HTKK 5.2.9 update: Declaration form for PIT paid on behalf of other persons supplemented?

HTKK 5.2.9 update: Declaration form for PIT paid on behalf of other persons supplemented?

On February 18, 2025, the General Department of Taxation announced the update of the HTKK Support for Electronic Tax Declaration application to version 5.2.9, meeting the requirement to add a declaration form for the detailed list of substituted personal income tax payments made for each individual. The specific update content is as follows:

- Addition of a declaration form for the detailed list of substituted personal income tax payments for each individual: Allows taxpayers to enter, upload Excel spreadsheets, export, and print the form.

Starting from February 17, 2025, when preparing tax declaration dossiers related to the above-mentioned update content, organizations, and individuals paying taxes will use the declaration functions in the HTKK 5.2.9 application instead of previous versions.

To download and install the latest version of the HTKK software (version 5.2.9), you can download it via the file below:

Download the latest HTKK 5.2.9 Software 2025...HERE

Moreover, organizations and individuals paying taxes can also download the software and user manual for the HTKK application at the following address:

http://www.gdt.gov.vn/wps/portal/home/hotrokekhai

Additionally, to install the latest HTKK 5.2.9 software version, the computer of the organization or taxpayer must meet the following specifications:

- Operating System: WinXP (SP2, SP3), Win 7 or higher... (does not support iOS, Mac operating systems).

- Computer equipped with .NET Framework 3.5 or higher.

- If using a computer with an operating system of Win 7 or higher, it does not need to install .NET Framework 3.5 but only needs to activate the integrated .NET Framework 3.5 following the installation manual HERE

Note: If you have trouble downloading, please contact the local tax authority for assistance during the installation and use process.

How to handle errors during using HTKK software ?

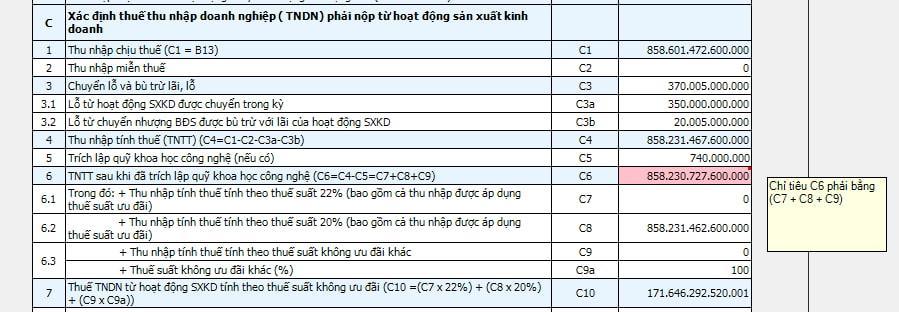

According to the guidance of the General Department of Taxation when using HTKK, if there is a declaration error, the system will notify the reporting error with all erroneous fields displayed with a pink background and a red mark at the top right corner. When hovering the mouse over this red mark, the system will automatically display the error content and instructions for correction.

The system automatically jumps to the first error cell. Below is an example of an error notification.

Taxpayers should perform the following steps to correct errors:

Step 1: Place the mouse over the red mark for the system to display the error content and correction instructions.

Step 2: Correct the error, and press F1 if detailed guidance is needed for the declaration section.

Step 3: Click on "Save" or "Print" or "Export" to have the system check the data again after correction.

Step 4: Repeat steps from 1 to 3 until the system no longer shows error notifications.

HTKK 5.2.9 update: Declaration form for PIT paid on behalf of other persons supplemented? (Image from the Internet)

Which entities must register tax directly with the tax authorities in Vietnam?

According to Clause 2, Article 4 of Circular 86/2024/TT-BTC, the regulation specifies taxpayers who must register tax directly with tax authorities, including:

(1) Enterprises operating in specialized fields not required to register business with the business registration office as stipulated by specialized laws (hereafter referred to as Economic Organizations).

(2) Public administrative units, economic organizations of the armed forces, economic organizations of political, socio-political, societal, social-professional organizations conducting business under the law but not required to register businesses through the business registration office;

Organizations from countries sharing a terrestrial border with Vietnam conducting the purchase, sale, exchange of goods in border markets, border gate markets, markets within economic zones; representative offices of foreign organizations in Vietnam;

Cooperatives established and operating under the provisions of Decree 77/2019/ND-CP but not required to register businesses through the business registration office as stipulated in Clause 2, Article 107 of Cooperative Law 2023 (hereafter referred to as Economic Organizations).

(3) Organizations established by competent authorities without production, business activities but have obligations to the state budget (hereafter referred to as Other Organizations).

(4) Foreign organizations and individuals in Vietnam using humanitarian aid, non-refundable aid funds of foreign countries to purchase goods and services with value-added tax in Vietnam for non-refundable aid, humanitarian aid;

Diplomatic representative agencies, consular offices and representative offices of international organizations in Vietnam entitled to value-added tax refund for subjects enjoying diplomatic privileges;

ODA project owners entitled to value-added tax refund, Offices of ODA sponsors, organizations designated by foreign sponsors to manage non-refundable ODA program or projects (hereafter referred to as Other Organizations).

(5) Foreign organizations without legal entity in Vietnam, or foreign individuals conducting independent business in Vietnam under Vietnamese law having income arising in Vietnam or accruing tax obligations in Vietnam (hereafter referred to as Foreign Contractors, Foreign Sub-contractors).

(6) Overseas suppliers without permanent establishments in Vietnam, non-resident foreign individuals conducting e-commerce business, digital platform business, and other services with organizations, individuals in Vietnam (hereafter referred to as Overseas Suppliers).

(7) Enterprises, organizations, individuals responsible for withholding and paying taxes on behalf of other taxpayers must declare and determine tax obligations separately from those of the taxpayer as per tax management legislation (except for income-paying agencies when withholding, paying on behalf of personal income tax);

Commercial banks, intermediary payment service providers, or organizations, individuals authorized by overseas suppliers shall declare, withhold and pay taxes on behalf of overseas suppliers (hereafter referred to as Organizations, Individuals Withholding Paying On Behalf).

Income-paying organizations when withholding, paying personal income tax on behalf, use the registered tax codes to declare, pay withheld personal income tax.

(8) Operators, joint operators, joint ventures, organizations assigned by the Government of Vietnam to receive Vietnam’s share from overlapping oil and gas resources, contractors, and investors involved in petroleum contracts, parent companies - Vietnam National Oil and Gas Group representing the host country receiving shared profits from petroleum contracts.

(9) Households, individuals conducting production, business activities in goods, services under regulatory laws but not required to register household businesses with the business registration office as stipulated by the Government of Vietnam on household business, business individuals from countries sharing a terrestrial border with Vietnam conducting the purchase, sale, exchange of goods in border markets, border gate markets, markets within economic zones.

(10) Individuals with income subject to personal income tax (excluding business individuals).

(11) Individuals classified as dependents in accordance with personal income tax legislation.

(12) Organizations, individuals commissioned by tax authorities for collection.

(13) Other organizations, households, and individuals having obligations to the state budget.

What does the first-time tax registration application include for taxpayers register tax directly with tax authorities in Vietnam?

According to Article 31 of Tax Administration Law 2019, the first-time tax registration application includes:

(1) A taxpayer who is an organization registering directly with tax authorities should include:

- tax registration declaration form;

- A copy of the establishment and operation license, establishment decision, investment registration certificate, or other equivalent documents issued by the competent authority that is still valid;

- Other relevant documents.

(2) A taxpayer who is a household, business household, or individual registering directly with tax authorities should include:

- tax registration declaration form or tax declaration form;

- A copy of the identity card, a copy of the citizenship identification card, or a copy of the passport;

- Other relevant documents.