How to look up for customs tax debt in Vietnam? What are the regulations for locations of customs declaration registration in Vietnam?

How to look up for customs tax debt in Vietnam?

*Note that taxpayers can perform a customs tax debt check by following these steps:

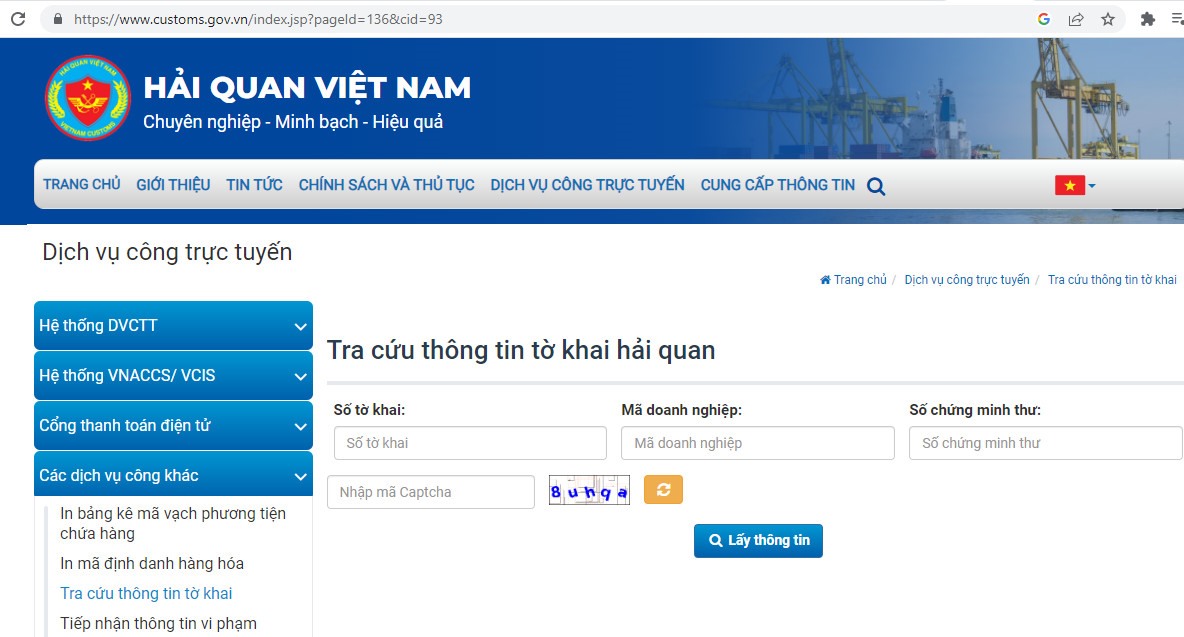

Step 1: Access the Vietnam General Department of Customs website:

Address: https://www.customs.gov.vn/

This is the official portal of the General Department of Customs, providing full online public services related to customs, including tax debt inquiry.

Step 2: Search for the "Tax Debt Enquiry" section

On the homepage of the General Department of Customs, you will easily find the "Tax Debt Enquiry" section or links leading to this service.

Typically, this section is located in the "Online Public Services" or "Other Public Services" parts.

Step 3: Enter the necessary information

When accessing the tax debt inquiry page, you will be required to input certain information for the system to determine the search results.

This information may include:

Tax code: This is the most crucial information to identify the business or individual.

Customs declaration number: If you have a specific declaration number, the search will be more accurate.

Declaration period: You can choose the time period you want to search.

Type of tax: If you know the type of tax you want to check (e.g., import tax, export tax, VAT), you can filter the results.

Step 4: Check the results

After entering all the required information and pressing the "Search" button, the system will display the search results.

The result will inform the taxpayer of details about any tax debt (if any), including the debt amount, payment term, type of tax, and other related information.

How to look up for customs tax debt in Vietnam? What are the regulations for locations of customs declaration registration in Vietnam? (Image from Internet)

How to look up for customs tax debt in Vietnam? What are the regulations for locations of customs declaration registration in Vietnam? (Image from Internet)

What are the regulations for locations of customs declaration registration in Vietnam?

Based on Article 19 of Circular 38/2015/TT-BTC stipulates as follows:

Registration of Customs Declarations

1. Locations for customs declaration registration

a) Exported goods are registered for customs declaration at the Customs Sub-department where the enterprise has its headquarters or production facility, or at the Customs Sub-department where the exported goods are gathered, or at the Customs Sub-department at the export gate;

b) Imported goods are registered for declaration at the Customs Sub-department at the gate where the goods storage area is managed, or at the port of destination stated in the bill of lading, transportation contract, or at the Customs Sub-department outside the gate where the enterprise has its headquarters or where the goods are delivered to;

c) For exported or imported goods under some specific forms, the location for customs declaration registration is carried out according to each corresponding type as stipulated in Decree No. 08/2015/ND-CP and guided in this Circular.

2. Checking the conditions for customs declaration registration

Information on the customs declaration is automatically checked by the System to evaluate the conditions for acceptance of registration. The contents include:

a) Conditions for implementing coercive measures, tax payment deadlines as prescribed, except for the following cases:

....

Accordingly, the locations for customs declaration registration are regulated as follows:

- Exported goods are registered for customs declarations at the Customs Sub-department where the enterprise has its headquarters or production facility, or at the Customs Sub-department where the exported goods are gathered, or at the Customs Sub-department at the export gate.

- Imported goods are registered for declaration at the Customs Sub-department at the gate where the goods storage area is managed, or at the port of destination recorded on the bill of lading, transportation contract, or at the Customs Sub-department outside the gate where the enterprise has its headquarters or where the goods are transferred to.

- For exported or imported goods under some specific forms, the location for customs declaration registration complies with each corresponding type as stipulated.

Vietnam: Can customs declarants amend customs declaration dossiers if errors are found?

Based on Article 20 of Circular 38/2015/TT-BTC as amended by Clause 9 Article 1 of Circular 39/2018/TT-BTC which regulates cases of supplementary declaration as follows:

Supplementary Declaration of Customs Dossiers

Cases of supplementary declaration:

a) Customs declarants can make a supplementary declaration for customs dossiers after the System channels the declaration but before the customs authority performs direct examination of the customs dossier;

b) Customs declarants, taxpayers identifying errors in customs declaration may make a supplementary declaration within 60 days from the date of clearance but before the point at which the customs authority decides post-clearance audit or inspection;

c) If customs declarants or taxpayers discover errors in the customs declaration after the customs authority has checked the dossier, checked the goods in reality but before clearance, they must make a supplementary declaration and be handled in accordance with tax law and administrative violation handling law;

d) Beyond the 60 days limit from the clearance date or after the customs authority decides post-clearance audit or inspection, if the customs declarants or taxpayers discover errors in customs declaration, they must make a supplementary declaration and be handled as per tax law and administrative violation handling law;

dd) Customs declarants conduct supplementary declarations upon the request of the customs authority when checking dossiers, checking actual goods and are handled as per tax law and administrative violation handling law.

....

Therefore, customs declarants who recognize errors in customs declarations can make a supplementary declaration within 60 days from the clearance date but before the customs authority decides on post-clearance audit or inspection.