Selecting PL142/2024/QH15 on HTKK for VAT Declaration for Q3/2024 in Vietnam

Selecting PL142/2024/QH15 on HTKK for VAT Declaration for Q3/2024 in Vietnam

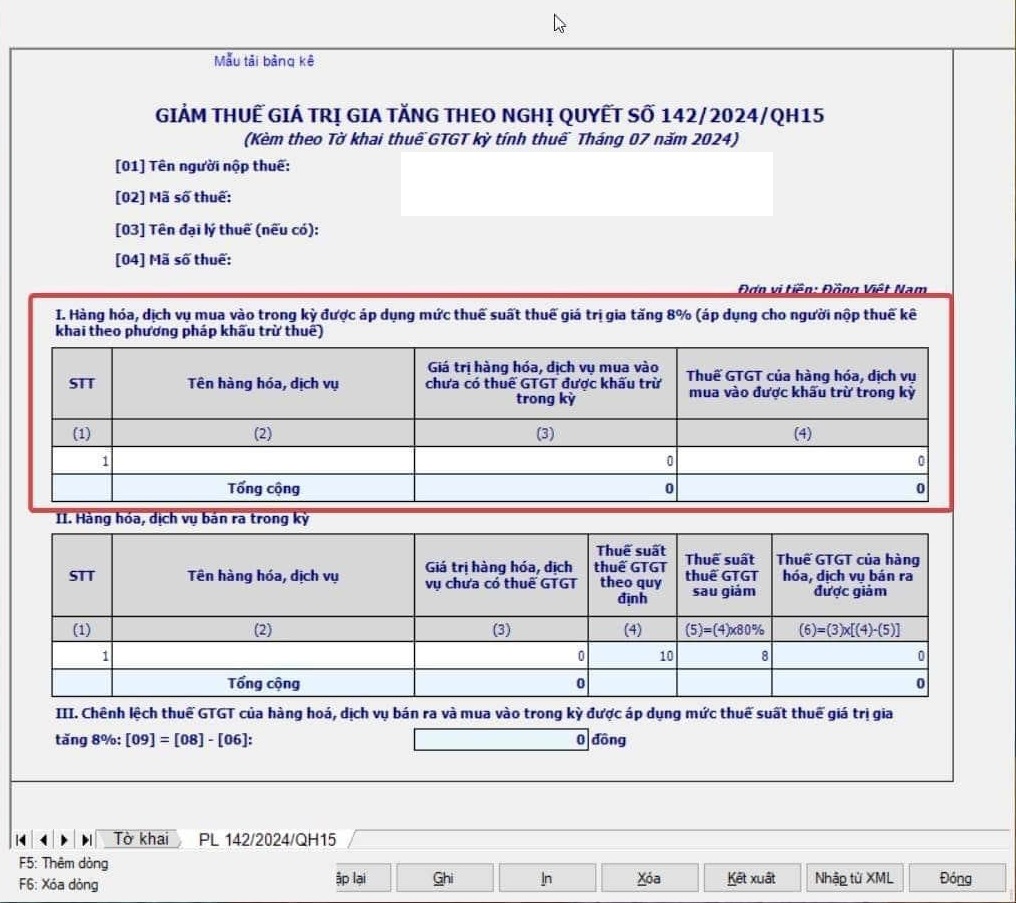

Below are the steps to select PL142/2024/QH15 on HTKK for VAT declaration for Q3/2024:

Step 1: Update and upgrade the HTKK software to version 5.2.3 => Select Value-Added Tax (VAT) declaration.

Step 2: Choose the monthly or quarterly declaration => The annex for VAT reduction declaration will be PL 142/2024/QH15.

Step 3: The system will move to the list of goods and services eligible for VAT reduction according to the VAT reduction annex under Resolution 142/2024/QH15.

Note:

- During the tax period, if the taxpayer only has purchased goods and services and no sales, they are not required to implement the VAT reduction annex as per Resolution 142/2024/QH15.

- Declare both input and output invoices with an 8% VAT rate.

- If the sales and purchase invoices have the same group of goods, same name, same type, they should be consolidated into one code, and the total amount and tax should be entered into PL142/2024.

- If there is an output invoice but no input invoice at 8%, leave Item I blank when declaring the VAT reduction annex.

- If the enterprise has multiple items, download the list and import it on HTKK.

Select PL142/2024/QH15 on HTKK for VAT declaration for Q3/2024 in Vietnam (Image from the Internet)

Goods and Services not eligible for VAT Reduction in 2024 in Vietnam

In Article 1 of Decree 72/2024/ND-CP, the reduction of VAT is applied to groups of goods and services currently taxed at a 10% rate, excluding the following groups:

- Telecommunications, financial activities, banking, securities, insurance, real estate business, metals and fabricated metal products, mining products (excluding coal mining), coke, refined petroleum, chemical products.

Details in Appendix I attached to Decree 72/2024/ND-CP

- Products and services subject to special consumption tax.

Details in Appendix II attached to Decree 72/2024/ND-CP

- Information technology as regulated by the law on information technology.

Details in Appendix III attached to Decree 72/2024/ND-CP

- The VAT reduction for each type of goods, services as stipulated in Clause 1, Article 1 of Decree 72/2024/ND-CP is consistently applied at the stages of import, production, processing, and commercial trade. For mined coal products sold (including coal that has been classified post-processing by a closed process before being sold) are eligible for VAT reduction. Coal products in Appendix I attached to Decree 72/2024/ND-CP are not eligible for VAT reduction outside of the mining sales stage.

The general corporations and economic groups implementing a closed process before selling are also subject to VAT reduction for mined coal products sold.

Cases where goods and services listed in Appendices I, II, and III attached to Decree 72/2024/ND-CP are not subject to VAT or are subject to a 5% VAT according to the Value Added Tax Law will be implemented according to the law and are not eligible for VAT reduction.

When does the reduction of 2% VAT take effect in Vietnam?

According to the provisions in Clause 1, Article 2 of Decree 72/2024/ND-CP as follows:

Effective Date and Implementation Organization

1. This Decree takes effect from July 1, 2024, until the end of December 31, 2024.

2. Ministries based on their functions, tasks, and the People's Committees of provinces and centrally governed cities shall instruct related agencies to implement, guide, supervise, ensuring consumers understand and benefit from the VAT reduction specified in Article 1 of this Decree, focusing on measures to stabilize the supply and demand of goods and services subject to VAT reduction to maintain price stability in the market (price excluding VAT) from July 1, 2024, to December 31, 2024.

3. If any issues arise during the implementation, they will be referred to the Ministry of Finance for guidance and solution.

4. Ministers, Heads of ministerial-level agencies, Heads of agencies under the Government of Vietnam, Chairpersons of People's Committees of provinces and centrally governed cities, and related enterprises, organizations, individuals are responsible for implementing this Decree.

The Decree 72/2024/ND-CP is effective from July 1, 2024, until December 31, 2024.

This means that the VAT reduction policy to 8% is only applicable until December 31, 2024.

From January 1, 2025, the VAT rate for goods and services previously reduced will revert to 10% (unless otherwise directed by a regulatory document).