Template for Personal Income Tax Withholding Certificate Latest According to Decree 123

The Latest Form of Personal Income Tax Deduction Certificate According to Decree 123?

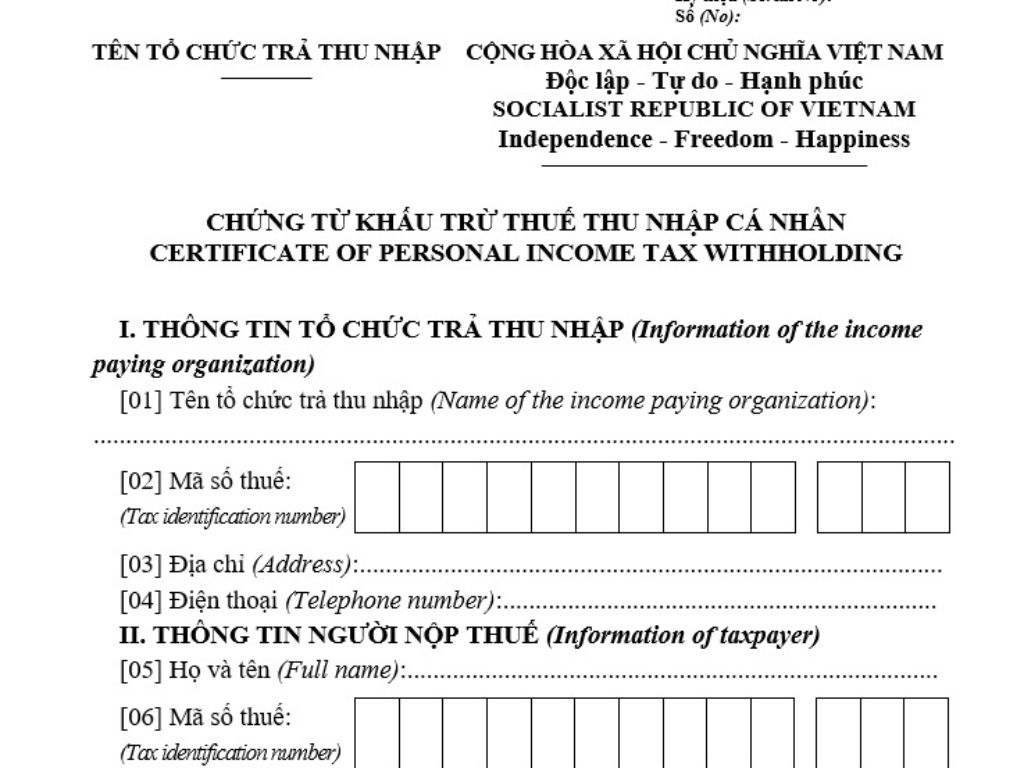

The latest form of the Personal Income Tax Deduction Certificate currently is Form No. 03/TNCN Appendix 3 issued together with Decree 123/2020/ND-CP:

>>Latest Personal Income Tax Deduction Certificate Form According to Decree 123 Download

Latest Personal Income Tax Deduction Certificate Form According to Decree 123? (Image from the Internet)

When is it mandatory to issue a personal income tax deduction certificate?

Based on Clause 2 Article 4 of Decree 123/2020/ND-CP which stipulates the issuance of personal income tax deduction certificates as follows:

Principles for issuance, management, and use of invoices and documents

1. When selling goods or providing services, the seller must issue an invoice to provide to the buyer (including cases where goods and services are used for promotions, advertisements, samples; or are used as gifts, donations, exchanges, or as compensation for employee salaries and internal consumption (excluding goods circulated internally for continued production); or goods are issued in the forms of loans, borrowings, or returns), and must fully fill in contents as prescribed in Article 10 of this Decree. In cases using e-invoices, they must comply with the standard data format set by the tax authority as stipulated in Article 12 of this Decree.

2. When deducting personal income tax, when collecting taxes, fees, or charges, the tax deduction organization, fee collection organization, tax collection organization must issue tax deduction certificates, tax receipts, fee receipts, and charge receipts to individuals with income subject to tax deduction, to taxpayers, fee payers, and charge payers, and must record all the necessary contents as prescribed in Article 32 of this Decree. In cases using e-receipts, they must follow the standard data format set by the tax authority. In cases where individuals authorize tax finalization, no personal income tax deduction certificate will be issued.

For individuals who do not have a labor contract or have a labor contract of fewer than 3 months, organizations or individuals that pay income have the option to issue tax deduction certificates for each tax deduction or issue one certificate for multiple deductions in a tax calculation period. For individuals with labor contracts of 3 months or more, organizations or individuals paying income only issue one tax deduction certificate per tax calculation period.

...

Thus, based on the above regulation, when personal income tax is deducted, the organization responsible for withholding the tax must issue a tax deduction certificate to the individual whose income is subject to tax deduction and must record all the prescribed contents.

In cases of using electronic receipts, they must follow the standard data format set by the tax authority. If an individual authorizes tax finalization, no personal income tax deduction certificate will be issued.

What is the purpose of a personal income tax deduction certificate?

According to regulations at Article 31 of Decree 123/2020/ND-CP on the timing for issuing personal income tax deduction certificates as follows:

Time to issue certificates

At the time of withholding personal income tax, at the time of collecting taxes, fees, charges, the organization withholding personal income tax, the organization collecting taxes, fees, charges must issue certificates or receipts to the individual whose income is subject to tax deduction, and to the person paying the taxes, fees, charges .

Additionally, according to point a, clause 2, Article 25 of Circular 111/2013/TT-BTC on tax deduction and tax deduction certificates as follows:

Tax deduction and tax deduction certificates

...

2. Tax Deduction Certificates

a) Organizations or individuals paying income that has tax deducted in accordance with Clause 1 of this Article must issue tax deduction certificates upon the request of the individual whose income is subject to deduction. In cases where individuals authorize tax finalization, no tax deduction certificate will be issued.

b) Issuance of tax deduction certificates in certain specific cases as follows:

b.1) For individuals without a labor contract or with a labor contract of less than three (03) months: individuals have the right to request the organization or individual paying income to issue tax deduction certificates for each tax deduction or issue one certificate for multiple deductions within a tax calculation period.

Example 15: Mr. Q signs a service contract with Company X to care for plants within the Company’s premises once a month from September 2013 to April 2014. Mr. Q's income is paid monthly by the Company at 3 million VND. In this case, Mr. Q may request the Company to issue a tax deduction certificate monthly or issue one certificate reflecting tax deducted from September to December 2013 and another for the period from January to April 2014.

b.2) For individuals with a labor contract of three (03) months or more: the organization or individual paying the income only issues one tax deduction certificate per tax calculation period.

Example 16: Mr. R signs a long-term labor contract (from September 2013 to the end of August 2014) with Company Y. In this case, if Mr. R is required to finalize tax directly with the tax authority and requests the Company to issue a tax deduction certificate, the Company will issue 1 certificate reflecting the tax deducted from September to the end of December 2013, and 1 certificate for the period from January to the end of August 2014.

Personal income tax deduction certificates are documents issued by organizations or individuals paying income to individuals whose income is subject to personal income tax deduction, recording information about the personal income tax that has been withheld.