May a person authorize an organization to finalize PIT during probation period in Vietnam?

May a person authorize an organization to finalize PIT during probation period in Vietnam?

Based on the provisions at subsection d.2, point d, clause 6, article 8 of Decree 126/2020/ND-CP regarding resident individuals with income from salaries, wages authorizing tax finalization to organizations, individuals paying income. To be specific:

Tax types declared monthly, quarterly, annually, separately and tax finalization declaration

...

- Tax types and fees declared for annual settlement and settlement up to the time of dissolution, bankruptcy, termination, cessation of operation, termination of contract, or corporate reorganization. In the case of a corporate form change (excluding state-owned enterprises subject to equitization) where the newly formed enterprise inherits all tax obligations of the converted enterprise, tax finalization declaration is not required up to the point of the decision on the enterprise conversion; the enterprise declares settlement at year-end. To be specific: as follows:

...

d) Personal income tax for organizations, individuals paying taxable income from salaries, wages; individuals with income from salaries, wages authorizing tax finalization to organizations, individuals paying income; individuals with income from salaries, wages directly settling taxes with tax authorities. To be specific: as follows:

...

d.2) Resident individuals with income from salaries, wages authorize tax finalization to organizations, individuals paying income. To be specific:

...

Individuals with income from salaries, wages signing employment contracts of 03 months or more at one place and actually working there at the time organizations, individuals paying income conduct tax finalization, even if not working for the full 12 months of the year. In cases where the individual is transferred from an old organization to a new one as stipulated at point d.1 of this clause, the individual is authorized to settle taxes with the new organization.

Individuals with income from salaries, wages signing employment contracts of 03 months or more at one place and actually working there at the time organizations, individuals paying income conduct tax finalization, even if not working for the full 12 months of the year; and also having irregular income at other places averaging not more than 10 million VND/month in the year and has had personal income tax withheld at a rate of 10% if there is no tax finalization requirement for this income part.

...

Conditions for resident individuals with income from salaries, wages to authorize personal income tax finalization to enterprises are as follows:

- Individuals signing employment contracts of 03 months or more at one place and actually working there at the time the enterprise conducts tax finalization, even if not working for the full 12 months of the calendar year.

- In case individuals have irregular income at other places, they must meet the following conditions:

+ Average irregular income not exceeding 10 million VND/month in the year;

+ Personal income tax has been withheld at a rate of 10% at that place;

+ No desire to settle taxes for the irregular income.

Additionally, point b, point i clause 1 article 25 of Circular 111/2013/TT-BTC stipulates as follows:

- For resident individuals signing employment contracts of three months or more, organizations, individuals paying income perform withholding tax according to the progressive tax schedule, even if individuals sign contracts of three months or more at multiple places.

- For resident individuals signing employment contracts of three months or more but quitting before the contract ends, organizations, individuals paying income still perform tax withholding according to the progressive tax schedule.

- Organizations, individuals paying wages, salaries, other payments to resident individuals not signing employment contracts (as guided at points c, d, clause 2, article 2 of Circular 111/2013/TT-BTC) or signing employment contracts under three (03) months with a total income level of two million (2,000,000) VND or more per payment must withhold tax at a rate of 10% on income before payment to individuals.

In cases where individuals only have income subject to the above withholding rate but estimate the total taxable income after family deduction does not reach taxable level, the income-receiving individual should make a commitment (according to the form issued with tax management guidance documents) sent to the income-paying organization to justify temporarily not withholding personal income tax.

Through the above two regulations, it can be seen that employees can authorize personal income tax finalization during probation if after the probation period, they are signed to a employment contract of 03 months or more and at the tax finalization time are still working there.

May a person authorize an organization to finalize PIT during probation period in Vietnam? (Image from the Internet)

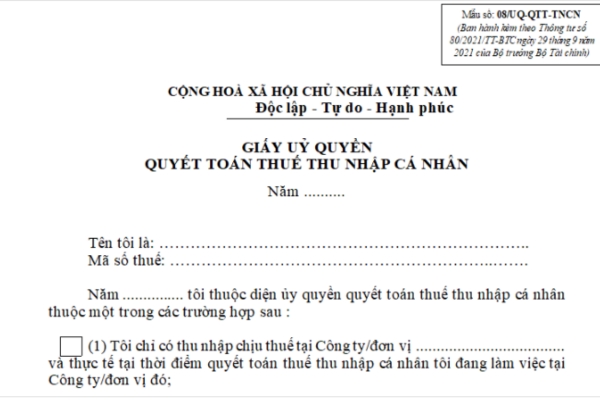

What is the Form for personal income tax finalization authorization in Vietnam in 2024?

The form for authorizing personal income tax finalization is form 08/UQ-QTT-TNCN issued with Circular 80/2021/TT-BTC as follows:

Download form 08/UQ-QTT-TNCN

What are the procedures for personal income tax finalization authorization in Vietnam in 2024?

To authorize personal income tax finalization in 2024, taxpayers should follow these two steps:

- Step 1: Prepare the tax finalization authorization form.

To authorize organizations, individuals paying income to settle on their behalf, taxpayers should download and complete the authorization form for personal income tax finalization (form 08/UQ-QTT-TNCN issued with Circular 80/2021/TT-BTC).

- Step 2: Send the completed authorization form to organizations, individuals paying income.