How to look up business lines using TIN in Vietnam? What are regulations on applying for taxpayer registration and TIN issuance in Vietnam?

How to look up business lines using TIN in Vietnam?

The process to look up business lines using a TIN is as follows:

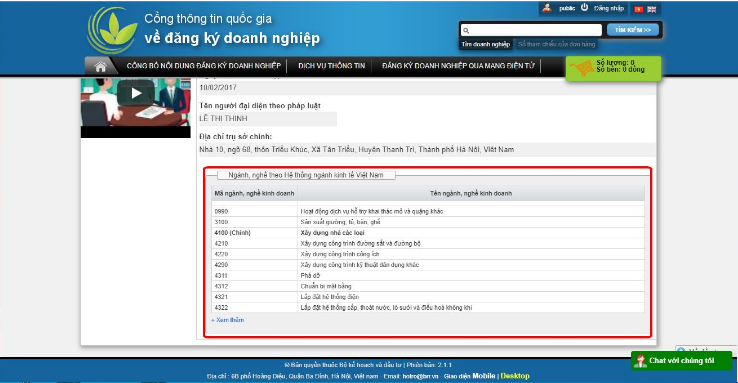

Step 1: Access the website: National Business Registration Portal. (The homepage of the National Business Registration Portal website will appear as shown below).

Step 2: Enter the business TIN or the full name of the company you need to look up in the search box as shown below

Step 3: Upon entering the correct information, the search results will display some basic information of the business such as:

[1] Business name;

[2] Business name written in a foreign language;

[3] Abbreviated business name;

[4] Operational status;

[5] Legal form (type of business);

[6] Full name of the legal representative;

[7] Establishment date, head office address, company seal, and business lines.

*Note: Information on how to look up business lines using TIN is for reference only./.

How to look up business lines using TIN in Vietnam? What are regulations on applying for taxpayer registration and TIN issuance in Vietnam? (Image from the Internet)

What are regulations on applying for taxpayer registration and TIN issuance?

According to the provisions at point a clause 3 Article 30 Law on Tax Administration 2019, the regulation on TIN issuance is as follows:

Applying for taxpayer registration and TIN issuance

1. Taxpayers must carry out taxpayer registration and are issued a TIN by the tax authority before starting production, business activities, or incurring obligations to the state budget. Taxpayer registration subjects include:

a) Enterprises, organizations, and individuals that perform taxpayer registration through a one-stop-shop mechanism, along with enterprise registration, cooperative registration, business registration as stipulated by the Law on Enterprises and other relevant legal regulations;

b) Organizations and individuals not covered by point a of this clause perform taxpayer registration directly with the tax authority according to regulations of the Minister of Finance.

2. The structure of the TIN is defined as follows:

a) A 10-digit TIN is used for enterprises, organizations with legal entity status; representatives of households, business households, and other individuals;

b) A 13-digit and character TIN is used for dependent units and other subjects;

c) The Minister of Finance provides detailed regulations on this clause.

3. TIN issuance is regulated as follows:

a) Enterprises, economic organizations, and other organizations are issued a single TIN to use throughout the operation from taxpayer registration until the TIN becomes ineffective. Taxpayers with branches, representative offices, and direct dependent units fulfilling tax obligations are issued a dependent TIN. In case enterprises, organizations, branches, representative offices, and dependent units perform taxpayer registration through a one-stop-shop mechanism along with enterprise registration, cooperative registration, business registration, the number recorded on the enterprise registration certificate, cooperative registration certificate, business registration certificate is simultaneously the TIN;

b) Individuals are issued a single TIN to use throughout their lifetime. Dependents of individuals are issued a TIN for personal income tax relief. The TIN issued for dependents simultaneously serves as the individual’s TIN when the dependent incurs obligations to the state budget;

c) Enterprises, organizations, and individuals responsible for withholding and paying tax on behalf of others are issued a substitute TIN to carry out the declaration and payment of tax on behalf of taxpayers;

d) Issued TINs may not be reused to issue to other taxpayers;

dd) TINs of enterprises, economic organizations, and other organizations after conversion, sale, donation, gifting, inheritance are retained;

e) TINs issued to households, business households, and individual businesses are the TINs issued to the personal representative of the household, business household, individual business.

4. Tax registration includes:

a) Initial tax registration;

b) Notification of changes in taxpayer registration information;

c) Notification of temporary cessation of activities, business;

d) Termination of TIN validity;

dd) Restoration of TIN.

Thus, taxpayer registration and TIN issuance include:

- Taxpayers must carry out taxpayer registration and are issued a TIN by the tax agency before starting production, business activities, or incurring obligations to the state budget. Taxpayer registration subjects include:

+ Enterprises, organizations, and individuals that perform taxpayer registration through a one-stop-shop mechanism, along with enterprise registration, cooperative registration, business registration as stipulated by the Law on Enterprises and other relevant legal regulations;

+ Organizations and individuals not covered by point a of this clause perform taxpayer registration directly with the tax authority according to regulations of the Minister of Finance.

What are regulations on the use of TIN in Vietnam?

According to Article 35 Law on Tax Administration 2019, the regulation on the use of TINs is as follows:

- Taxpayers must enter the issued TIN on invoices, documents, and records when conducting business transactions; opening deposit accounts at commercial banks, other credit institutions; declaring tax, paying tax, tax exemption, tax reduction, tax refund, non-tax collection, registering customs declarations, and performing other tax transactions for all obligations owed to the state budget, including cases where taxpayers engage in production, business activities in multiple locations.

- Taxpayers must provide the TIN to relevant agencies, organizations or enter the TIN on records when performing administrative procedures through a one-stop-shop mechanism with tax management agencies.

- Tax management agencies, the State Treasury, commercial banks coordinating in state budget collection, and organizations authorized by tax agencies to collect tax use the taxpayer’s TIN in tax management and tax collection for the state budget.

- Commercial banks, other credit institutions must enter the TIN in account opening records and in transaction documents through taxpayers' accounts.