Is October 30 or 31 the payment deadline for provisional corporate income tax in Vietnam for the third quarter of 2024?

Is October 30 or 31 the payment deadline for provisional corporate income tax in Vietnam for the third quarter of 2024?

Based on Clause 1, Article 55 of the Law on Tax Administration 2019, the payment deadline for provisional corporate income tax is stipulated as follows:

Tax Payment Deadline

1. In cases where taxpayers calculate their own taxes, the latest deadline for payment is the last day of the tax declaration submission period. If additional tax declaration is required, the tax payment deadline corresponds to the tax declaration submission period for the fiscal period with errors.

For corporate income tax, it is provisional and paid quarterly, and the latest payment deadline is the 30th day of the first month of the following quarter.

For crude oil, the payment deadline for resource tax and corporate income tax upon each sale of crude oil is 35 days from the sale date for domestically sold crude oil or from the customs clearance date for exported crude oil, according to legal regulations on customs.

For natural gas, the payment deadline for resource tax and corporate income tax is on a monthly basis.

Accordingly, for corporate income tax, the provisional payment is quarterly, with the latest payment deadline being October 30, 2024, which is a Wednesday.

Additionally, the deadline for submitting other taxes like VAT, personal income tax follows the provisions of Article 44 of the Law on Tax Administration 2019 as follows:

payment deadline for Tax Declarations

1. For taxes declared on a monthly or quarterly basis, the deadlines are stipulated as follows:

a) No later than the 20th day of the month following the month when the tax obligation arises for monthly declarations and payments;

b) No later than the last day of the first month of the following quarter for quarterly declarations and payments.

The deadline for submitting tax declarations for monthly or quarterly declared taxes is stipulated as follows:

- No later than the 20th day of the month following the month when the tax obligation arises for monthly declarations, i.e., October 20, 2024

- No later than the last day of the first month of the following quarter for quarterly declarations, i.e., October 31, 2024.

Is October 30 or 31 the payment deadline for provisional corporate income tax in Vietnam for the third quarter of 2024? (Image from the Internet)

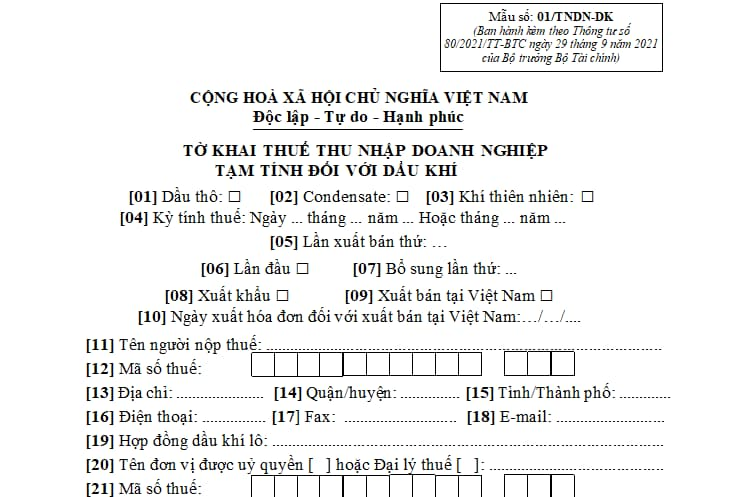

What is the provisional corporate income tax declaration form for oil and gas bussiness?

The Form for the Provisional Corporate Income Tax Declaration for oil and gas bussiness is Form 01/TNDN-DK, as stipulated in Appendix 2 issued with Circular 80/2021/TT-BTC, and it appears as follows:

Download Form 01/TNDN-DK Provisional Corporate Income Tax Declaration for oil and gas bussiness: Here.

When Will the Provisional Corporate Income Tax Declaration Form for oil and gas bussiness Be Applied?

Based on Clause 1 and Clause 5, Article 8 of Decree 126/2020/ND-CP as follows:

Types of Taxes to Be Declared Monthly, Quarterly, Annually, Upon Each Arising Tax Obligation, and Tax Finalization Declarations

1. Taxes and other revenue liable to the state budget managed and collected by tax authorities which fall under monthly declarations include:

a) Value-added tax, personal income tax. If taxpayers meet the criteria stipulated in Article 9 of this Decree, they may opt to declare quarterly.

b) Special consumption tax.

c) Environmental protection tax.

d) Resource tax, excluding the resource tax specified in point e of this clause.

dd) Fees and charges liable to the state budget (excluding fees and charges collected by Vietnam's representative agencies abroad according to provisions in Article 12 of this Decree; customs fees; fees for goods, luggage, and transport vehicles in transit).

e) For natural gas exploration and sale bussiness: Resource tax; corporate income tax; special taxes of the Vietnam-Russia Joint Venture Vietsovoil and gas in Lot 09.1 per the Agreement between the Government of the Socialist Republic of Vietnam and the Government of the Russian Federation signed on December 27, 2010, on continued cooperation in geologic exploration and oil and gas exploitation on the continental shelf of the Socialist Republic of Vietnam within the framework of the Vietnam-Russia Joint Venture Vietsovoil and gas (hereinafter referred to as the Vietsovoil and gas Joint Venture in Lot 09.1); national host gas profit share.

2. Other taxes and revenues owed to the state budget, declared quarterly, include:

a) Corporate income tax for foreign airlines, foreign reinsurance.

b) Value-added tax, corporate income tax, personal income tax for credit institutions or third parties authorized by credit institutions to exploit security assets while awaiting processing to declare on behalf of taxpayers with security assets.

c) Personal income tax for individuals and organizations paying income subject to tax withholding as prescribed by personal income tax laws, if such organizations or individuals declare value-added tax quarterly and choose to declare personal income tax quarterly; individuals with income from salaries, wages, who directly declare personal income tax with the tax authority and select quarterly declarations.

d) Taxes and other revenues due to the state budget where organizations and individuals declare and pay taxes on behalf of individuals, provided they declare VAT quarterly and choose to declare on behalf of individuals quarterly, excluding the case prescribed in point g, clause 4 of this Article.

đ) Additional charges when crude oil prices increase (excluding oil and gas bussiness of the Vietsovoil and gas Joint Venture in Lot 09.1).

...

5. Declaration for each sale in crude oil exploration and sale bussiness, including: Resource tax; corporate income tax; special tax, and additional charges when crude oil prices increase of the Vietsovoil and gas Joint Venture in Lot 09.1; national host oil profit share. The deadline for submitting tax declarations and other revenue for this item per sale is 35 days from the sale date (including domestic and export crude oil sales). The sale date is the date of the completed oil transfer at the handover point.

...

Thus, the Provisional Corporate Income Tax Declaration Form for oil and gas bussiness applies in the following two cases:

- Provisional corporate income tax declaration upon each crude oil sale for exploration and sale bussiness (excluding oil and gas bussiness of the Vietsovoil and gas Joint Venture in Lot 09.1).

- Provisional corporate income tax declaration monthly for exploration and sale of natural gas bussiness (excluding oil and gas bussiness of the Vietsovoil and gas Joint Venture in Lot 09.1).