Is the overtime pay subject to personal income tax in Vietnam?

Is the overtime pay subject to personal income tax in Vietnam?

Currently, the law does not provide a specific definition of overtime, yet it is understood as working beyond the regular working hours.

Based on Article 107 of the Labor Code 2019 the provisions are as follows:

Overtime Work

1. Overtime is the period of work performed beyond the regular working hours as prescribed by law, collective bargaining agreement, or labor regulations.

2. Employers are allowed to employ workers for overtime when the following conditions are fully met:

a) Consent from the worker must be obtained;

b) Ensure that the worker's overtime does not exceed 50% of the regular working hours in one day; in cases applying the weekly work time regulation, the total regular and overtime hours must not exceed 12 hours in a day; not exceeding 40 hours in a month;

c) Ensure that a worker's overtime does not exceed 200 hours in a year, except in cases specified in Clause 3 of this Article.

3. Employers may employ workers for up to 300 hours of overtime in a year for certain industries, trades, tasks, or specific cases:

....

According to Point i, Clause 1, Article 3 of Circular 111/2013/TT-BTC, the regulations are as follows:

Income Exempted from Tax

1. Based on the provisions of Article 4 of the Personal Income Tax Law, Article 4 of Decree No. 65/2013/ND-CP, income exempted from tax includes:

...

i) Income from night work wages and overtime wages paid that exceed the day work wages as prescribed by the Labor Code. Specifically:

i.1) The portion of wages and salaries paid higher for night work and overtime is exempted from tax based on the actual paid wages and salaries due to night work or overtime minus (-) the wages and salaries calculated according to regular working hours.

Example 2: Mr. A has a regular working hour wage as per the Labor Code of 40,000 VND/hour.

- If an individual works overtime on regular days and is paid 60,000 VND/hour, the exempted income is:

60,000 VND/hour – 40,000 VND/hour = 20,000 VND/hour

- If an individual works overtime on holidays or days off and is paid 80,000 VND/hour, the exempted income is:

80,000 VND/hour – 40,000 VND/hour = 40,000 VND/hour

i.2) Organizations and individuals paying income must prepare a schedule reflecting clearly the night work time, overtime, and additional pay for night work, overtime that have been paid to employees. This schedule must be retained at the income-paying unit and presented when required by the tax authority.

...

According to the regulations, income from night and overtime work wages paid in excess of day work wages, as stipulated by the Labor Code 2019, is income exempt from personal income tax.

Thus, it can be understood that overtime pay is exempt from personal income tax, but it is not fully exempted; only the portion of income that is paid in excess of the regular working hour wage is exempt.

Is the overtime pay subject to personal income tax in Vietnam? (Image from the Internet)

What salary requires personal income tax payment in Vietnam?

Based on Article 19 of the Personal Income Tax Law 2007 (amended by Clause 4, Article 1 of the Amended Personal Income Tax Law 2012, Article 1 of Resolution 954/2020/UBTVQH14, and related provisions on tax determination for business individuals specified in this Article, annulled by Clause 4, Article 6 of the Amended Laws on Taxation 2014) regulations on family deduction are as follows:

Family Deduction

1. Family deduction is the amount deducted from taxable income before calculating tax on income from business, wages, salaries of taxpayers who are residents. Family deduction consists of the following two parts:

a. The deduction for taxpayers is 11 million VND/month (132 million VND/year);

b. The deduction for each dependant is 4.4 million VND/month.

If the Consumer Price Index (CPI) fluctuates by more than 20% compared to the time the Law takes effect or the most recent adjusted family deduction, the Government of Vietnam shall report to the Standing Committee of the National Assembly to adjust the family deduction in accordance with price fluctuations for application in the next tax period.

2. Determination of the family deduction for dependants is carried out on the principle that each dependant is only deducted once from one taxpayer.

3. A dependant is a person whom the taxpayer is responsible for supporting, including:

a) Minor children; disabled children, unable to work;

b) Individuals without income or with income not exceeding the prescribed level, including adult children studying at universities, colleges, secondary profession, or vocational training; spouse unable to work; parents beyond working age or unable to work; other unsupported persons whom the taxpayer must directly nurture.

The Government of Vietnam shall prescribe the income level, declaration to determine eligible dependants for family deduction.

Thus, currently, personal income tax must be paid by individuals with a salary over 11 million VND/month (132 million VND/year) if they have no dependants.

If a worker has one dependant, the salary must be over 15.4 million VND/month. Accordingly, for each dependant, the employee is further deducted 4.4 million VND/month.

What is the latest 2024 personal income tax reduction application form in Vietnam?

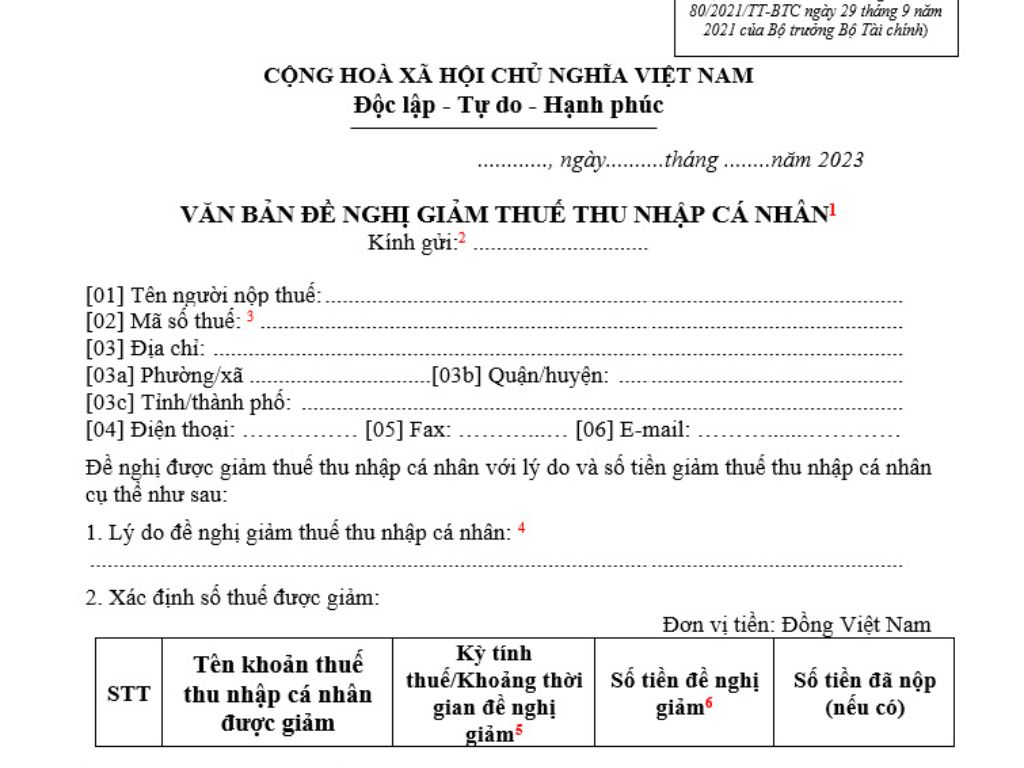

The latest 2024 personal income tax reduction application form is used according to Form 01/MGTH issued with Circular 80/2021/TT-BTC as follows:

Latest 2024 Personal Income Tax Reduction Application Form Download