Is golf tickets subject to excise tax in Vietnam?

Is golf tickets subject to excise tax in Vietnam?

First of all, to have an initial understanding of excise tax, currently, the law does not provide a definition of "What is the excise tax?" However, it can be based on the taxable and non-taxable objects specified in Article 2 Law on excise tax 2008 (amended by Clause 1, Article 1 Law on Amending and Supplementing Law on excise tax 2014) and Article 3 Law on excise tax 2008.

Simultaneously, based on Article 5 Law on excise tax 2008 as follows:

Basis for tax calculation

The basis for calculating excise tax is the taxable price of goods and services and the tax rate. The amount of excise tax payable is equal to the taxable price multiplied by the excise tax rate.

Based on the above regulations, it can be understood that the excise tax is an indirect tax levied on certain types of luxury goods and services to regulate production, import, and social consumption.

It also strongly regulates consumer income, contributes to increasing state budget revenue, and enhances business management for taxable goods and services.

excise tax is levied by the establishments that directly produce these goods, but consumers bear the tax because it is included in the selling price.

Next, based on Article 2 Law on excise tax 2008 (amended by Clause 1, Article 1 Law on Amending and Supplementing Law on excise tax 2014), the taxable objects are as follows:

Taxable objects

1. Goods:

a) Cigarettes, cigars, and other products from tobacco used for smoking, inhaling, chewing, sniffing, or sucking;

b) Alcohol;

c) Beer;

d) Automobiles with less than 24 seats, including automobiles that both carry passengers and goods, with fixed partitions between the passenger cabin and the cargo compartment;

dd) Motorcycles with a cylinder capacity above 125cm3;

e) Aircraft, yachts;

g) All types of gasoline;

h) Air conditioners with a capacity of 90,000 BTU or less;

i) Playing cards;

k) Votive papers, votive items.

2. Services:

a) Nightclub business;

b) Massage and karaoke business;

c) Casino business; electronic gaming business with rewards including jackpot machines, slot machines, and similar equipment;

d) Betting business;

dd) Golf business including selling membership cards, golf tickets;

e) Lottery business.

Therefore, according to the above regulations, golf tickets is one of the taxable objects and must pay excise tax.

Is golf tickets subject to excise tax in Vietnam? (Picture from Internet)

What is the excise tax rate for golf tickets in Vietnam?

Based on Article 5 Law on excise tax 2008 which stipulates the basis for excise tax calculation as follows:

Basis for tax calculation

The basis for calculating excise tax is the taxable price of goods and services and the tax rate. The amount of excise tax payable is equal to the taxable price multiplied by the excise tax rate.

Additionally, the amount of excise tax to be paid is calculated according to the following formula:

excise tax amount = taxable price x tax rate

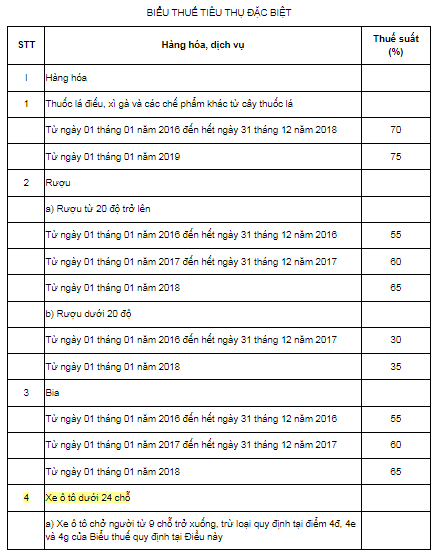

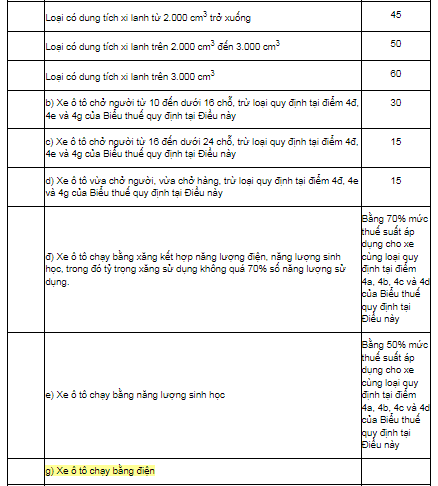

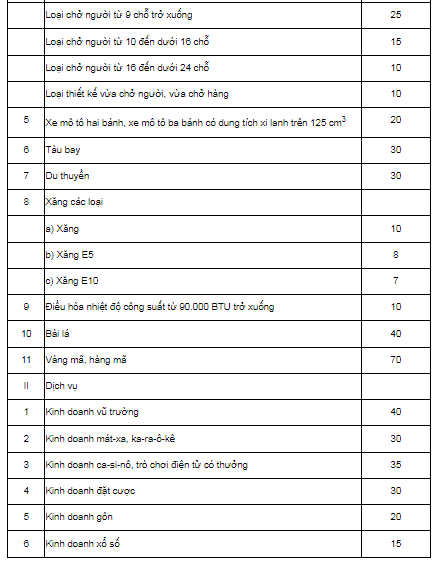

Simultaneously, according to Article 7 Law on excise tax 2008 (amended by Clause 4, Article 1 Law on Amending and Supplementing Law on excise tax 2014, Clause 2, Article 2 Law on VAT, Law on excise tax, and Law on Tax Administration Amendment 2016 and Article 8 Law on Amending Law on Public Investment, PPP, Investment, Housing, Bidding, Electricity, Enterprise, excise tax, and Law on Civil Judgment Execution 2022) the excise tax rates for goods are as follows:

Tax rates

The excise tax rates for goods and services are stipulated according to the following excise tax Schedule:

...

Therefore, according to the above regulations, the excise tax rate for golf tickets under golf business activities is 20%.

What are 4 cases where the excise tax payer is eligible for a tax refund in Vietnam?

According to Article 8 Law on excise tax 2008 the excise tax payer is eligible for a tax refund in the following cases:

Case 1: Goods temporarily imported for re-export;

Case 2: Goods used as imported materials to produce and process exported goods;

Case 3: Tax settlement upon merger, consolidation, division, separation, dissolution, bankruptcy, ownership transfer, enterprise transformation, termination of operation with excess tax payment;

Case 4: Decision on tax refund by competent authorities as prescribed by law and cases of excise tax refund under international treaties of which the Socialist Republic of Vietnam is a member.

Tax refunds according to case 1 and case 2 above are only applicable to actually exported goods.