Is it required to submit a licensing fee declaration when establishing a new business location in Vietnam?

Is it required to submit a licensing fee declaration when establishing a new business location in Vietnam?

Based on Clause 1, Article 10 of Decree 126/2020/ND-CP, the deadline for submitting licensing fee declarations is regulated as follows:

Deadline for submitting tax declaration dossiers for land-related fees, licensing fees, registration fees, usage rights fees, and other fees according to the law on management and use of public assets.

Taxpayers must comply with the regulations on the deadline for submitting tax declaration dossiers as stipulated in Article 44 of the Tax Administration Law. For the deadline for submitting declaration dossiers for land-related fees, licensing fees, registration fees, usage rights fees, and other fees according to the law on the management and use of public assets as stipulated in Clause 5, Article 44 of the Tax Administration Law, it is implemented as follows:

1. licensing fee

a) Entities liable for the licensing fee (excluding business households and individual businesses) newly established (including small and medium-sized enterprises transitioning from household businesses) or establishing additional dependent units, business locations or commencing production and business activities, must submit the licensing fee declaration dossier no later than January 30 of the year following the year of establishment or commencement of production and business activities.

In case there is a change in capital during the year, the entity liable for the licensing fee must submit the licensing fee declaration dossier no later than January 30 of the year following the year in which the change occurs.

b) Business households and individual businesses are not required to submit a licensing fee declaration dossier. The tax authority will base on the tax declaration dossier and tax management database to determine revenue to calculate the payable licensing fee rate and notify the fee payer to comply according to the regulations in Article 13 of this Decree.

...

Thus, if a licensing fee payer establishes an additional business location, it is required to submit a new licensing fee declaration. The final deadline for submitting the licensing fee declaration is January 30 of the year following the year in which the change occurs.

Is it required to submit a licensing fee declaration when establishing a new business location in Vietnam? (Image from the Internet)

What is the latest licensing fee declaration form in Vietnam for 2025?

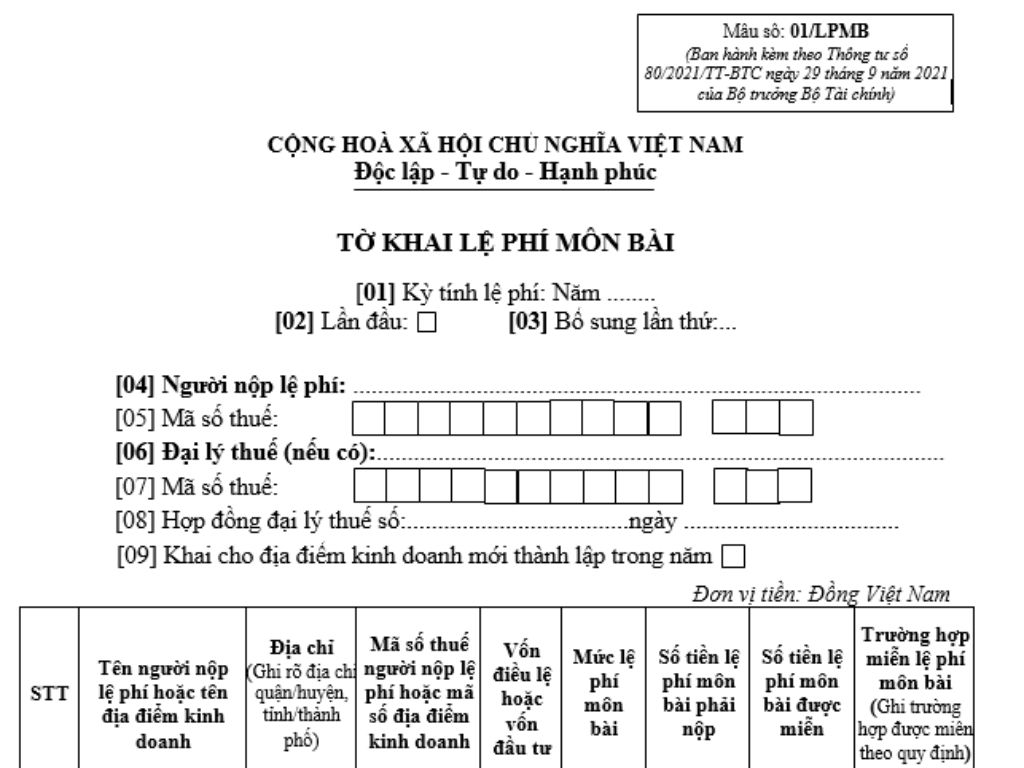

The latest licensing fee declaration form for 2025 is form 01/LPMB Appendix 2 issued together with Circular 80/2021/TT-BTC.

The licensing fee declaration form is as follows:

Download the licensing fee declaration form: form 01/LPMB

What is the licensing fee rate for 2025 in Vietnam?

According to Article 4 of Decree 139/2016/ND-CP (amended and supplemented by Clause 2, Article 1 of Decree 22/2020/ND-CP), the licensing fee rates for 2024 are stipulated as follows:

[1] The licensing fee rate for organizations engaged in the production and trading of goods and services is as follows:

- Organizations with charter capital or investment capital over 10 billion VND: 3,000,000 VND/year.

- Organizations with charter capital or investment capital of 10 billion VND or less: 2,000,000 VND/year.

- Branches, representative offices, business locations, public service providers, other economic organizations: 1,000,000 VND/year.

The licensing fee rate for organizations stipulated at points (i) and (ii) is based on the charter capital recorded on the business registration certificate; if there is no charter capital, it is based on the investment capital recorded on the investment registration certificate.

[2] The licensing fee rate for individuals and households engaged in the production and trading of goods and services is as follows:

- Individuals, groups of individuals, households with revenue over 500 million VND/year: 1,000,000 VND/year.

- Individuals, groups of individuals, households with revenue over 300 to 500 million VND/year: 500,000 VND/year.

- Individuals, groups of individuals, households with revenue over 100 to 300 million VND/year: 300,000 VND/year.

- Revenue for determining the licensing fee rate for individuals, groups of individuals, households is guided by the Ministry of Finance.

[3] Small and medium enterprises transitioning from household businesses (including branches, representative offices, business locations) when the exemption period for licensing fees ends (fourth year from the year of enterprise establishment): if it ends in the first 6 months, the full annual licensing fee is paid, if it ends in the last 6 months, 50% of the annual licensing fee is paid.

Households, individuals, groups of individuals engaged in production and business that have dissolved and resumed production and business activities in the first 6 months must pay the full annual licensing fee, in the last 6 months, 50% of the annual licensing fee is paid.

[4] Organizations with charter capital or investment capital over 10 billion VND and organizations with charter capital or investment capital of 10 billion VND or less, in the case of capital changes, the basis for determining the licensing fee rate is the charter capital or investment capital of the previous year immediately preceding the calculation year.

If the charter capital or investment capital is recorded in foreign currency on the business registration certificate or investment registration certificate, it must be converted to Vietnamese dong to determine the licensing fee rate at the buying rate of the commercial bank or credit institution where the fee payer has an account at the time of payment to the state budget.

[5] Fee payers who are operating and send a written notice to the direct tax authority regarding the suspension of production and business activities in the calendar year are not required to pay the licensing fee for the year of business suspension, provided that: the written request to suspend production and business activities is sent to the tax authority before the fee deadline (January 30 every year) and the licensing fee for the year of the request for business suspension has not been paid.

If the suspension of production and business activities does not meet the above conditions, the full annual licensing fee must be paid.