Is a stepchild considered a dependant when calculating personal income tax in Vietnam?

Is a stepchild considered a dependant when calculating personal income tax in Vietnam?

Based on Point d, Clause 1 of Article 9 of Circular 111/2013/TT-BTC (Contents related to personal income tax for individual businesses in this Article are repealed by Clause 6, Article 25 of Circular 92/2015/TT-BTC), the regulations are as follows:

Deductions

The deductions as guided in this Article are amounts that are subtracted from an individual's taxable income before determining taxable income from salary and wages. Specifically:

- Personal exemptions

...

d) dependants include:

d.1) Children: biological children, legally adopted children, illegitimate children, stepchildren of the wife, stepchildren of the husband, specifically including:

d.1.1) Children under 18 years old (calculated by full month).

d.1.2) Children aged 18 or older who are disabled and unable to work.

d.1.3) Children studying in Vietnam or abroad at university, college, professional secondary school, vocational training, including children aged 18 or older attending general education (including the waiting period for university entrance exam results from June to September in 12th grade) without income or with an average monthly income in the year from all income sources not exceeding 1,000,000 VND.

d.2) The spouse of the taxpayer who meets the conditions at point d, clause 1, of this Article.

d.3) Biological father, mother; father-in-law, mother-in-law (or father, mother of the spouse); stepfather, stepmother; legally adoptive father and mother of the taxpayer who meet the conditions at point d, clause 1, of this Article.

d.4) Other individuals with no one to rely on whom the taxpayer must directly support and who meet conditions at point d, clause 1, of this Article, including:

d.4.1) Siblings of the taxpayer.

d.4.2) Grandparents; uncle, aunt, uncle-in-law, aunt-in-law of the taxpayer.

d.4.3) Nephews and nieces of the taxpayer, including: children of siblings.

d.4.4) Other individuals needing direct support as per legal regulations.

...

Thus, the stepchild of a husband is considered a dependant. Therefore, in cases of supporting a husband's stepchild, the taxpayer can still claim the personal exemptions for dependants when submitting personal income tax.

Is a stepchild considered a dependant when calculating personal income tax in Vietnam? (Image from the Internet)

What are documents proving dependant for a stepchild in Vietnam?

According to Subsection g.1, Point g, Clause 1 of Article 9 of Circular 111/2013/TT-BTC, the documents required to prove the stepchild of a husband as a dependant are as follows:

(1) Children under 18 years old:

- Copy of Birth Certificate

- Copy of Identification Card (if available).

(2) Children aged 18 or older who are disabled and unable to work:

- Copy of Birth Certificate and copy of Identification Card (if available).

- Copy of the Certificate of Disability according to regulations on persons with disabilities.

(3) Children studying in Vietnam or abroad at university, college, professional secondary school, vocational training, including children aged 18 or older attending general education (including the waiting period for university exam results from June to September in 12th grade) without income or with an average monthly income in the year from all sources not exceeding 1,000,000 VND.

- Copy of Birth Certificate.

- Copy of Student Card or declaration with school certification or other documents proving enrollment at universities, colleges, professional secondary, high school, or vocational training institutions.

Note: For adopted children, illegitimate children, or stepchildren, in addition to the documents listed for each case, the proof of relationship should include other documents such as a copy of the decision recognizing adoption, decision on recognition of paternity, maternity, and filiation by the competent state authority.

What is the current personal exemption level in Vietnam?

Based on Article 1 of Resolution 954/2020/UBTVQH14, the adjustment for the personal exemptions is as follows:

personal exemptions

Adjust the personal exemptions as stipulated in Clause 1, Article 19 of the Law on Personal Income Tax No. 04/2007/QH12, as amended and supplemented by Law No. 26/2012/QH13, as follows:

- The deduction for the taxpayer is 11 million VND/month (132 million VND/year);

- The deduction for each dependant is 4.4 million VND/month.

Thus, the current personal exemption levels are regulated as follows:

- The deduction for the taxpayer is 11 million VND/month (132 million VND/year);

- The deduction for each dependant of the taxpayer is 4.4 million VND/month.

What is the form for dependant registration to receive personal exemptions in Vietnam?

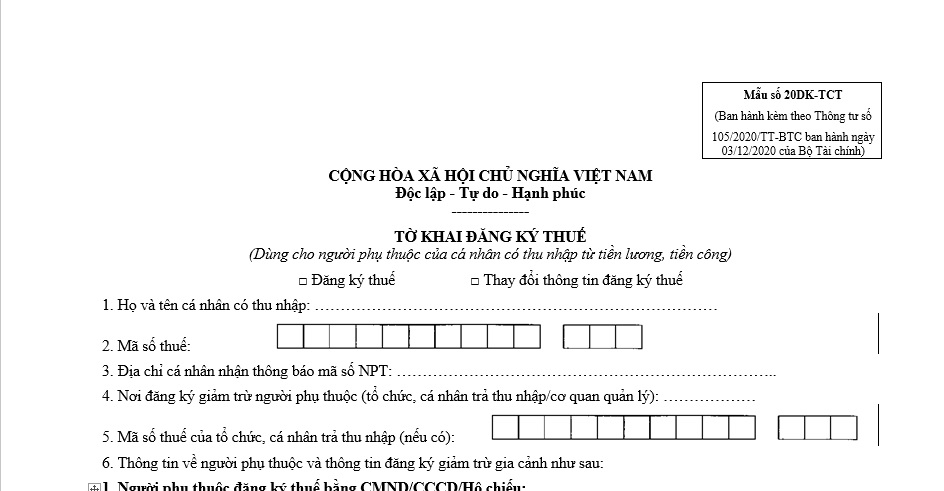

The current form for dependant registration for personal exemptions is Form 20-DK-TH-TCT issued together with Circular 105/2020/TT-BTC.

The form for dependant registration for personal exemptions is as follows:

Form for dependant registration for personal exemptions...Download