Is it possible to have a reduction on excise tax if the taxpayer encounters an accident in Vietnam? What conditions are required for the deduction of excise tax?

Is it possible to have a reduction on excise tax if the taxpayer encounters an accident in Vietnam?

Pursuant to Clause 1, Article 52 of Circular 80/2021/TT-BTC, the cases where the tax authority notifies, decides tax exemption or reduction are specified as follows:

- Personal income tax exemption for income under the provisions of Clauses 1, 2, 3, 4, 5, 6 of Article 4 of the Personal Income Tax Law;

- Tax reduction as prescribed for individuals, business households, business individuals facing difficulties due to natural disasters, fires, accidents, severe illnesses affecting tax payment ability;

- Reduction of excise tax for taxpayers who produce goods subject to excise tax facing difficulties due to natural disasters, unexpected accidents according to the law on excise tax;

- Exemption, reduction of resource tax for taxpayers facing natural disasters, fires, unexpected accidents causing damage to declared, taxed resources;

- Exemption, reduction of non-agricultural land use tax;

- Exemption, reduction of agricultural land use tax according to the provisions of the Agricultural Land Use Tax Law and resolutions of the National Assembly;

- Exemption, reduction of land rent, water surface rent, land levy;

- Exemption from registration fees.

Taxpayers will be eligible for a reduction of excise tax if they manufacture goods subject to excise tax and encounter difficulties due to natural disasters or unexpected accidents, as per the law on excise tax.

Thus, it can be seen that in cases where the taxpayer unexpectedly faces an accident per the law, they are eligible for a reduction of excise tax.

Is it possible to have a reduction on excise tax if the taxpayer encounters an accident in Vietnam? What conditions are required for the deduction of excise tax? (Image from the Internet)

What are the conditions for the deduction of excise tax in Vietnam?

According to Clause 3, Article 7 of Decree 108/2015/ND-CP (amended by Clause 3, Article 1 of Decree 14/2019/ND-CP), the conditions for the deduction of excise tax are specifically stipulated as follows:

(1) For cases of importing materials subject to excise tax for producing goods subject to excise tax and cases of importing goods subject to excise tax, the document as a basis for deducting excise tax is the excise tax payment document at the import stage.

(2) For cases of purchasing materials directly from domestic manufacturers:

- Sales contract, which must include contents showing that the goods are directly produced by the selling establishment; a copy of the business registration certificate of the selling establishment (with the signature and seal of the selling establishment).

- Bank payment documents.

- The document serving as the basis for the deduction of excise tax is the value-added tax invoice when purchasing goods.

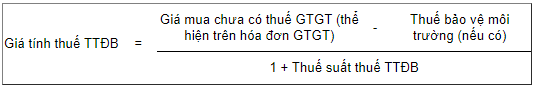

The excise tax amount that the purchasing unit has paid when purchasing the materials is determined = taxable price of excise tax multiplied by (x) excise tax rate; in which:

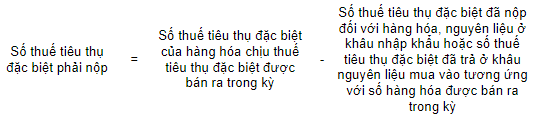

The deduction of excise tax is carried out when declaring excise tax and the excise tax payable is determined according to the following formula:

Note: In cases where it is not possible to accurately determine the excise tax amount paid (or paid) for the respective materials consumed in the period, it is possible to base on previous period data to calculate the excise tax amount eligible for deduction and will determine according to the actual figures at the end of the quarter or year.

In any case, the deductible excise tax amount cannot exceed the excise tax calculated on the material portion according to the technical and economic standards of the product.

Is excise tax refundable according to international treaties to which the Socialist Republic of Vietnam is a member?

According to Clause 4, Article 7 of Circular 195/2015/TT-BTC as follows:

Refund of Tax

...

4. Refund of excise tax in the following cases:

a) Tax refund according to a decision of a competent authority under the provisions of the law.

b) Tax refund according to international treaties to which the Socialist Republic of Vietnam is a member.

c) Tax refund in cases where the paid excise tax amount is greater than the required excise tax amount under regulations.

The procedures, dossiers, order, and authority for resolving excise tax refunds as provided in Clauses 3 and 4 of this Article are implemented according to the provisions of the Law on Tax Administration and implementing guidance documents.

According to regulations, excise tax can be refunded in the following cases:

- Tax refund according to a decision of a competent authority under the provisions of the law.

- Tax refund according to international treaties to which the Socialist Republic of Vietnam is a member.

- Tax refund in cases where the paid excise tax amount is greater than the required excise tax amount under regulations.

Thus, in cases according to international treaties to which the Socialist Republic of Vietnam belongs, excise tax will be refunded.