Download link for the latest retail invoice templates in Word, Excel, PDF format for 2025

Vietnam: Download link for the latest retail invoice templates in Word, Excel, PDF format for 2025

A sales invoice is an indispensable part of business operations, especially for retail stores. Having a pre-defined retail sales invoice template can help individuals and businesses save time, easily customize, and manage more effectively.

Currently, the law does not specify the particular form of a retail sales invoice. Therefore, individuals and organizations selling products can refer to the following retail sales invoice templates:

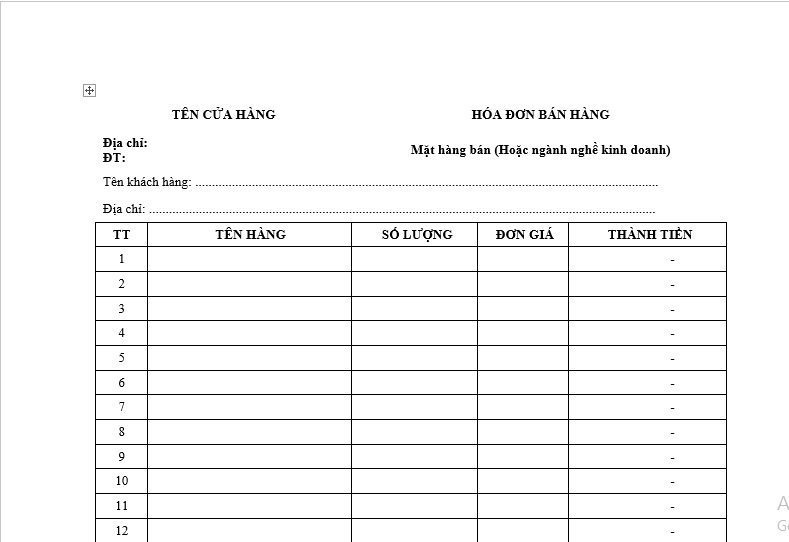

(1) Retail Invoice Template in Word Format 2025

The retail invoice template in Word format is as follows:

Download the retail invoice template in Word format...Download

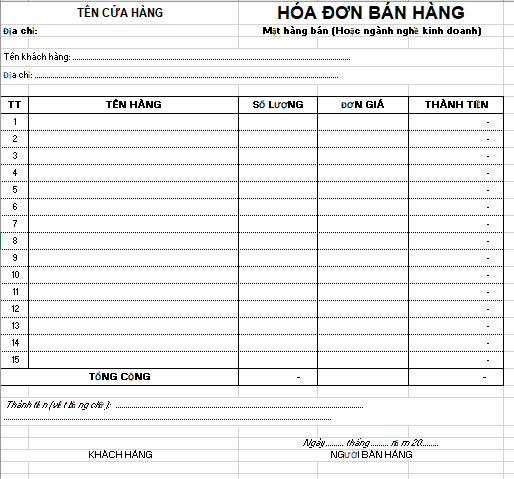

(2) Retail Invoice Template in Excel Format 2025

The retail invoice template in Excel format is as follows:

Download the retail invoice template in Excel format...Download

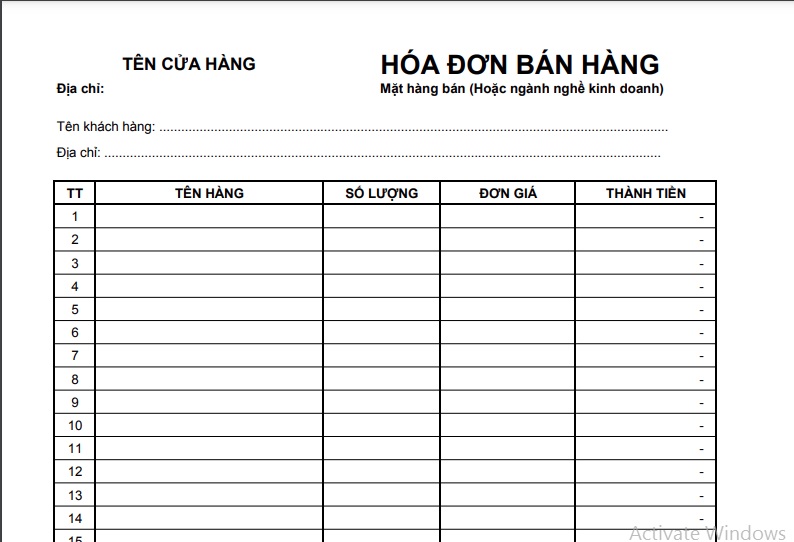

(3) Retail Invoice Template in PDF Format 2025

The retail invoice template in PDF format is as follows:

Download the retail invoice template in PDF format...Download

Vietnam: Download link for the latest retail invoice templates in Word, Excel, PDF format for 2025 (Image from Internet)

Which organizations and individuals may use sales invoices in Vietnam?

Pursuant to Clause 2 of Article 8 of Decree 123/2020/ND-CP, sales invoices are intended for organizations and individuals as follows:

- Organizations and individuals declare and calculate value-added tax using the direct method for activities such as:

+ Selling goods and providing services domestically;

+ International transportation activities;

+ Exporting goods into non-tariff zones and cases deemed equivalent to export;

+ Exporting goods and providing services abroad.

- Organizations and individuals in non-tariff zones when selling goods, providing services domestically or to other organizations and individuals within non-tariff zones, export goods, and provide services abroad, indicating on the invoice "For organizations and individuals in non-tariff zones."

What are the regulations regarding the rules for issuance, management and use of invoices and records in Vietnam in 2025?

Based on Article 4 of Decree 123/2020/ND-CP, regulations on the rules for issuance, management and use of invoices and records are as follows:

(1) When selling goods or providing services, the seller must issue an invoice to the buyer (including cases where goods, services are used for promotion, advertising, samples; goods, services are used for giving, gifting, exchanging, payment for employees, and internal consumption (excluding internally circulating goods for continued production); exporting goods in various forms such as loans, borrowing, or returning goods) and must fill all details as prescribed in Article 10 of Decree 123/2020/ND-CP. If using electronic invoices, they must comply with the standard data format of the tax authorities as specified in Article 12 of Decree 123/2020/ND-CP.

(2) When deducting personal income tax or collecting taxes, fees, and charges, the organization performing the tax deduction, collecting taxes, fees, and charges must issue a tax deduction voucher, tax receipt, and fee or charge receipt to the taxpayer and record all necessary details according to Article 32 of Decree 123/2020/ND-CP. For electronic receipts, they must follow the standard data format of the tax authorities. If an individual authorizes tax finalization, no personal income tax deduction certificate is issued.

For individuals without a labor contract or with a labor contract less than 3 months, the organization or individual paying the income can choose to issue a tax deduction certificate for each tax deduction or for multiple deductions within one tax period.

For individuals with a labor contract lasting 3 months or more, the organization or individual paying the income issues only one tax deduction certificate within a tax period.

(3) Before using invoices, enterprise, economic organization, other organizations, household, business individuals, fee, charge, tax collecting agencies must register their use with the tax authorities or notify the issuance as per the regulations stated in Article 15, Article 34, and Clause 1 of Article 36 of Decree 123/2020/ND-CP.

For invoices and receipts printed by the tax authorities, the tax authorities will announce the issuance according to Clause 3, Article 24, and Clause 2, Article 36 of Decree 123/2020/ND-CP.

(4) Organizations, households, and business individuals must report the use of invoices purchased from tax authorities, printed or self-printed receipts, or receipts bought from tax authorities as stipulated in Article 29, Article 38 of Decree 123/2020/ND-CP.

(5) The registration, management, and usage of electronic invoices and documents must comply with the legal regulations on electronic transactions, accounting, taxation, and tax management outlined in this Decree.

(6) Invoice and document data when selling goods, providing services, and data documents when engaging in tax payment, tax deduction and paying taxes, fees, charges are the database to assist tax management and provide invoice and document information to the relevant organizations and individuals.

(7) Sellers of goods or providers of services who are businesses, economic organizations, or other organizations may delegate to a third party to issue electronic invoices for selling goods or providing services. The delegate must display the seller’s name as the delegator. The delegation must be confirmed in writing between the delegator and the delegate specifying all information regarding the delegated invoice (purpose, duration, and method of payment for the delegated invoice) and must inform the tax authorities when registering usage of electronic invoices.

If the delegated invoice is an electronic invoice without the tax authority's code, the delegate must transfer invoice data electronically to the tax authorities via a service provider. The Ministry of Finance shall provide specific guidance on this matter.

(8) Fee and charge collection organizations may delegate to a third party to issue fee and charge receipts. The receipt issued by the delegate must still display the fee collecting organization’s name as the delegator. The delegation must be confirmed in writing between the delegator and delegate specifying all information regarding the delegated receipt (purpose, duration, and payment method for the delegated receipt) and must inform the tax authorities upon announcing the issuance of the receipt.