Is the KPI bonus for sales employees subject to personal income tax in Vietnam?

Is the KPI bonus for sales employees subject to personal income tax in Vietnam?

Taxable income for individuals comprises various forms of income as stipulated in point e, clause 2, Article 3 of Decree 65/2013/ND-CP as follows:

Taxable Income

Taxable income for individuals includes the following types of income:

...

2. Income from wages and salaries received from employers, including:

a) Wages, salaries, and other income in the nature of wages and salaries received in the form of money or non-money.

...

e) Bonuses in money or non-money in any form, including stock bonuses, except the following bonuses:

- Bonuses accompanying titles conferred by the State, including bonuses accompanying emulation titles and awards according to legal provisions on emulation and commendation;

- Bonuses accompanying national prizes or international awards recognized by the State of Vietnam;

- Bonuses for technical improvements, inventions, and patents recognized by competent state agencies;

- Bonuses for detecting or reporting violations of the law to competent state agencies.

...

Thus, the KPI bonus for sales employees is subject to personal income tax (PIT).

Is the KPI bonus for sales employees subject to personal income tax in Vietnam? (Image from the Internet)

How is personal income tax calculated for KPI bonus for sales employees in Vietnam?

The method for calculating personal income tax on KPI bonus for sales employees is determined according to clause 3, Article 7 of Circular 111/2013/TT-BTC as follows:

Tax Calculation Basis for Taxable Income from Business, Wages, and Salaries

...

3. Tax Calculation Method

Personal income tax on income from business, wages, and salaries is the total tax calculated according to each income bracket. The tax for each income bracket is the taxable income of the bracket multiplied by the corresponding tax rate for that bracket.

To facilitate calculations, a simplified calculation method can be applied based on Appendix No. 01/PL-TNCN attached to this Circular.

Example 4: Ms. C has an income from wages and salaries in the month of 40 million VND and pays insurance contributions: 7% social insurance, 1.5% health insurance on salary. Ms. C supports 2 children under 18, and in the month Ms. C does not make any charitable, humanitarian, or educational contributions. The personal income tax temporarily payable by Ms. C in the month is calculated as follows:

- Ms. C's taxable income is 40 million VND.

- Ms. C is entitled to the following deductions:

+ personal exemption: 9 million VND

+ Dependent deduction for 02 dependents (2 children):

3.6 million VND × 2 = 7.2 million VND

+ Social insurance, health insurance:

40 million VND × (7% + 1.5%) = 3.4 million VND

Total deductions:

9 million VND + 7.2 million VND + 3.4 million VND = 19.6 million VND

- Ms. C’s taxable income is:

40 million VND - 19.6 million VND = 20.4 million VND

- Tax payable:

Method 1: Tax payable calculated according to each tier of the progressive tax rate schedule:

+ Tier 1: taxable income up to 5 million VND, tax rate 5%:

5 million VND × 5% = 0.25 million VND

+ Tier 2: taxable income over 5 million VND to 10 million VND, tax rate 10%:

(10 million VND - 5 million VND) × 10% = 0.5 million VND

+ Tier 3: taxable income over 10 million VND to 18 million VND, tax rate 15%:

(18 million VND - 10 million VND) × 15% = 1.2 million VND

+ Tier 4: taxable income over 18 million VND to 32 million VND, tax rate 20%:

(20.4 million VND - 18 million VND) × 20% = 0.48 million VND

- Total tax Ms. C needs to temporarily pay for the month is:

0.25 million VND + 0.5 million VND + 1.2 million VND + 0.48 million VND = 2.43 million VND

Method 2: Tax payable calculated using the simplified method:

Taxable income in the month of 20.4 million VND belongs to tier 4. Personal income tax payable is calculated as follows:

20.4 million VND × 20% - 1.65 million VND = 2.43 million VND

...

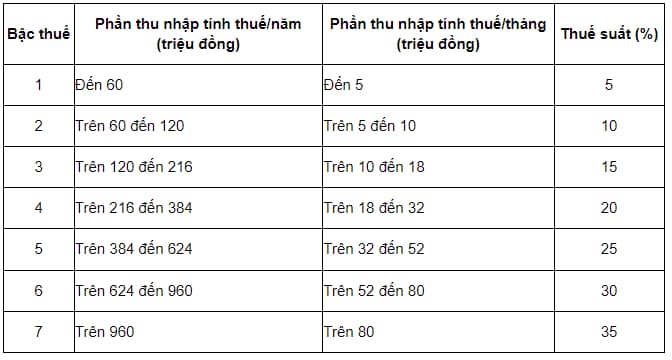

In addition, according to Article 22 of the Law on Personal Income Tax 2007, which stipulates the progressive tax rate schedule as follows:

- The progressive tax rate schedule applies to taxable income stipulated in clause 1, Article 21 of the Law on Personal Income Tax 2007, as amended by clause 5, Article 1 of the Law on Amendments to the Law on Personal Income Tax 2012 (Provisions relating to determining taxes for business individuals under clause 1 of this Article were annulled by clause 4, Article 6 of the Law on Amendments to Tax Laws 2014).

- The progressive tax rate schedule is stipulated as follows:

Based on the above regulations, the formula for calculating personal income tax on KPI bonus for sales employees is:

| PIT Payable = (Taxable Income - Deductions) x Tax Rate |

What is the current personal exemption rate in Vietnam?

Based on the provisions of Article 19 of the Law on Personal Income Tax 2007, as amended by clause 4, Article 1 of the Law on Amendments to the Law on Personal Income Tax 2012, Article 1 of Resolution 954/2020/UBTVQH14 (Provisions relating to determining taxes for business individuals under clause 1 of this Article were annulled by clause 4, Article 6 of the Law on Amendments to Tax Laws 2014), personal exemptions are amounts deducted from taxable income before tax calculation for income from business, wages, and salaries for tax-paying resident individuals.

Personal exemptions include:

- Personal exemption rate: 11 million VND/month (132 million VND/year) applicable for the taxpayer;

- Dependent deduction amount: 4.4 million VND/month applied to each dependent of the taxpayer.