Is votive gilt paper subject to excise tax in Vietnam?

Is votive gilt paper subject to excise tax in Vietnam?

Pursuant to Article 2 of the Law on excise tax 2008 (amended by Clause 1 Article 1 of the Law on Amending the Law on excise tax 2014), the subjects subject to the excise tax are stipulated as follows:

Subjects Subject to Tax

1. Goods:

a) Cigarettes, cigars, and other tobacco products used for smoking, inhaling, chewing, sniffing, sucking;

b) Alcohol;

c) Beer;

d) Automobiles with fewer than 24 seats, including vehicles designed for both passenger and cargo transport with two or more rows of seats, designed with a fixed partition between the passenger and cargo compartments;

dd) Motorcycles with engine displacement over 125cm3;

e) Aircraft, yachts;

g) All types of gasoline;

h) Air conditioners with a capacity of 90,000 BTU or less;

i) Playing cards;

k) Votive gilt papers and votive objects.

2. Services:

a) Nightclubs;

b) Massage, karaoke;

c) Casinos; electronic games with prizes including jackpot machines, slot machines, and similar types of machines;

d) Betting business;

dd) Golf business, including the sale of membership cards and golf playing tickets;

e) Lottery business.

Thus, votive gilt paper is one of the subjects subject to the excise tax.

What is the excise tax rate on votive gilt paper in Vietnam?

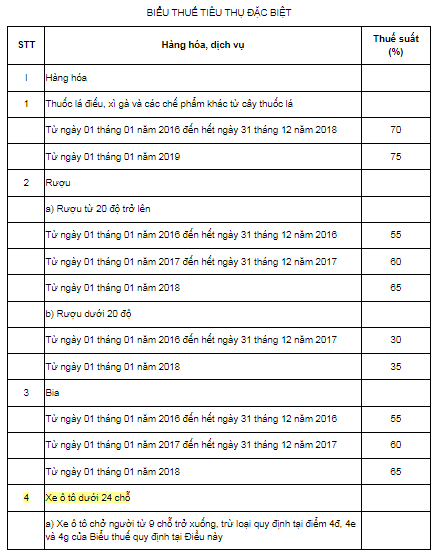

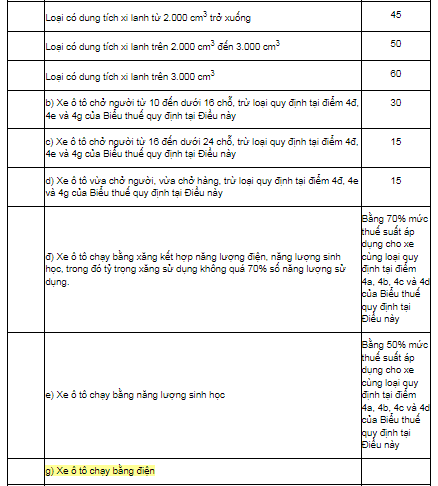

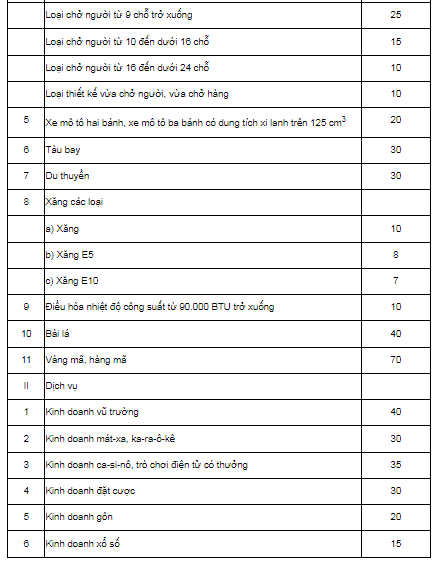

Pursuant to Article 7 of the Law on excise tax 2008 (amended by Clause 4 Article 1 of the Law on Amending the Law on excise tax 2014), Clause 2 Article 2 of the Law on Amending the Law on Value-Added Tax, Law on excise tax, and Law on Tax Administration 2016 and Article 8 of the Law on Amending the Law on Public Investment, Law on Public-Private Partnership Investment, Law on Investment, Law on Housing, Law on Bidding, Law on Electricity, Law on Enterprises, Law on excise tax, and Law on Civil Judgment Enforcement 2022), the excise tax rates for goods and services are defined in the following excise tax Schedule:

Thus, votive gilt paper is subject to a excise tax rate of 70%.

What are cases of excise tax refund in Vietnam?

According to Article 8 of the Law on excise tax 2008, the cases of tax refund, tax deduction are prescribed as follows:

- Taxpayers of excise tax are entitled to tax refunds in the following cases:

+ Goods temporarily imported for re-export;

+ Imported goods used as raw materials for producing, processing export goods;

+ Tax settlement upon merging, consolidating, dividing, splitting, dissolving, bankrupting, converting ownership, converting enterprises, or terminating operations with excess tax amounts paid;

+ A decision for tax refund by a competent authority pursuant to law and cases of excise tax refund according to international agreements to which the Socialist Republic of Vietnam is a member.

The refund of excise tax under points a and b of this clause is only applied to goods actually exported.

Additionally, the refund and tax deduction are further guided in detail at Article 6 of Decree 108/2015/ND-CP (amended by Clause 2 Article 1 of Decree 14/2019/ND-CP) as follows:

The implementation of excise tax refund is pursuant to Article 8 of the Law on excise tax 2008.

- For temporarily imported goods for re-export as stipulated in point a clause 1 Article 8 of the Law on excise tax 2008, including:

+ Imported goods that have paid excise tax but are still in warehouses, depots at the border gate and are under the supervision of the Customs Agency and are re-exported out of the country;

+ Imported goods that have paid excise tax to be delivered or sold to foreign parties through agents in Vietnam; imported goods sold to foreign companies' vehicles operating on international routes via Vietnamese ports or Vietnamese vehicles operating on international transport routes as prescribed by law;

+ Temporary imported goods for re-export under the method of temporary import and re-export business, when re-exported shall be refunded the paid excise tax corresponding to the actually re-exported goods;

+ Imported goods that have paid excise tax but are re-exported abroad shall be refunded the paid excise tax for the exported goods;

+ Temporary imported goods for trade fairs, exhibitions, product presentations, or for other purposes within a certain period as prescribed by law and have paid excise tax, when re-exported, shall be refunded the paid tax.

In cases where goods are temporarily imported for re-export, if the actual re-export is done within the tax payment time limit as prescribed by the law on export-import tax, no excise tax applied for the actual re-exported goods equivalent.

- Imported materials for producing, processing export goods shall be refunded the paid excise tax corresponding to the amount of materials used for the actually exported goods.

- Procedures, dossiers, sequences, and authority for solving the refund of excise tax:

+ Procedures, dossiers, sequences, and authority for solving the refund of excise tax for temporarily imported goods for re-export as stipulated in clause 1 of this Article shall be carried out according to the provisions for import tax refund.

+ Procedures, dossiers, sequences, and authority for solving the refund of excise tax for imported materials for producing, processing export goods as stipulated.

In cases where the import declaration has both import tax and excise tax to be refunded, the import tax refund dossier is also the excise tax refund dossier.

- Production and business establishments finalize tax when merging, dividing, splitting, dissolving, bankrupting, converting ownership, handing over, selling, leasing state enterprises with excess paid excise tax.

- The tax refund stipulated at point d clause 1 Article 8 of the Law on excise tax 2008 includes:

+ Refund of tax as per the decision of the competent authority according to law;

+ Tax refund according to international treaties to which the Socialist Republic of Vietnam is a member;

+ Refund of tax in cases where the paid excise tax is greater than the payable excise tax pursuant to law.