Is the registration form of T-VAN services made in Form 01/DK-T-VAN in Vietnam?

What legislative document specifies the registration form of T-VAN services - Form 01/DK-T-VAN in Vietnam?

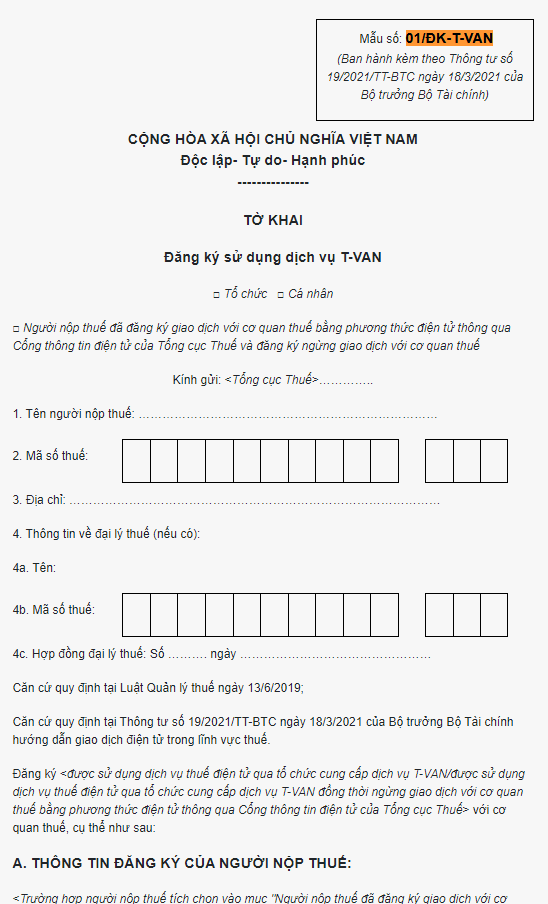

Pursuant to the list of forms/templates issued together with Circular 19/2021/TT-BTC, the registration form of T-VAN services will follow Form 01/DK-T-VAN as follows:

>>> Download the registration form of T-VAN services - Form 01/DK-T-VAN in Vietnam

What are the steps for registration of T-VAN services in Vietnam?

Pursuant to Article 42 of Circular 19/2021/TT-BTC, the procedures for registration of T-VAN services are as follows:

- Every taxpayer is entitled to use T-VAN services for implementing e-tax administrative procedures.

- Procedures for registration of e-transactions through a T-VAN service provider

Step 1) The taxpayer shall make an application form for registration of T-VAN services (Form No. 01/ĐK-T-VAN Download enclosed herewith) and submit it to the GDT’s web portal through the T-VAN service provider.

Step 2) Within 15 minutes from the receipt of the application form, the GDT’s web portal shall send a notification (Form No. 03/TB-TĐT enclosed herewith) of acceptance or non-acceptance of the application form through the T-VAN service provider’s information exchange system in order for the T-VAN service provider to send it to the taxpayer.

++ In the case of acceptance, the GDT’s web portal shall send a notification to the account on the GDT’s web portal through the T-VAN service provider’s information exchange system in order for the T-VAN service provider to send it to the taxpayer. The taxpayer shall change the password for the account granted for the first time and change the password at least every 03 (three) months to ensure safety and security.

++ In the case of non-acceptance, the taxpayer shall rely on the notification of non-acceptance provided by the tax authority in the notification to complete the registered information, e-sign and send it to the GDT’s web portal through the T-VAN service provider or contact the supervisory tax authority for instructions and assistance.

What is the registration form of T-VAN services - Form 01/DK-T-VAN in Vietnam? (Image from the Internet)

What are the procedures for unsubscribing T-VAN services in Vietnam?

Pursuant to Article 44 of Circular 19/2021/TT-BTC, the procedures for unsubscribing T-VAN services in Vietnam:

- In case of unsubscribing T-VAN services, the taxpayer shall complete the Form No. 03/DK-T-VAN issued together with Circular 19/2021/TT-BTC and send it to the GDT’s web portal via the T-VAN service provider.

- Within 15 minutes from the receipt of the application form, the GDT’s web portal shall send a confirmation (Form No. 03/TB-TĐT issued together with Circular 19/2021/TT-BTC) to the taxpayer via the T-VAN service provider.

- From the time of unsubscribing T-VAN services, the taxpayer is entitled to register e-transactions with the tax authority via the GDT’s web portal or another T-VAN service provider.

What is the time limit for the tax authority to send notifications to taxpayers through the T-VAN service provider in Vietnam?

Pursuant to Article 43 of Circular 19/2021/TT-BTC, the regulations are as follows:

Registration of changes and additions to information about T-VAN services

1. In the case of a change or addition to the information on the T-VAN service registration form, the taxpayer shall complete the Form No. 02/ĐK-T-VAN enclosed herewith and send it to the GDT’s web portal through the T-VAN service provider.

Within 15 minutes from the receipt of the application form, the GDT’s web portal shall send a notification (Form No. 03/TB-TĐT enclosed herewith) of acceptance or non-acceptance of the application form to the taxpayer through the T-VAN service provider.

In the case of a change or addition to the information on the account serving e-tax payment, the taxpayer shall comply with the regulations set forth in Clause 5 Article 10 of this Circular.

2. In the case of change of the T-VAN service provider, the taxpayer shall follow the unsubscribing procedures in Article 44 and apply again in accordance with Article 42 of this Circular.

Thus, according to the above regulation, no later than 15 minutes from receiving the application, the tax authority sends a notification about the acceptance or non-acceptance of the registration of changes and additions to information about T-VAN services to the taxpayer through the T-VAN service provider.