How to prepare form 01/GTGT on VAT declaration for taxes declared quarterly and monthly on the HTKK in Vietnam?

How to prepare form 01/GTGT on VAT declarations for taxes declared quarterly and monthly on the HTKK in Vietnam?

Step 1: Select the VAT declaration form

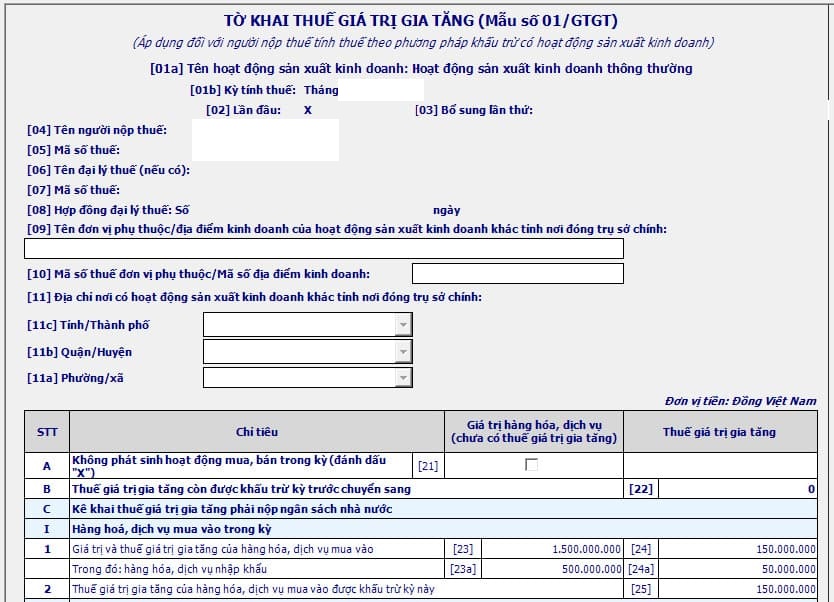

Log into the HTKK software => Select: "Value Added Tax" => Select: “VAT Declaration Form (01/GTGT)(TT80/2021)”

Step 2: Select the tax period:

On the Select Tax Period tab, the taxpayer chooses as follows:

- Select the place to submit the VAT declaration:

The software will automatically display according to the initial information declared by the enterprise on the HTKK software (can be edited).

- Choose the VAT declaration period on a monthly or quarterly basis:

Taxpayers may declare VAT quarterly if they meet the following conditions:

+ Enterprises subject to monthly VAT declaration can declare VAT quarterly if their total turnover of goods and service provision in the preceding year does not exceed 50 billion VND. This turnover is determined as the total from all VAT declarations for the calendar year.

If taxpayers declare taxes centrally at the headquarters for dependent units or business locations, the turnover includes the revenue of those units and locations.

+ New enterprises starting operations and business can choose to declare VAT quarterly. After operating for 12 months, from the following calendar year, they shall determine the basis for declaring VAT monthly or quarterly based on the revenue of the preceding calendar year (of 12 months).

=> If the enterprise does not meet the above conditions, it falls into the category of monthly VAT declaration.

Note:

+ Taxpayers are responsible for self-determining whether they belong to the quarterly declaration category to comply accordingly.

+ Taxpayers eligible for quarterly declaration can opt for a stable monthly or quarterly declaration for the entire calendar year.

- Choose the declaration status as "First time" or "Supplementary":

Check “First time Declaration” if this is the first time the enterprise is filing the VAT declaration for the tax period.

In case the taxpayer discovers errors in the initially filed tax return, they should file a supplementary declaration, numbered sequentially for each filing.

Note: From the time the eTax system accepts the initial tax declaration, all subsequent declarations for the same tax period and business activity are considered “Supplementary”. Enterprises must submit the “Supplementary” declarations following the supplementary filing regulations.

- Choose the business category:

The software defaults to selecting "General business activity".

If the enterprise is declaring VAT for other activities listed below, they should choose accordingly:

+ Lottery, computer lottery activities.

+ Oil and gas exploration.

+ Investment projects in infrastructure, and housing for transfer to other provinces.

+ Electricity production plants located in provinces different from the headquarters.

Note: If a taxpayer is engaged in multiple business activities, they must file multiple tax declarations, each corresponding to one business activity based on the tax information.

- Choose annexes attached to the declaration (if any):

If your enterprise engages in activities related to the following annexes, select them for declaration:

+ Annex for the allocation table for VAT to localities entitled to revenue from hydropower production as per form 01-2/GTGT attached in Appendix II of Circular 80/2021/TT-BTC.

+ Annex for the allocation table for VAT to localities entitled to revenue from computerized lottery operations as per form 01-3/GTGT attached in Appendix II of Circular 80/2021/TT-BTC.

+ VAT allocation annex for localities entitled to revenue (excluding hydropower production and computerized lottery operations) as per form 01-6/GTGT attached in Appendix II of Circular 80/2021/TT-BTC.

+ Annex “PL_GiamThue_GTGT_23_24” to declare goods and services with reduced VAT for the first 6 months of 2024: If your company has transactions subject to VAT reduction during quarter 1/2024 or quarter 2/2024, under Decree 94/2023/ND-CP as per Resolution 110/2023/QH15, select additional annex “PL_GiamThue_GTGT_23_24” to declare reduced VAT transactions.

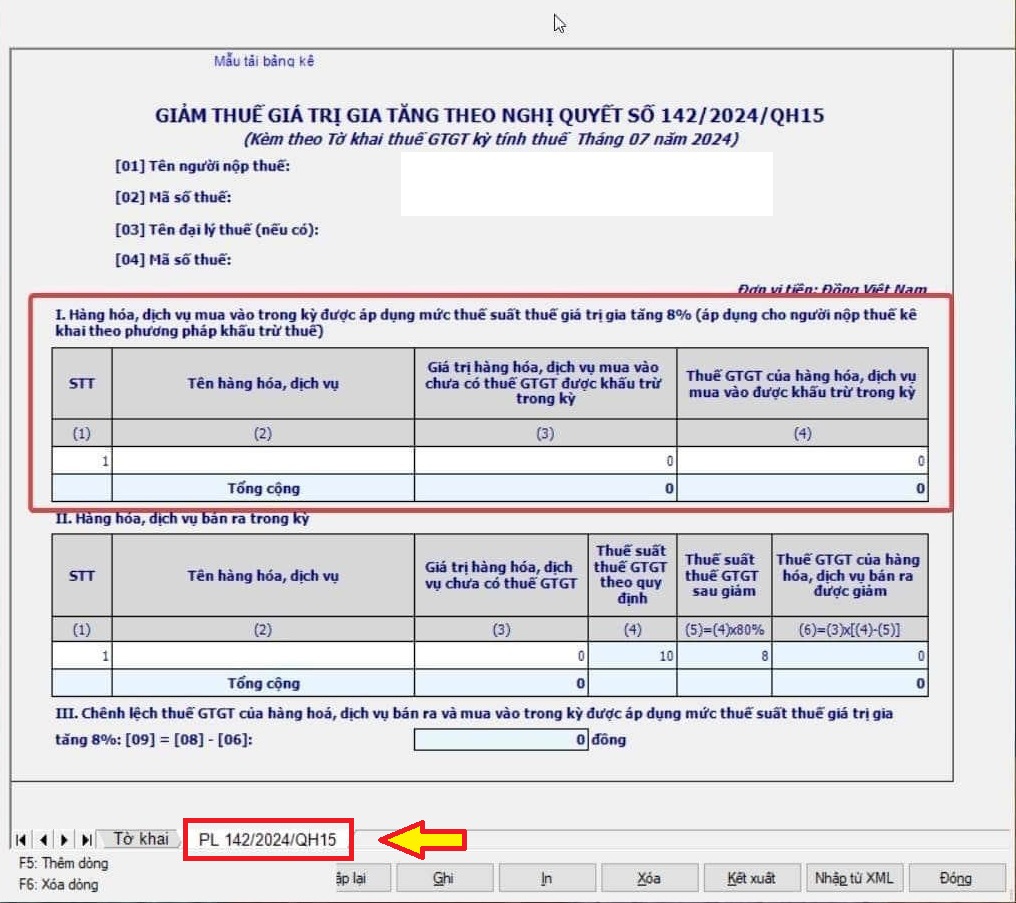

+ Annex “PL 142/2024/QH15” to declare goods and services with reduced VAT for the last 6 months of 2024:

If your company has transactions of goods and services sold with reduced VAT during Q3/2024, Q4/2024 (for quarterly filers) or from July to December/2024 (for monthly filers) under Decree 72/2024/ND-CP as per Resolution 142/2024/QH15, select additional annex “PL 142/2024/QH15” for declaring output transactions with reduced VAT to 8%.

Note: The software version HTKK 5.2.2 updated on August 16, 2024, includes annex “PL 142/2024/QH15”.

- Click "OK" for HTKK software to display VAT declaration form 01/GTGT.

- To declare the VAT reduction annex according to Resolution 142/2024/QH15, the taxpayer selects as follows:

How to prepare form 01/GTGT on VAT declaration for taxes declared quarterly and monthly on the HTKK in Vietnam? (Image from Internet)

What goods and services are not subject to VAT reduction in Vietnam in 2024?

Article 1 of Decree 72/2024/ND-CP provides for VAT reduction for groups of goods and services currently subject to a 10% tax rate, except for the following:

- Telecommunications, financial, banking, securities, insurance activities, real estate business, metals and fabricated metal products, and mineral products (excluding coal mining), coke, refined petroleum, chemical products.

Details in Appendix I attached to Decree 72/2024/ND-CP.

- Goods and services subject to special consumption tax.

Details in Appendix II attached to Decree 72/2024/ND-CP.

- Information technology as prescribed by the law on information technology.

Details in Appendix III attached to Decree 72/2024/ND-CP.

- Implementation of VAT reduction for each type of goods and services specified in Clause 1 Article 1 of Decree 72/2024/ND-CP is uniformly applied at stages of import, production, processing, and trade. For coal products mined and sold (including where coal is mined and later screened, classified, and then sold in a closed process), the reduction of VAT applies. Coal is included in Appendix I attached to Decree 72/2024/ND-CP, with no VAT reduction applied at stages other than mining and selling.

Corporations and economic groups conducting closed-process sales are also subject to VAT reduction for mined coal sold.

If the goods and services specified in Appendices I, II, and III attached to Decree 72/2024/ND-CP fall under the non-VAT or 5% VAT subject as prescribed in the Law on VAT, they follow the Law on VAT and are not eligible for VAT reduction.

What are deadlines for submitting VAT declarations for taxes declared quarterly and monthly?

According to point a, clause 1, point a, clause 4, Article 8 of Decree 126/2020/ND-CP:

Taxes declared monthly, quarterly, annually, per occurrence, and tax finalization:

1. Taxes and other payments administered by the tax authority subject to monthly declaration include:

a) VAT, personal income tax. Taxpayers meeting criteria under Article 9 of this Decree may opt for quarterly declaration.

b) Special consumption tax.

c) Environmental protection tax.

d) Natural resources tax, except for the cases specified in point e of this clause.

...

4. Taxes and other payments administered by the tax authority declared per occurrence include:

a) VAT for taxpayers under clause 3, Article 7 of this Decree or taxpayers declaring VAT by direct method and incurring VAT liabilities from real estate transactions.

...

VAT can be declared monthly, quarterly, or per occurrence.

Article 44, clauses 1 and 3 of the Tax Administration Law 2019 stipulates:

Tax return filing deadline

1. The deadline for tax returns for taxes declared monthly or quarterly:

a) No later than the 20th day of the month following the taxable event for monthly filings;

b) No later than the last day of the first month of the quarter following the taxable event for quarterly filings.

...

3. The deadline for tax returns for taxes declared and paid per taxable event is no later than the 10th day from the taxable event.

...

Thus, for monthly VAT, the last filing day is the 20th day of the month following the taxable event, i.e., the 20th of every month.

For quarterly VAT, the last filing day is the last day of the first month of the quarter following the taxable event, i.e., the 30th or 31st of the first month of the subsequent quarter.