Is golf business subject to excise tax in Vietnam? What is the excise tax rate for golf business in Vietnam?

Is golf business subject to excise tax in Vietnam?

Based on Article 2 of the Law on Excise Tax 2008 which stipulates the taxable objects as follows:

Taxable Objects

...

- Services:

a) Nightclub business;

b) Massage (massage), karaoke business;

c) Casino business; electronic games with rewards including jackpot machines, slot machines, and similar machines;

d) Betting business;

đ) Golf business including the sale of membership cards, golf playing tickets;

e) Lottery business.

From the above regulations, it can be seen that the golf business, including the sale of membership cards and golf playing tickets, is subject to excise tax.

Is golf business subject to excise tax in Vietnam? What is the excise tax rate for golf business in Vietnam? (Image from the Internet)

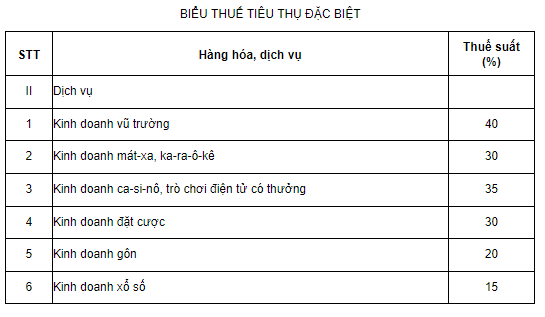

What is the excise tax rate for golf business in Vietnam?

According to the provisions in Article 7 of the Law on Excise Tax 2008 as amended by Clause 4, Article 1 of the Law on Amendments to the Law on Excise Tax 2014, it is stipulated as follows:

From the above regulations, it can be seen that the excise tax rate for golf business is 20%.

Determining the excise tax payable for golf business in Vietnam

According to the provisions of Article 5 of the Law on Excise Tax 2008, the basis for calculating excise tax is the taxable price of goods and services and the tax rate. The amount of excise tax payable is the taxable price multiplied by the excise tax rate.

Hence, the formula for calculating the amount of excise tax payable when doing golf business is:

excise Tax = Taxable Price * Tax Rate = Taxable Price * 20%

In which, the taxable price when doing golf business is determined as follows:

Based on point a, clause 7, Article 4 of Decree 108/2015/ND-CP, regarding the taxable price for golf business, it is stipulated as follows:

Taxable Price

...

- For goods sold on installment or deferred payment, the taxable price is the one-time payment price excluding installment interest or deferred payment interest.

7. For services, the taxable price is the service provision price set by the service business entity.

a) For golf business, it is revenue excluding VAT from the sale of membership cards, golf playing tickets, including ticket fees for golfing practice, grass maintenance fees, the operation of vehicle (buggy) rental and caddy services, deposits (if any), and other fees paid by golfers or members to the golf business entity. If a golf business entity provides other goods and services not subject to excise tax such as: accommodation, dining, sale of goods, or games, those goods and services are not subject to excise tax.

b) For casino business and electronic games with rewards, the taxable price is revenue from such activities minus (-) the reward payments to customers;

c) For betting business, the taxable price is revenue from betting ticket sales minus reward payments;

d) For nightclubs, massage, and karaoke business, the taxable price is revenue from activities in nightclubs, massage, and karaoke establishments including revenue from dining and other accompanying services;

dd) For lottery business, the taxable price is revenue from sales of various authorized lottery types.

- For goods and services used for exchange, internal consumption, gifting, giving, or promotion, the taxable price is the taxable price of similar or equivalent goods and services at the time of exchange, internal consumption, gifting, giving, or promoting these goods and services.

...

Therefore, the taxable price when doing golf business is revenue excluding VAT from the sale of membership cards, golf playing tickets, including ticket fees for golfing practice, grass maintenance fees, vehicle (buggy) rentals, caddy services, deposits (if any), and other fees paid by golfers or members to the golf business entity.

In the event that a golf business entity provides other goods and services not subject to excise tax, such as hotels, dining, sale of goods, or games, those goods and services are not subject to excise tax.

Which entities are excise taxpayers for golf business in Vietnam?

According to the provisions of Article 4 of the Law on Excise Tax 2008, the entity liable for the excise tax when doing golf business is as follows:

Taxpayers

Taxpayers of the excise tax are organizations and individuals producing, importing goods and providing services that are subject to excise tax.

In cases where organizations or individuals engaged in export business purchase goods subject to excise tax from production facilities for export but do not export and consume domestically, the export business organization or individual is the taxpayer of the excise tax.

Thus, the payer of the excise tax when doing golf business is the organization or individual that provides services subject to the excise tax, or in other words, the organization or individual engaging in the golf business.