Is Methyl Bromide Storage Warehouse Disinfectant Subject to Environmental Protection Tax?

Does Methyl Bromide Warehouse Fumigant Subject to Environmental Protection Tax?

Based on the provisions of Article 3 of the Law on Environmental Protection Tax 2010 regarding objects subject to environmental protection tax as follows:

Taxable Objects

1. Gasoline, oil, grease, including:

a) Gasoline, excluding ethanol;

b) Jet fuel;

c) Diesel oil;

d) Kerosene;

đ) Mazut oil;

e) Lubricants;

g) Grease.

2. Coal, including:

a) Brown coal;

b) Anthracite coal;

c) Fat coal;

d) Other types of coal.

3. Hydro-chloro-fluoro-carbon (HCFC) solution.

4. Taxable plastic bags.

5. Herbicides restricted for use.

6. Termiticides restricted for use.

7. Wood preservatives restricted for use.

8. Warehouse fumigants restricted for use.

9. Should it be deemed necessary to add other taxable objects to match each period, the Standing Committee of the National Assembly shall consider and stipulate.

The Government of Vietnam provides detailed guidelines for this Article.

Pursuant to the provisions, warehouse fumigants restricted for use are subject to environmental protection tax.

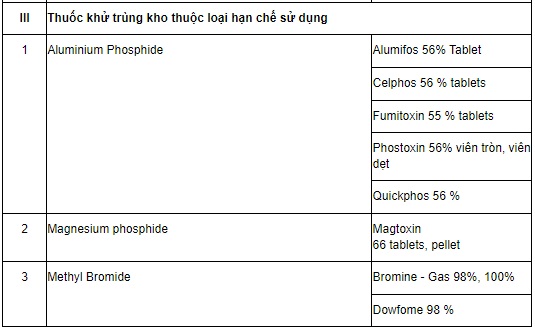

Additionally, warehouse fumigants restricted for use are detailed in the Schedule attached to Resolution 579/2018/UBTVQH14 concerning the Environmental Protection Tax Schedule as follows:

Thus, the Methyl Bromide warehouse fumigant is subject to environmental protection tax.

Methyl Bromide Warehouse Fumigant Subject to Environmental Protection Tax? (Image from Internet)

What is the basis for calculating the environmental protection tax for Methyl Bromide warehouse fumigant?

According to Article 6 of the Law on Environmental Protection Tax 2010, the basis for calculating the environmental protection tax for Methyl Bromide warehouse fumigant is as follows:

Basis for Tax Calculation

1. The basis for calculating environmental protection tax is the quantity of taxable goods and the absolute tax rate.

2. The quantity of taxable goods is specified as follows:

a) For domestically-produced goods, the taxable quantity is the quantity of goods produced and sold, exchanged, internally consumed, or given as gifts;

b) For imported goods, the taxable quantity is the quantity of goods imported.

3. The absolute tax rate for calculation is stipulated in Article 8 of this Law.

Thus, the basis for calculating the environmental protection tax for Methyl Bromide warehouse fumigant is the quantity of taxable goods and the absolute tax rate.

- The taxable quantity is defined as follows:

+ For domestically-produced goods, the taxable quantity is the quantity of goods produced and sold, exchanged, internally consumed, or given as gifts;

+ For imported goods, the taxable quantity is the quantity of goods imported.

- The environmental protection absolute tax rate for calculation is stipulated in Article 8 of the Law on Environmental Protection Tax 2010, as guided by Resolution 579/2018/UBTVQH14 on the Environmental Protection Tax Schedule.

In what cases are taxpayers entitled to a refund of the paid environmental protection tax?

According to Article 8 of Circular 152/2011/TT-BTC, taxpayers are entitled to a refund of the paid environmental protection tax in the following cases:

(1) Imported goods stored in bonded warehouses at port and under Customs supervision for re-export abroad.

(2) Imported goods delivered or sold to foreign countries through agents in Vietnam; gasoline and oil sold to means of transport of foreign companies on the routes through Vietnamese ports or means of transport of Vietnam on international transport routes as prescribed by law.

(3) Goods temporarily imported for re-export under temporary import and re-export business methods are entitled to a refund of the environmental protection tax paid on the re-exported quantity.

(4) Imported goods re-exported by the importer (including returned goods) abroad are refunded the paid environmental protection tax on the re-exported goods.

(5) Goods temporarily imported for fairs, exhibitions, product introduction are refunded the paid environmental protection tax corresponding to the quantity re-exported abroad.

Note: The refund of environmental protection tax under this Article applies only to actually exported goods. The procedures, dossiers, sequence, and authority for resolving environmental protection tax refunds for exported goods are implemented according to regulations as for handling import tax refunds as prescribed by the law on export and import taxes.