How to search for the latest 2024 EVN electronic electricity bills in Vietnam?

What is an electronic electricity bill in Vietnam?

According to Clause 2, Article 3 of Decree 123/2020/ND-CP, an e-invoice is defined as an invoice with or without a tax authority code, presented in an electronic data format, issued by organizations or individuals selling goods or providing services by electronic means to record the sale and provision of goods or services in accordance with accounting and tax laws. This also includes invoices generated from cash registers connected to electronic data transmission with tax authorities.

From this regulation, an electronic electricity bill can be understood as an e-invoice issued to record information on the provision of electricity services. An electronic electricity bill will include information about the seller (electricity provider), the buyer (electricity customer), information on electricity usage, unit price, and the total payment amount.

How to search for the latest 2024 EVN electronic electricity bills in Vietnam?

Based on the guidance on searching electricity bills from the Vietnam Electricity Group (EVN), the following steps should be performed to search for electricity bills:

- Step 1: Access the address http://cskh.npc.com.vn

- Step 2: On the homepage, click “LOGIN” at the top right corner.

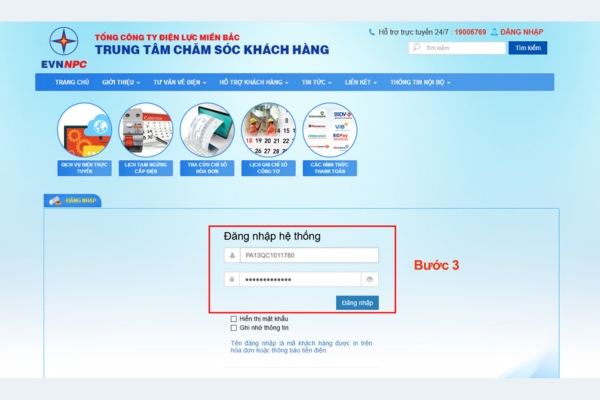

- Step 3: The screen will display a login request. Enter account information in the two fields as shown in the image, then click login.

Where:

+ Username: Customer code

+ Password: Customer code

The customer code is printed on the invoice or electricity payment notice.

- Step 4: Choose login

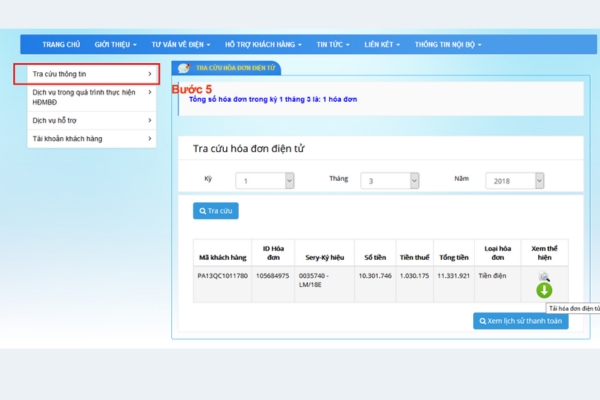

- Step 5: After successful login, the screen will display the customer’s personal information page. Click on “Search Information”

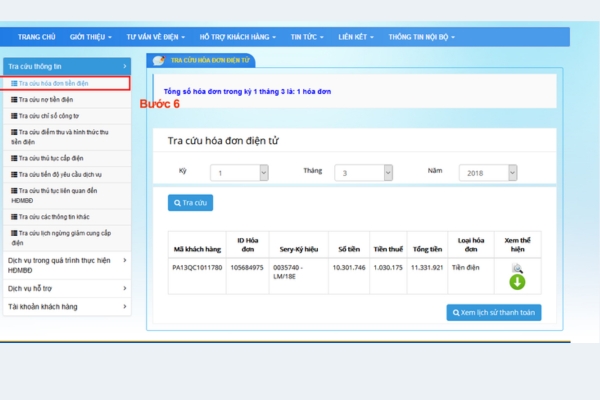

- Step 6: Click on “Search for Electricity Bills”

The screen will then display as follows (with the most recent billing period).

* Note:

- Customers can print or download the e-invoice by following these steps:

+ Click the magnifying glass icon to "VIEW AND PRINT e-invoice," then click the “PRINT INVOICE INFORMATION” button or the blue arrow icon to DOWNLOAD the INVOICE.

- To view invoices from previous months, customers need to enter the necessary period/month/year information and click search, then the screen will display the invoice for the month desired.

- To view payment history, customers need to click on the "View Payment History" button.

Information is for reference purposes only.

How to search for the latest 2024 EVN electronic electricity bills in Vietnam? (Image from the Internet)

What is the application of e-invoices in sales and service provision in Vietnam?

According to the provisions of Article 91 of the Law on Tax Administration 2019, the application of e-invoices in sales and service provision is conducted as follows:

- Enterprises and economic organizations use e-invoices with tax authority codes when selling goods or providing services, regardless of the value of each transaction, except as specified in Clause 2 and Clause 4 of Article 91 of the Law on Tax Administration 2019.

- Businesses operating in electricity, petroleum, postal and telecommunications, clean water, financial credit, insurance, healthcare, e-commerce, supermarkets, trade, air, road, railway, sea, and waterway transport sectors, and businesses and economic organizations that have conducted or will conduct electronic transactions with tax authorities, have built IT infrastructure, possess accounting software, and e-invoice software that meets the requirements for issuing, retrieving, and storing e-invoice data as regulated, ensuring the transmission of e-invoice data to buyers and tax authorities, may use e-invoices without tax authority codes when selling goods or providing services, regardless of the transaction value, except in cases of high tax risk as prescribed by the Minister of Finance and cases registered to use e-invoices with tax authority codes.

- Business households and individuals under the provisions of Clause 5, Article 51 of the Law on Tax Administration 2019 and cases where revenue identification requires utilizing e-invoices with tax authority codes when selling goods or providing services.

- Business households and individuals not meeting the conditions of utilizing e-invoices with tax authority codes but need an invoice to deliver to customers, or cases where businesses, economic organizations, or other organizations approved by tax authorities are issued e-invoices to deliver to customers, shall be issued e-invoices with codes on each occurrence and must declare and pay taxes before the tax authorities issue e-invoices on each occurrence.