Is the laundry detergent eligible for a reduction in value-added tax in Vietnam in 2024?

Is the laundry detergent eligible for a reduction in value-added tax in Vietnam in 2024?

Groups of goods and services not eligible for a reduction in value-added tax for 2024 are specified in Clause 1, Article 1 of Decree 72/2024/ND-CP which stipulates the policy for reducing value-added tax as follows:

* Value-added tax reduction for groups of goods and services currently applying a tax rate of 10%, except for the following groups of goods and services:

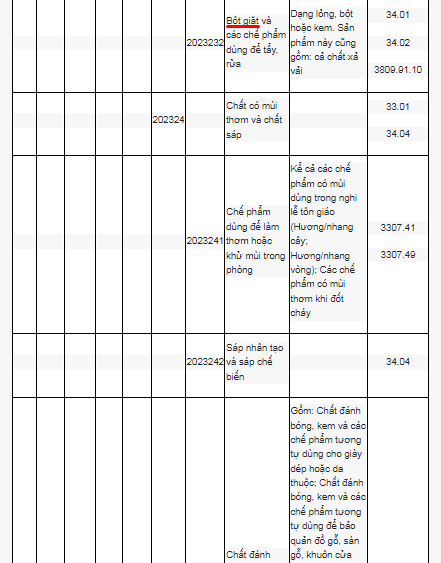

[1] Telecommunications, financial activities, banking, securities, insurance, real estate business, metals and fabricated metal products, mineral products (excluding coal mining), coke, refined petroleum, chemical products. Details are in Appendix 1 issued together with this Decree. (Download Appendix 1)

[2] Products and services subject to excise tax. Details are in Appendix 2 issued together with this Decree. (Download Appendix 2)

[3] Information technology as per IT law. Details are in Appendix 3 issued together with this Decree. (Download Appendix 3)

[4] The reduction in value-added tax for each type of goods and services specified in Clause 1, Article 1 of Decree 72/2024/ND-CP is uniformly applied at different stages, including importation, production, processing, and commercial business.

For coal mining products sold (including coal mined and then screened and classified through a closed loop process) that are subject to a reduction in value-added tax.

Coal products specified in Appendix 1 issued together with this Decree (Download Appendix 1) in stages other than mining sales are not subject to a reduction in value-added tax.

State Corporations and Economic Groups that perform closed-loop processes before sale are also eligible for a reduction in value-added tax for coal mining products sold.

If the goods and services listed in Appendices 1, 2, and 3 issued with this Decree are not subject to value-added tax or subject to a 5% value-added tax as per the Law on Value-Added Tax, they shall follow the provisions of the Law on Value-Added Tax and are not eligible for a reduction in value-added tax.

Hence, it can be seen that groups of goods and services previously subject to a 10% value-added tax will be eligible for a 2% tax reduction, except for the cases mentioned above.

In particular, laundry detergent is a product group not eligible for a reduction in value-added tax.

Therefore, according to the above regulations, the sale of laundry detergent will not be eligible for a reduction in value-added tax in 2024.

>>> See details List of goods and services not eligible for value-added tax rate reduction issued with Decree 72/2024/ND-CP.

Is the laundry detergent eligible for a reduction in value-added tax in Vietnam in 2024? (Image from the Internet)

What is the value-added tax declaration form for individuals engaged in business who pay tax under the declaration method in Vietnam?

Based on Clause 1, Article 11 of Circular 40/2021/TT-BTC stipulating tax management for business households and individuals who pay tax under the declaration method as follows:

Tax management for business households and individual business who pay tax under the declaration method

1. Tax declaration dossier

The tax declaration dossier for business households and individuals who pay tax under the declaration method is stipulated in item 8.2 of Appendix I - List of tax declaration dossier issued together with Decree No. 126/2020/ND-CP dated October 19, 2020 of the Government of Vietnam. Specifically:

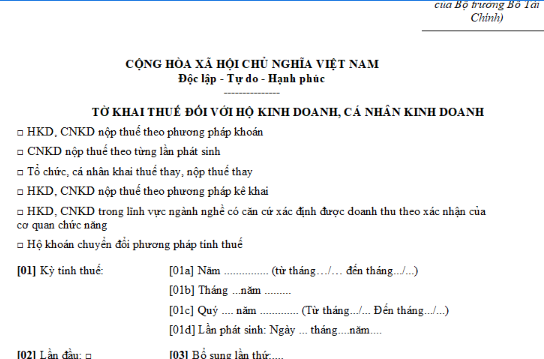

a) Tax declaration form for business households and individuals under form No. 01/CNKD issued together with this Circular;

b) Annex Table of Business Activities within the period of business households and individuals who pay tax under the declaration method under Form No. 01-2/BK-HDKD issued together with this Circular. In cases where business households and individuals who pay tax under the declaration method can determine revenue according to the verification of functional agencies, they are not required to submit Annex Table of Business Activities under Form No. 01-2/BK-HDKD issued together with this Circular.

...

Therefore, according to the above regulations, the value-added tax declaration form for individuals engaged in business who pay tax under the declaration method is form No. 01/CNKD issued together with Circular 40/2021/TT-BTC as follows:

>>> Download Latest value-added tax declaration form for individuals engaged in business who pay tax under the declaration method for 2024.

What is the basis for calculating value-added tax in Vietnam according to current regulations?

Pursuant to Article 2 of the Law on Value-Added Tax 2008 which defines value-added tax as follows:

Value-Added Tax

Value-added tax is a tax calculated on the added value of goods and services arising in the process from production, circulation to consumption.

Additionally, according to Article 6 of the Law on Value-Added Tax 2008 which stipulates the basis for calculating value-added tax is the taxable price and tax rate.

Therefore, the basis for calculating value-added tax is based on the taxable price and the tax rate.