Is warehouse disinfectant which is restricted from use subject to environmental protection tax in Vietnam?

Is warehouse disinfectant which is restricted from use subject to environmental protection tax in Vietnam?

Pursuant to the provisions of Article 3 of the Environmental Protection Tax Law 2010, there are 08 entities subject to environmental taxes as follows:

| No. | Entities |

|---|---|

| 1 | Gasoline, oil, and lubricants, including: - Gasoline, except ethanol; - Jet fuel; - Diesel oil; - Kerosene; - Mazut oil; - Lubricating oil; - Lubricating grease. |

| 2 | Coal, including: - Brown coal; - Anthracite coal; - Fat coal; - Other types of coal. |

| 3 | Hydro-chloro-fluoro-carbon (HCFC) solution. |

| 4 | Taxable plastic bags. |

| 5 | Restricted use herbicides. |

| 6 | Restricted use termite control agents. |

| 7 | Restricted use forest product preservatives. |

| 8 | Warehouse disinfectant which is restricted from use. |

As such, warehouse disinfectant which is restricted from use is one of the entities subject to environmental protection tax.

Is warehouse disinfectant which is restricted from use subject to environmental protection tax in Vietnam? (Image from the Internet)

How to calculate the environmental protection tax in Vietnam in 2024?

The concept of environmental protection tax is defined in Clause 1, Article 2 of the Environmental Protection Tax Law 2010 as follows:

Environmental protection tax is an indirect tax collected on products and goods (hereinafter collectively referred to as goods) when their use causes adverse environmental impacts.

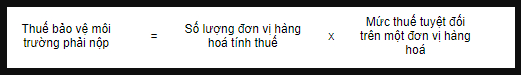

The formula for calculating the environmental protection tax is stipulated in Article 4 of Circular 152/2011/TT-BTC as follows:

What are bases for calculating the environmental protection tax in Vietnam?

Pursuant to the provisions of Article 5 of Circular 152/2011/TT-BTC (amended and supplemented by Article 1 of Circular 106/2018/TT-BTC, Article 3 of Circular 159/2012/TT-BTC), the basis for calculating the environmental protection tax includes the taxable quantity of goods and the absolute tax rate.

Specifically, the determination of the tax basis is performed as follows:

The basis for calculating environmental protection tax is the taxable quantity of goods and the absolute tax rate.

- The taxable quantity of goods is stipulated as follows:

+ For domestically produced goods, the taxable quantity of goods is the quantity of goods sold, exchanged, internally consumed, given, promoted, or advertised.

+ For imported goods, the taxable quantity of goods is the quantity of imported goods.

In cases where the taxable quantity of environmental protection tax is exported, sold, and imported in units of measurement different from the units specified for calculating taxes in the Environmental Protection Tax Schedule issued by the Standing Committee of the National Assembly, it must be converted to the measurement units specified in the Environmental Protection Tax Schedule to calculate the tax.

+ For mixed fuel containing gasoline, oil, lubricants of fossil origin, and biofuel, the taxable quantity of goods for the period is the quantity of gasoline, oil, and lubricants of fossil origin in the mixed fuel imported or produced and sold, exchanged, given, or consumed internally, converted to the measurement units specified for calculating tax of the corresponding goods.

The determination method is as follows:

Taxable quantity of gasoline, oil, fossil-origin lubricants = Quantity of mixed fuel imported, produced and sold, consumed, exchanged, given x Percentage (%) of gasoline, oil, fossil-origin lubricants in mixed fuel

Based on the technical standard of mixed fuel processing approved by competent authorities (even if there are changes in the percentage (%) of gasoline, oil, fossil-origin lubricants in mixed fuel), the taxpayer calculates, declares, and pays environmental protection tax on the quantity of gasoline, oil, fossil-origin lubricants.

Simultaneously, they have the responsibility to notify tax authorities of the percentage (%) of gasoline, oil, fossil-origin lubricants in mixed fuel and submit it along with the tax declaration form of the month following the month of starting (or changing the ratio) the sale of mixed fuel.

+ For multi-layer plastic bags produced or processed from single plastic films HDPE, LDPE, LLDPE, and other plastic films (PP, PA, etc.) or other substances such as aluminum, paper, etc., the environmental protection tax is determined according to the percentage weight of the single plastic films HDPE, LDPE, LLDPE in the multi-layer plastic bags.

Based on the standard amount of single plastic films HDPE, LDPE, LLDPE used to produce or process multi-layer plastic bags, the producer or importer of the multi-layer plastic bags declares themselves, bearing responsibility for their declaration.

For example 8: Enterprise A produces or imports 100 kg of multi-layer plastic bags, in which the weight of single plastic films HDPE, LDPE, LLDPE in the multi-layer plastic bags is 70% and the weight of other plastic films (PA, PP, etc.) is 30%.

Therefore, the environmental protection tax of enterprise A to be paid on 100 kg of multi-layer plastic bags is: 100 kg x 70% x 40,000 VND/kg = 2,800,000 VND.

- The absolute tax rate used as a basis for calculating environmental protection tax for each type of goods subject to environmental protection tax is the rate specified in the Tax Schedule of Environmental Protection issued with Resolution No. 579/2018/UBTVQH14 dated September 26, 2018, of the Standing Committee of the National Assembly on the Environmental Protection Tax Schedule.