Is Form CTT50 a tax receipt form in Vietnam?

Is Form CTT50 a tax receipt form in Vietnam?

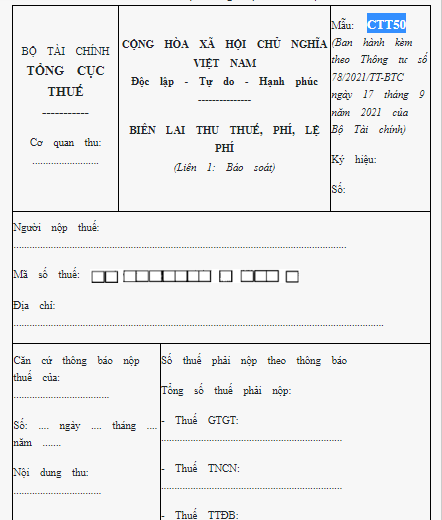

Based on Appendix 1C Tax Receipt Form, fees, and charges used by the Tax Authority when collecting taxes, fees, and charges from individuals, issued with Circular 78/2021/TT-BTC, it is indeed Form CTT50 as follows:

Download the complete Form CTT50 as a tax receipt form.

Does an organization collecting fees using e-receipts need to send documentation to the General Department of Taxation of Vietnam for adjustments?

According to Article 9 Circular 78/2021/TT-BTC, the regulations are as follows:

Use of receipts and vouchers

1. The Tax Department prints, creates, and issues tax receipt Form CTT50, Appendix I.C issued with this Circular in printed, self-printed, and e-forms for tax, fee, and charge collection for households and business individuals in areas meeting the conditions for receipt use and debt collection for set tax, agricultural land use, and non-agricultural land use tax for households and individuals.

2. Criteria for determining areas meeting the conditions for using tax receipts: Based on actual management at the local Tax Sub-department, the regional Tax Sub-department is responsible for identifying and updating the list of areas meeting the conditions for using tax receipts, to be submitted for approval by the Tax Department. Areas that qualify for tax receipt use must meet three conditions: no collection points, not enrolled for tax collection delegation, and classified as difficult or particularly difficult areas according to the administrative unit regulations at the commune level in disadvantaged areas.

3. In the process of managing taxes, fees, and charges under the Tax Management Law, if an organization requires the use of other types of certificates under Clause 2, Article 30 of Decree No. 123/2020/ND-CP, the organization must send a document to the Ministry of Finance (General Department of Taxation of Vietnam) for approval and implementation.

4. For organizations collecting fees and charges using e-receipts, if adjustment of certain criteria on receipts per Clause 2, Article 32 of Decree No. 123/2020/ND-CP is required, the organization must send a document to the Ministry of Finance (General Department of Taxation of Vietnam) for approval and implementation.

Thus, based on the above regulations, an organization collecting fees using e-receipts that needs adjustment must submit a document to the Ministry of Finance (General Department of Taxation of Vietnam) for approval and implementation.

Is Form CTT50 a tax receipt form in Vietnam? (Image from the Internet)

Vietnam: What content does the tax receipt include?

The content of the tax receipt is stipulated in Clause 2, Article 32 Decree 123/2020/ND-CP as follows:

- Type of receipt name: Tax, fee, and charge receipt not pre-printed with a value; tax, fee, and charge receipt pre-printed with a value; tax, fee, and charge receipt.

- Form symbol and receipt symbol.

+ The receipt form symbol includes details displaying the receipt type name, copy number of the receipt, and the model order in a receipt type (a receipt type may have multiple models).

+ The receipt symbol is an identification mark of the receipt using the system of Vietnamese letters and the last two digits of the year.

+ For printed receipts, the last two digits of the year are the year the receipt was printed. For self-printed and e-receipts, the last two digits of the year are the year when the receipt starts being used as noted in the issuance notice or the year the receipt is generated.

- Serial number on the receipt for tax, fee, and charge collection. The serial number is represented by up to 7 Arabic numerals. For self-printed and printed receipts, the serial number starts from 0000001. For e-receipts, the e-serial number starts from 1 on January 1 or on the date starting to use e-receipts and ends on December 31 each year.

- Copies of the receipt (applies to printed and self-printed receipts) are the sheets within the same receipt number. Each receipt number must have at least two copies or parts, including:

+ Copy (part) 1: Retain at the collecting organization;

+ Copy (part) 2: Given to the taxpayer, fee payer;

In cases with the third copy onwards, naming them according to specific functions for management purposes defined by law.

- Name, tax identification number of the collecting organization.

- Name and categories of collected taxes, fees, and charges, with amounts written in numbers and words.

- Date of issuance of the receipt.

- Signature of the collector. If using an e-receipt, the signature on the e-receipt is a digital signature.

- Name, tax identification number of the receipt printing organization (for printed receipts).

- The language used on the receipt is Vietnamese. In cases where foreign language additions are necessary, the foreign language parts are placed to the right within parentheses “( )” or directly below the Vietnamese text line with a smaller font size.

Note:

- The numbers written on the receipt are natural numbers 0, 1, 2, 3, 4, 5, 6, 7, 8, 9.

- The currency stated on the receipt is Vietnamese Dong. In instances where other items collected for the state budget prescribed by law are to be collected in foreign currency, collection may occur in foreign currency or in Vietnamese Dong converted based on the ratio set by law.

- If, during fee and charge collection, the fee and charge list exceeds the lines of one receipt, an accompanying schedule may be created. The schedule is self-designed by the fee and charge collecting organization according to the characteristics of each type of fee and charge, stating clearly “attached to receipt number... on day... month.... year”.

- For organizations collecting fees and charges using e-receipts that need to adjust certain criteria on the e-receipt for suitability with actual conditions, the fee and charge collecting organization must send a communication to the Ministry of Finance (General Department of Taxation of Vietnam) for review and guidance before implementation.

- Besides the mandatory information mentioned, the fee and charge collecting organization may create additional information, including logos, decorative images, or advertisements compliant with the legal requirements and not obscuring or fading the mandatory contents shown on the receipt.

- The font size of additional information must not be larger than the font size of the mandatory content displayed on the receipt.