Shall additional goods and services purchased during the period entitled to a 8% VAT rate in Vietnam be declared according to Resolution 142/2024?

What is the value-added tax calculation method in Vietnam from July 1, 2025?

Based on Article 10 of the Law on Value-Added Tax 2024 (Law effective from July 1, 2025), the calculation methods for value-added tax from July 1, 2025, include two methods:

The tax deduction method and the direct calculation method.

Shall additional goods and services purchased during the period entitled to a 8% VAT rate in Vietnam be declared according to Resolution 142/2024?

According to the procedure for reducing VAT under Decree 72/2024/ND-CP, the following is instructed:

- For businesses calculating VAT by the deduction method that applies an 8% VAT rate when issuing VAT invoices for goods and services subject to VAT reduction, the percentage “8%” should be stated in the VAT rate line; the amount of value-added tax; and the total amount the buyer must pay.

Based on the VAT invoice, the business selling goods and services declares output VAT, while the purchasing business declares input VAT deduction according to the reduced tax amount recorded on the VAT invoice.

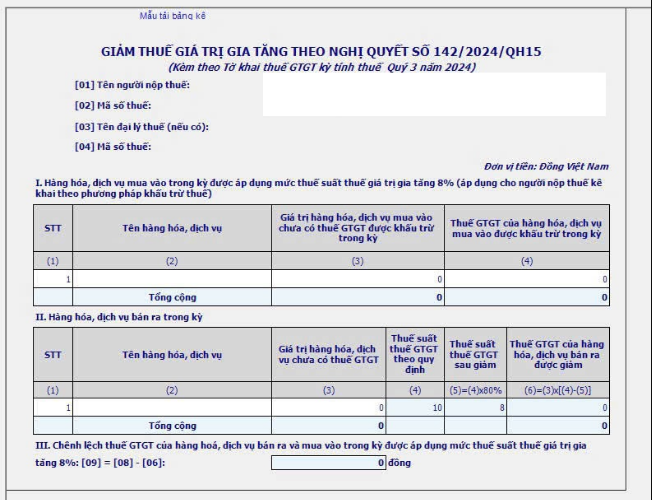

Simultaneously, as per the VAT declaration with a 2% VAT reduction appendix according to Resolution 142/2024/QH15 updated in the HTKK version 5.2.2 below:

Thus, according to the above regulations, when declaring the 2% VAT reduction appendix on HTKK version 5.2.2 according to Resolution 142/2024, it is necessary to declare additional goods and services purchased during the period subject to an 8% VAT rate.

Shall additional goods and services purchased during the period entitled to a 8% VAT rate in Vietnam be declared according to Resolution 142/2024? (Image from the Internet)

What are the VAT rates in Vietnam from July 1, 2025?

According to Article 9 of the Law on Value-Added Tax 2024 (Law effective from July 1, 2025), the following applies:

- A tax rate of 0% applies to the following goods and services:

+ Exported goods include: goods from Vietnam sold to organizations, individuals abroad and consumed outside Vietnam; goods from domestic Vietnam sold to organizations in non-tariff zones and consumed in non-tariff zones directly serving production for export; goods sold in isolated areas to individuals (foreigners or Vietnamese) who have completed exit procedures; goods sold at duty-free shops;

+ Export services include: services provided directly to organizations, individuals abroad and consumed outside Vietnam; services provided directly to organizations in non-tariff zones and consumed in non-tariff zones directly serving production for export activities;

+ Other exported goods and services include: international transportation; rental services for transport means used outside Vietnam's territory; services of the aviation and maritime industries provided directly or through agents for international transportation; construction, installation projects abroad or in non-tariff zones; digital content products supplied to foreign parties with records, documents proving consumption outside Vietnam as regulated by the Government of Vietnam;

Accessories, spare parts for the repair and maintenance of vehicles, machinery, equipment for foreign parties and consumed outside Vietnam; outsourced goods for export as regulated by law; goods, services not subject to value-added tax when exported, except cases exempted from the 0% tax rate provided at point d of this clause;

+ Cases not applying the 0% tax rate include: technology transfer, intellectual property rights transfer abroad; reinsurance services abroad; credit granting services; capital transfer; derivative products; postal, telecommunication services; export products regulated at Clause 23, Article 5 of the Law on Value-Added Tax 2024; imported cigarettes, alcohol, beer subsequently exported; petroleum purchased domestically sold to businesses in non-tariff zones; automobiles sold to organizations, individuals in non-tariff zones.

- A tax rate of 5% applies to the following goods and services:

+ Clean water for production and household use not including bottled, canned water and other beverages;

+ Fertilizers, ores for producing fertilizers, pesticides, and growth stimulants according to the law;

+ Canal, ditch, pond dredging services for agricultural production; cultivation, care, pest prevention for crops; preliminary processing, preservation of agricultural products;

+ Cultivated plant product, planted forest (excluding wood, bamboo shoots), livestock, aquaculture, fishing products not processed into other products or only through simple processing, except products specified at Clause 1, Article 5 of the Law on Value-Added Tax 2024;

+ Rubber latex in crepe rubber, rubber sheet, latex, crumbs form; nets, netting threads and strings for knitting fishing nets;

+ Products made from jute, sedge, bamboo, rattan, leaves, straw, coconut husk, shell, water hyacinth, and other handicraft products produced from agricultural by-products; cotton fibers combed, carded; newsprint paper;

+ Fishing vessels for exploiting aquatic resources at sea; machinery, specialized equipment for agricultural production as prescribed by the Government of Vietnam;

+ Medical equipment according to the law on medical device management; drugs for disease prevention, treatment; pharmaceutical substances, medicinal herbs as raw materials for medicine production for treatment, prevention;

+ Equipment used for teaching and learning including: models, drawings, boards, chalk, rulers, compasses;

+ Traditional, folk performing arts activities;

+ Children's toys; books of all kinds, except books specified at Clause 15, Article 5 of the Law on Value-Added Tax 2024;

+ Science, technology services as prescribed by the Science and Technology Law;

+ Sale, rental, lease purchase of social housing as prescribed by the Housing Law.

- A tax rate of 10% applies to goods and services not regulated in clauses 1 and 2 of Article 9 Law on Value-Added Tax 2024, including services provided by foreign suppliers without a permanent establishment in Vietnam to organizations, individuals in Vietnam via e-commerce and digital platforms.

- Businesses handling multiple types of goods, services with different VAT rates (including non-taxable VAT subjects) must declare VAT according to the tax rates for each type of goods, services; if businesses cannot determine according to each tax rate, they must calculate and pay tax according to the highest tax rate of the goods, services produced, traded.

- Products of crops, planted forests, livestock, aquaculture not processed into other products or only through simple processing, used as animal feed, medicinal herbs apply VAT rates as per the tax rate for crop, forest, livestock, aquaculture products.

Recovered waste products, by-products, scrap for recycling, reuse sold apply the tax rate as per the tax rate of the sold waste products, by-products, scrap.

- the Government of Vietnam stipulates details in clauses 1 and 2, Article 9 Law on Value-Added Tax 2024. The Minister of Finance regulates the documents, procedures for applying a 0% VAT rate in clause 1, Article 9 of the Law on Value-Added Tax 2024.