Is there a severance tax when exploiting natural gas in Vietnam?

What is natural gas?

According to Section 1.4.4, Subsection 1.4, Section 1 of the National Technical Regulation QCVN 01:2019/BCA issued together with Circular 52/2019/TT-BCA, the following definitions are prescribed:

Definitions

In addition to the terms and definitions used in the current regulations and standards, the following terms and definitions are also used in this regulation:

...

1.4.4 Natural Gas

A mixture of hydrocarbons with methane (CH4) as the main component, accounting for up to 98%. Natural gas also contains other hydrocarbons such as ethane, propane, butane, etc. Natural gas is used in two main forms: compressed under high pressure and liquefied.

1.4.5 Compressed Natural Gas (CNG)

Natural gas, methane compressed at a high pressure of 200 - 250 bar.

...

Thus, according to the above regulation, natural gas is a mixture of hydrocarbons with methane (CH4) as the main component, accounting for up to 98%.

Moreover, natural gas also contains other hydrocarbons such as ethane, propane, butane, etc., and is used in two main forms: compressed under high pressure and liquefied.

Is there a severance tax when exploiting natural gas in Vietnam? (Image from the Internet)

Is there a severance tax when exploiting natural gas in Vietnam?

The subjects liable to severance tax are stipulated in Article 2 of the 2009 Law on Severance tax (amended by Clause 1, Article 4 of the 2014 Law on Amendments to Various Tax Laws) as follows:

Subjects of Taxation

1. Metallic minerals.

2. Non-metallic minerals.

3. Crude oil.

4. Natural gas, coal gas.

5. Natural forest products, excluding animals.

6. Natural aquatic products, including marine animals and plants.

7. Natural water, including surface water and groundwater, excluding natural water used for agriculture, forestry, fishery, salt production.

8. Natural bird's nests.

9. Other resources as stipulated by the Standing Committee of the National Assembly.

Thus, according to the above regulation, natural gas is one of the subjects liable to severance tax.

When is the deadline for paying the severance tax on natural gas in Vietnam?

According to Article 55 of the 2019 Law on Tax Administration, the deadlines for tax payment are as follows:

Tax Payment Deadlines

1. In cases where the taxpayer calculates the tax, the tax payment deadline is the last day of the tax declaration filing deadline. In cases of supplementary tax declaration, the tax payment deadline is the deadline for filing the tax declaration of the tax period with errors or omissions.

For corporate income tax, the provisional quarterly tax payment deadline is the 30th day of the first month of the next quarter.

For crude oil, the severance tax and corporate income tax payment deadline for each crude oil sale is 35 days from the date of sale for domestic crude oil or from the date of customs clearance for exported crude oil according to regulations of the law on customs.

For natural gas, the severance tax and corporate income tax payment deadlines are monthly.

2. In cases where the tax agency calculates the tax, the tax payment deadline is the deadline stated in the notice from the tax agency.

3. For other receipts belonging to the state budget from land, water resource exploitation rights, mineral resource exploitation rights, registration fees, and business license fees, the deadlines are in accordance with the regulations of the Government of Vietnam.

4. For export and import goods subject to taxation as per the law on export and import tax, the tax payment deadlines are in accordance with the Export and Import Tax Law; for additional tax amounts payable after customs clearance, the deadlines are as follows:

a) The deadline for supplementary declaration tax payments and fixed tax amounts is in line with the tax payment deadline of the initial customs declaration;

b) The deadline for payments related to goods requiring analysis or assessment to determine the exact tax amount payable; goods not having official prices at customs declaration registration; goods with actual payment amounts or price adjustments not determined at customs declaration registration; follow regulations of the Minister of Finance.

Thus, according to the above regulation, the deadline for paying the severance tax on natural gas is monthly.

Note:

In cases where the taxpayer calculates the tax, the tax payment deadline is the last day of the tax declaration filing deadline.

In cases of supplementary tax declaration, the tax payment deadline is the deadline for filing the tax declaration of the tax period with errors or omissions.

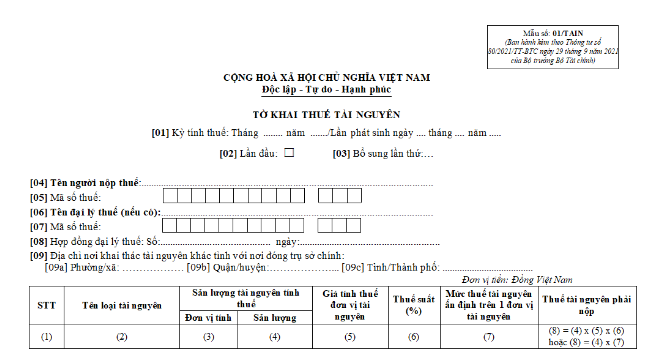

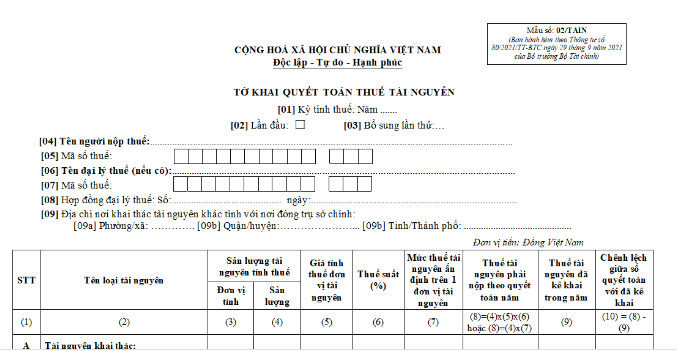

What are the templates for the severance tax declaration and severance tax finalization in Vietnam in 2024?

The templates for the severance tax declaration and the severance tax finalization declaration are template number 01/TAIN and template 02/TAIN-VSP as specified in Appendix 2 issued together with Circular 80/2021/TT-BTC.

Download the latest severance tax Declaration Form 2024.

Download the latest severance tax Finalization Declaration Form 2024.