Is a guarantee letter required for tax payment in instalments in Vietnam?

Is a guarantee letter required for tax payment in instalments in Vietnam?

Based on Clause 2, Article 66 of Circular 80/2021/TT-BTC, the regulations are as follows:

Tax payment in instalments

- Procedure for processing the application for tax payment in instalments

a) Taxpayers shall prepare an application for tax payment in instalments as stipulated in Clause 2 of this Article and send it to the directly managing tax authority.

b) In case the application for tax payment in instalments is incomplete, within 3 working days from the date of receipt of the application, the tax authority shall notify in writing using form 01/TB-BSTT-NNT issued together with Decree 126/2020/ND-CP, requesting the taxpayer to explain or supplement the application.

In case the application for tax payment in instalments is complete, within 10 working days from the date of receipt of the application, the tax authority shall issue:

b.1) Notification of non-acceptance of tax payment in instalments using form 03/NDAN issued together with Appendix I of this Circular in case a guarantee letter is found to have signs of illegality, and at the same time, the tax authority shall send a document using form 05/NDAN issued together with Appendix I of this Circular to the guarantor for verification. The guarantor shall send the verification result to the tax authority within the period stipulated by law;

b.2) Decision of acceptance for tax payment in instalments using form 04/NDAN issued together with Appendix I of this Circular in case the subject is eligible for tax payment in instalments.

- Application for tax payment in instalments

a) Written request according to form 01/NDAN issued together with Appendix I of this Circular;

b) Guarantee letter in compliance with the law on guarantees, containing a commitment by the guarantor to pay on behalf of the taxpayer in case the taxpayer fails to adhere to the prescribed installment payment schedule;

c) Decision on coercive implementation of administrative decisions on tax management (if any).

...

Accordingly, the application for tax payment in instalments includes:

- Written request for tax payment in instalments

- Guarantee letter in compliance with the law on guarantees, containing a commitment by the guarantor to pay on behalf of the taxpayer in case the taxpayer fails to adhere to the prescribed installment payment schedule;

- Decision on coercive implementation of administrative decisions on tax management (if any).

Thus, a guarantee letter is required in the application for tax payment in instalments.

Is a guarantee letter required for tax payment in instalments in Vietnam? (Image from the Internet)

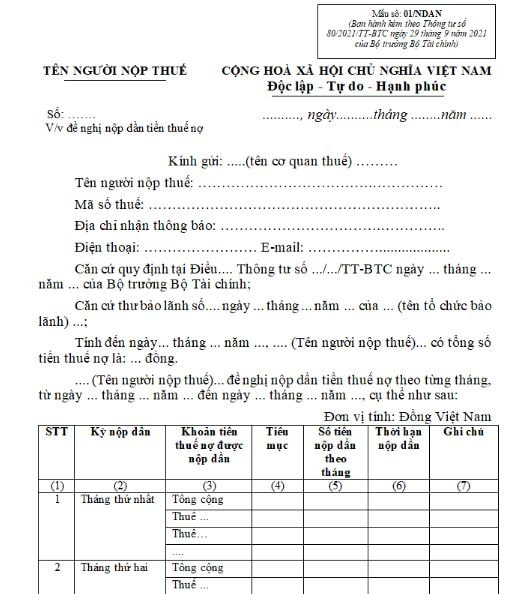

What is the latest form 01/NDAN- Request for tax payment in instalments in Vietnam?

The written request for tax payment in instalments is regulated in form 01/NDAN issued together with Appendix 1 of Circular 80/2021/TT-BTC as follows:

Download form 01/NDAN for the written request for tax payment in instalments: Here

How long can a taxpayer pay tax arrears in installments in Vietnam?

According to Clause 3, Article 66 of Circular 80/2021/TT-BTC, the regulations are as follows:

tax payment in instalments

...

3. Number of installments and amount of tax arrears to be paid

a) The amount of tax arrears to be paid in installments is the amount of tax arrears at the time the taxpayer requests installment payment but does not exceed the amount of tax arrears guaranteed by the credit institution.

b) The taxpayer can pay the tax arrears in installments within a period not exceeding 12 months and within the validity period of the guarantee letter.

c) The taxpayer can pay the tax arrears monthly, ensuring that each installment payment is not less than the average monthly installment amount. The taxpayer must calculate the overdue payment amount incurred to pay along with the installment amount of the tax arrears.

Taxpayers can pay the tax arrears in installments within a period not exceeding 12 months and within the validity period of the guarantee letter.

Additionally, taxpayers can pay the tax arrears monthly, ensuring that each installment payment is not less than the average monthly installment amount.

Taxpayers must calculate the overdue payment amount incurred to pay along with the installment amount of the tax arrears.