Is the 2025 Tet bonus subject to personal income tax in Vietnam?

Is an employer required to give a Tet bonus to employees in Vietnam?

Based on Article 104 of the Labor Code 2019, the regulations on bonuses are as follows:

Bonus

- Bonus is the money or assets or other forms that the employer awards to the employee based on the production and employer results, the level of task completion of the employee.

- The bonus regulation is decided and publicly announced by the employer at the workplace after consulting the organization representing the employees at the facility where such an organization exists.

From the above regulations, it can be seen that the Tet bonus specifically and bonuses in general are not mandatory but are determined by the employer based on (i) the company's production and employer results, (ii) the level of task completion of the employee.

However, for cases where the company already has a Bonus Regulation (clearly stipulating cases where employees are rewarded by the company) and has publicly disclosed it to employees, the company must execute the payment of bonuses to employees in accordance with the company's Bonus Regulation.

Is the 2025 Tet bonus subject to personal income tax in Vietnam? (Image from the Internet)

Is the 2025 Tet bonus subject to personal income tax in Vietnam?

According to point e, clause 2, Article 2 of Circular 111/2013/TT-BTC, regulations on taxable income are as follows:

Taxable Income

According to the provisions of Article 3 of the Personal Income Tax Law and Article 3 of Decree No. 65/2013/ND-CP, taxable personal income includes:

...

- Income from wages, salaries

Income from wages, salaries is the income received by an employee from an employer, including:

...

e) Bonuses in cash or non-cash in any form, including bonuses in securities, except for the following bonuses:

e.1) Bonuses accompanying titles awarded by the State, including bonuses accompanying emulation titles, forms of commendation according to the law on emulation and commendation, specifically:

e.1.1) Bonuses accompanying emulation titles such as National Emulation Soldier; Ministry, sector, central union, province-level Emulation Soldier; Basic Emulation Soldier, Advanced Worker, Advanced Soldier.

e.1.2) Bonuses accompanying forms of commendation.

e.1.3) Bonuses accompanying titles awarded by the State.

e.1.4) Bonuses accompanying awards given by Associations, Organizations under Political Organizations, Socio-political Organizations, Social Organizations, Socio-professional Organizations from the central and local level according to the constitution of those organizations and in accordance with the Law on Emulation and Commendation.

...

Based on the above regulations, it can be seen that the 2025 Tet bonus is subject to personal income tax. However, employees only have to pay tax after deducting the exempt portions if the remainder reaches the taxable personal income level.

How to determine taxable income on Tet bonuses of Vietnamese residents?

According to the provisions of Article 7 of Circular 111/2013/TT-BTC, the basis for calculating tax on income from Tet bonuses specifically or income from wages and salaries in general of Vietnamese residents is the taxable income and the tax rate. Specifically:

(1) Taxable Income

Taxable income is determined by taking the taxable income minus (-) the following exemptions:

- Personal exemptions.

- Mandatory insurance contributions, voluntary pension fund.

- Charitable, humanitarian, educational incentives contributions.

(2) Tax Rate

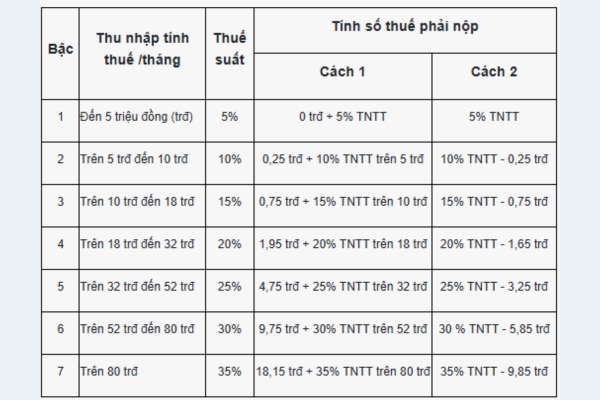

The personal income tax rate for income from wages and salaries is applied according to the progressive tax rate schedule as follows:

| Tax Bracket | Annual Taxable Income (million VND) | Monthly Taxable Income (million VND) | Tax Rate (%) |

| 1 | Up to 60 | Up to 5 | 5 |

| 2 | Over 60 to 120 | Over 5 to 10 | 10 |

| 3 | Over 120 to 216 | Over 10 to 18 | 15 |

| 4 | Over 216 to 384 | Over 18 to 32 | 20 |

| 5 | Over 384 to 624 | Over 32 to 52 | 25 |

| 6 | Over 624 to 960 | Over 52 to 80 | 30 |

| 7 | Over 960 | Over 80 | 35 |

(3) Tax Calculation Method

Personal income tax on income from employer activities, wages, and salaries is the total tax amount calculated according to each income bracket. The tax for each income bracket is the taxable income of that bracket multiplied (×) by the corresponding tax rate of that bracket.

(4) Simplified Tax Calculation Method:

For convenience in calculation, the simplified method according to appendix number 01/PL-TNCN issued with Circular 111/2013/TT-BTC can be applied as follows: