How to search for a TIN online using the citizen ID card of Vietnam?

How to search for a TIN online using the citizen ID card of Vietnam?

Currently, to search for a TIN online using an citizen ID card, two main methods can be utilized as follows:

(1) Method 1: Search for a TIN on the General Department of Taxation's website:

The process of searching for a TIN online using an citizen ID card is carried out in the following steps:

- Step 1: Access the General Department of Taxation's Information page at http://tracuunnt.gdt.gov.vn/tcnnt/mstcn.jsp

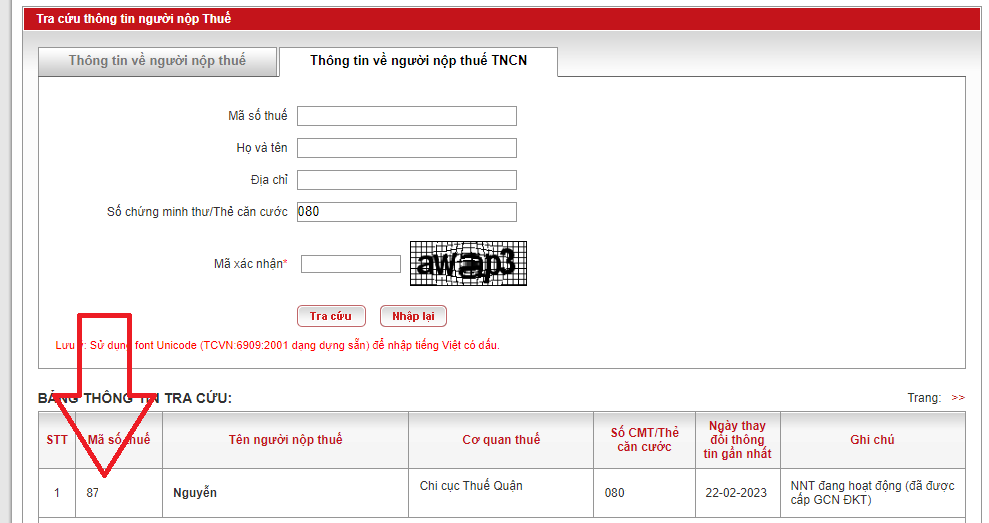

- Step 2: Click on the section "Personal Income Taxpayer Information", enter your citizen ID card number, verification code, and then click "Search":

- Step 3: The system will display the TIN. The information obtained when searching for a TIN includes:

+ TIN

+ Full name of the taxpayer

+ Tax authority: Where the individual pays tax.

+ ID/citizen ID card number is the ID/CCCD number of the taxpayer

+ Most recent information change date: The date the individual was issued a TIN

+ Operational status.

(2) Method 2: Search for a TIN on the Electronic Taxation website

The process of searching for a TIN online using an citizen ID card is carried out in the following steps:

- Step 1: Visit the Electronic Taxation website at https://thuedientu.gdt.gov.vn and select "Individual"

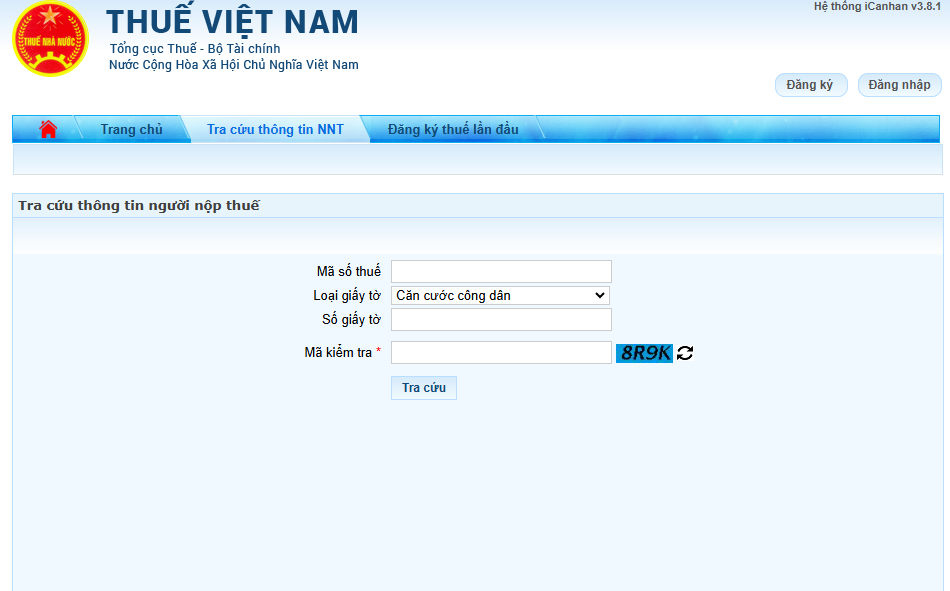

- Step 2: On the Vietnam Tax page, select the "Taxpayer Information Search" button and enter the following details:

+ Document type: "citizen ID card/Citizen ID (citizen ID card)";

+ Verification code: Enter the exact 4-character sequence in the right-hand side box

Then select "Search" to view results.

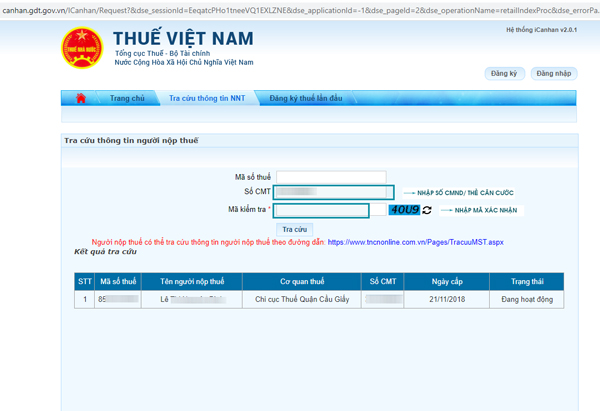

- Step 3: Receive search results. The system will return search results for the TIN, including information such as:

+ Personal taxpayer TIN

+ Full name of the taxpayer

+ Tax authority: Where the individual pays tax

+ Taxpayer's ID number

+ Issuance date: The issuance date of the TIN.

+ Status: TIN operational status of the taxpayer.

Note:

If the individual has not yet incurred personal income tax obligations, no information about the TIN will appear. A TIN is only issued when the individual has paid taxes for the first time.

Additionally, TINs can also be searched using an citizen ID card on the following websites:

+ Law Library website at: https://thuvienphapluat.vn/ma-so-thue;

+ TracuuMST website at: https://tracuumst.com

+ Masothue website at: https://masothue.com

How to search for a TIN online using the latest citizen ID card of Vietnam? (Image from Internet)

What are regulations on the issuance of TINs in Vietnam?

According to Clause 3, Article 30 of the Law on Tax Administration 2019, the issuance of a TIN is regulated as follows:

Subject to taxpayer registration and TIN issuance

...

- The structure of the TIN is regulated as follows:

a) A 10-digit TIN is used for enterprises, organizations with legal status; representatives of households, business households, and other individuals;

b) A 13-digit TIN and other characters are used for dependent units and other subjects;

c) The Minister of Finance details this clause.

3. Issuance of TINs is regulated as follows:

a) Enterprises, economic organizations, and other organizations are issued a single TIN to be used throughout the course of their operations, from taxpayer registration until termination of the TIN's validity. Taxpayers with branches, representative offices, and subsidiaries directly fulfill tax obligations and are issued a dependent TIN. If enterprises, organizations, branches, representative offices, and subsidiaries register taxpayers under a one-stop interlinked mechanism with business registration, cooperative registration, or business registration, the number on the business registration certificate, cooperative registration certificate, business registration certificate simultaneously serves as the TIN;

b) Individuals are issued a single TIN to be used throughout their lifetime. Dependents of individuals are issued a TIN to reduce deductions for personal income taxpayers. The TIN issued to dependents is simultaneously the individual's TIN when dependents incur obligations to the state budget;

c) Enterprises, organizations, or individuals responsible for withholding and paying taxes on behalf of others are issued a substitute TIN for tax declaration and payment on behalf of the taxpayer;

d) An issued TIN cannot be reused for another taxpayer;

dd) The TIN of enterprises, economic organizations, or other organizations remains unchanged after changes in their form, sales, donations, gifts, or inheritances;

e) The TIN issued to households, business households, and business individuals is issued to the individual who represents the household, business household, or business individual.

...

From the above regulation, the issuance of TINs is implemented as follows:

- An individual is issued a single TIN to use throughout their lifetime. Dependents of individuals are issued a TIN to reduce deductions for personal income taxpayers. The TIN issued to dependents is simultaneously the individual’s TIN when dependents incur obligations to the state budget;

- Individuals responsible for withholding and paying taxes on behalf of others are issued a substitute TIN for tax declaration and payment on behalf of the taxpayer;

- An issued TIN cannot be reused for another taxpayer;

- The TIN issued to business individuals is the TIN issued to the individual representing the business individual.

What does the TIN registration dossier include?

According to Clause 3, Article 31 of the Law on Tax Administration 2019, the taxpayer registration dossier for individuals registering directly with the tax authority includes:

- Taxpayer registration declaration or tax declaration;

- A copy of the identity card, copy of the citizen citizen ID card, or a copy of the passport;

- Other relevant documents.