List of 26 traffic violation fines increased in Vietnam under Decree 168? What is the registration fee rate of motorcycles in Vietnam?

List of 26 traffic violation fines increased in Vietnam under Decree 168?

Effective January 1, 2025, Decree 168/2024/ND-CP stipulates administrative penalties in the road traffic sector. This decree will replace certain articles, clauses, and provisions of Decree 100/2019/ND-CP (amended and supplemented by Decree 123/2021/ND-CP).

According to the new regulations in Decree 168/2024/ND-CP, many violations will face significantly higher administrative fines than currently enforced. Specifically, there are 03 groups of behaviors with increased fines, including:

- Violations against state management order such as using fake license plates, covering license plates.

- Intentional traffic violations, poor traffic culture such as running red lights, driving in the wrong direction.

- Behaviors causing traffic accidents.

Some behaviors like not complying with traffic signal instructions will see fines multiplied several times from the current 4-6 million VND to 18-20 million VND for cars and from 800 thousand VND to 1 million VND up to 4-6 million VND for motorcycles.

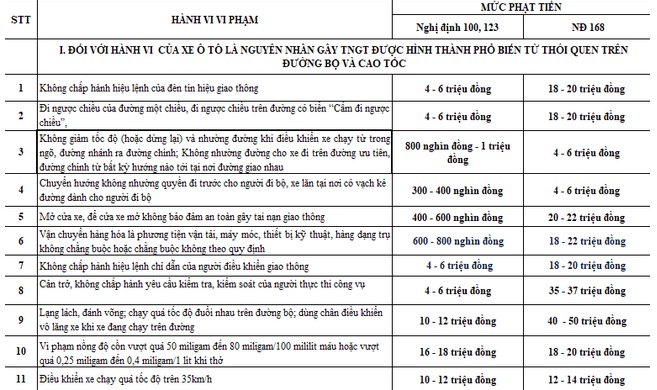

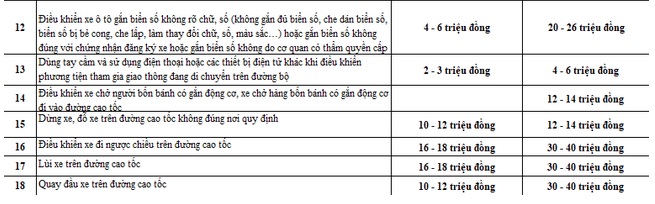

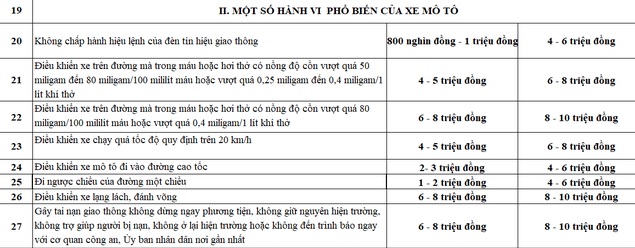

Below is a list of 26 traffic violations with increased fines under Decree 168, as follows:

(1) Fines for Cars:

(2) Fines for Motorcycles:

Regarding this matter, the Traffic Police Department stated the necessity of significantly increasing fines to ensure deterrence for certain groups of behaviors, especially intentional and dangerous violations directly causing traffic accidents.

Furthermore, many individuals deliberately drive without license plates or obscure plates to engage in illegal activities, smuggling, prohibited goods transport, criminal activities, evasion of law enforcement, or avoiding automated fines from monitoring systems. Hence, increasing penalties is necessary to ensure the rule of law's severity.

The Traffic Police Department has directed the nationwide force to review urban roads, major intersections, and complex traffic safety routes to strictly handle violations, prioritize using surveillance systems, handheld, and body-worn cameras by officers to record, educate, and manage traffic participants, contributing to gradually forming good habits in traffic participation and building a civilized and safe traffic system.

List of 26 traffic violation fines increased in Vietnam under Decree 168? (Image from the Internet)

Are motorcycles subject to registration fees in Vietnam?

Pursuant to Article 3 Decree 10/2022/ND-CP, detailing which subjects are liable to registration fees as follows:

Subjects Liable to registration fees

1. Houses, land.

2. Hunting guns; guns used for practice, sports competition.

3. Vessels under the legal provisions on inland waterway traffic and maritime law (hereinafter referred to as watercraft), including barges, canoes, tugboats, push boats, submarines, submersibles; excluding floating docks, floating storage facilities, and mobile rigs.

4. Boats, including yachts.

5. Aircraft.

6. Two-wheeled motorcycles, three-wheeled motorcycles, motor scooters, and types similar to motorcycles and motor scooters that must be registered and carry license plates issued by competent state agencies (hereinafter collectively referred to as motorcycles).

7. Cars, trailers, or semi-trailers pulled by cars; types similar to cars must be registered and carry license plates issued by competent state agencies.

8. Hulls, chassis, engines, frames of assets specified in clauses 3, 4, 5, 6, and 7 of this Article that are replaced and must be registered with competent state agencies.

The Ministry of Finance provides detailed regulations on this Article.

Thus, motorcycles are included as subjects liable to registration fees.

What is the registration fee for motorcycles in terms of percentage in Vietnam?

According to clause 4, Article 8 Decree 10/2022/ND-CP and clause 1, Article 4 Circular 13/2022/TT-BTC, the registration fee rate (%) for motorcycles is 2%. The fee for specific cases is as follows:

- Motorcycles owned by organizations or individuals in centrally governed cities, provincial cities; district-level towns where the provincial People's Committee is headquartered: subject to a first-time registration fee at a rate of 5%.

Centrally governed cities, provincial cities; district-level towns where the provincial People's Committee, centrally governed city is headquartered are identified based on state administrative boundaries at the time of registration declaration, including all wards, districts of the city, district-level town, regardless of inner city or outer district, urban or rural; Provincial cities and district-level towns where the provincial People's Committee is headquartered include all wards, communes belonging to the city, district-level town, regardless of inner-city, inner-market, or suburban, outer-market communes.

- Motorcycles subject to registration fees from the second time onwards are applicable at a rate of 1%.

In cases where the asset owner has declared and paid a registration fee of 2% for motorcycles and then transfers it to an organization or individual in the area specified at point a of this clause, the registration fee is payable at a rate of 5%. If the motorcycle has paid a registration fee at a rate of 5%, subsequent ownership transfers will require a registration fee at a rate of 1%.

The previously declared and paid fee area is determined by "Place of Residence," "Registered Permanent Residence," or "Address" recorded in the vehicle registration or registration certificate recovery document, and is identified based on state administrative boundaries at the time of registration fee declaration.