Is the taxpayer allowed to request a postponement of the tax audit at the taxpayer's headquarters?

Is a Taxpayer Allowed to Request a Postponement of the Tax Inspection at the Taxpayer's Headquarters?

According to the provisions in Point c, Clause 5, Article 72 of Circular 80/2021/TT-BTC which provides for inspections at the taxpayer's headquarters as follows:

Inspection at the Taxpayer's Headquarters

....

- Procedure for Tax Inspection at the Taxpayer's Headquarters

....

c) In cases where the taxpayer submits a written request to postpone the inspection, the document must clearly state the reasons and the time of postponement. In case the tax authority has a force majeure reason to postpone the inspection, the tax authority must issue a notification to the taxpayer before the deadline for announcing the inspection decision according to form 08/KTT, issued together with Appendix I of this Circular.

During the inspection, if a force majeure reason arises, making it impossible to continue the inspection, the Head of the inspection team shall report to the person issuing the inspection decision to temporarily suspend the inspection. The suspension period is not counted within the inspection period.

d) In the case where during the tax inspection there arises a necessity to amend the Inspection Decision (changing the Head of team, members, or adding team members, supplementing content, inspection period, or reducing team members, content, inspection period), the Head of the inspection team must report to the competent person to issue an Amending Inspection Decision. The Amending Inspection Decision shall be executed according to forms 09/KTT, 10/KTT, 11/KTT issued together with Appendix I of this Circular.

....

Thus, taxpayers have the right to request a postponement of the tax inspection. However, the taxpayer must submit a written request to postpone the tax inspection, and the document must clearly state the reasons and the exact time of postponement.

Additionally, the postponement of the tax inspection will also be executed if the tax authority has a force majeure reason to do so, and a written notification will be sent to the taxpayer before the deadline for announcing the inspection decision.

Is a taxpayer allowed to request a postponement of the tax inspection at the taxpayer's headquarters? (Image from the Internet)

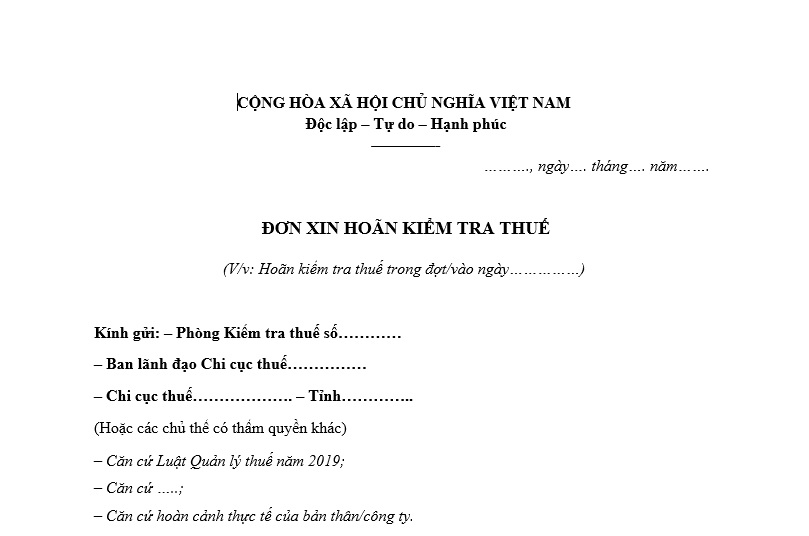

Sample Application for Postponement of Tax Inspection in 2024?

Currently, there is no legal regulation providing a specific form for applying for a postponement of tax inspection. Therefore, the following is a reference sample application for postponement of tax inspection:

The sample application for postponement of tax inspection in 2024 appears as follows:

Sample application for postponement of tax inspection in 2024...Download

In What Cases is the Taxpayer Subject to a Tax Inspection at the Taxpayer's Headquarters?

Based on Clause 1, Article 110 of the Law on Tax Administration 2019, the cases subject to tax inspection at the taxpayer's headquarters are regulated as follows:

(1) Cases where the dossier is subject to pre-refund inspection; post-refund inspection for dossiers subject to pre-refund;

(2) Cases stipulated at Point b, Clause 2, Article 109 of the Law on Tax Administration 2019;

(3) Cases of post-clearance inspection at the declarer’s headquarters as per customs legislation;

(4) Cases with signs of legal violations;

(5) Cases chosen as per plan, thematic projects;

(6) Cases based on recommendations of State Audit, State Inspection, or other competent authorities;

(7) Cases involving division, separation, merger, consolidation, conversion of enterprise type, dissolution, termination of operations, equitization, termination of tax code validity, change of business location and extraordinary inspections, inspections as directed by competent authorities, except in cases of dissolution and termination of operations where the tax authority is not required to finalize tax according to legal provisions.

How Soon Does a Taxpayer Receive a Tax Inspection Decision?

According to Clause 3, Article 110 of the Law on Tax Administration 2019, provisions regarding tax inspection at the taxpayer's headquarters are as follows:

Tax Inspection at the Taxpayer's Headquarters

...

- The tax inspection decision must be sent to the taxpayer within 03 working days and announced within 10 working days from the date of signing. Before announcing the inspection decision, if the taxpayer proves that the declared tax amount is correct and has paid the full tax amount due, the tax administration agency shall cancel the tax inspection decision.

...

Thus, the tax inspection decision at the taxpayer's headquarters must be sent to the taxpayer within 03 working days and announced within 10 working days from the date of signing.

Before the announcement of the inspection decision, if the taxpayer demonstrates that the declared tax amount is correct and has fully paid the tax due, the tax administration agency shall abolish the tax inspection decision.