How to handle errors when HTKK notifies incorrect declaration in Vietnam?

How to handle errors when HTKK notifies incorrect declaration in Vietnam?

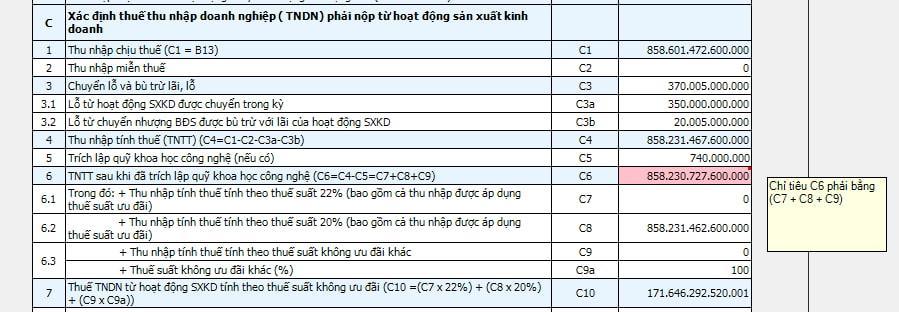

According to the instructions from the General Department of Taxation when using HTKK, if there is an incorrect declaration, the system will notify an error, and all incorrect declaration fields will display with a pink background and a red mark at the top right corner. When hovering over this red mark, the system will automatically display the error content and guidance for correction.

The system will automatically jump to the first error field. Below is an example of an error notification.

Taxpayers should follow these steps to correct errors:

Step 1: Hover over the red mark to have the system display the error content and guidance for correction.

Step 2: Make the necessary corrections and press F1 if detailed guidance is needed for this declaration field.

Step 3: Press the "Save" or "Print" or "Export" button for the system to re-check the data after correction.

Step 4: Repeat steps 1 to 3 until the system no longer shows any error notifications.

How to handle errors when HTKK notifies incorrect declaration in Vietnam? (Image from the Internet)

What are principles of tax administration in Vietnam according to the Law on Tax Administration?

As stipulated in Article 5 of the Law on Tax Administration 2019, the following principles are outlined:

- All organizations, households, business households, and individuals are obligated to pay taxes according to the law's regulations.

- tax administration agencies and other state agencies tasked with administration must execute tax administration in accordance with this Law and other relevant laws, ensuring transparency, equality, and the protection of the legal rights and benefits of taxpayers.

- Agencies, organizations, and individuals have the responsibility to participate in tax administration as prescribed by law.

- Implement administrative reforms and apply modern information technology in tax administration; apply tax administration principles according to international practices, including the principle that the nature of transactions determines tax obligations, principles of risk management in tax administration, and other principles suitable to Vietnam's conditions.

- Implement preferential measures when carrying out tax procedures for import and export goods according to customs law and the regulations of the Government of Vietnam.

What are prohibited acts in tax administration in Vietnam?

As provided for in Article 6 of the Law on Tax Administration 2019, the following acts are prohibited in tax administration:

- Collusion, linkage, or cover-up between taxpayers and tax administration officials or tax administration agencies to transfer pricing or evade taxes.

- Harassment or causing trouble for taxpayers.

- Appropriating or unlawfully using tax money.

- Deliberately not declaring or improperly, incompletely, promptly, and accurately declaring tax liabilities.

- Obstructing tax administration officials from performing official duties.

- Using another taxpayer’s tax identification number to commit illegal acts or allowing others to use one's tax identification number contrary to the law.

- Selling goods, providing services without issuing invoices according to the law, using illegal invoices, and using invoices unlawfully.

- Tampering, misusing, unauthorized access, or destruction of taxpayers' information systems.

What is a Tax File According to the Law on Tax Administration?

Based on Article 3 of the Law on Tax Administration 2019, it is defined as follows:

Definitions

...

- A tax identification number is a sequence of 10 or 13 digits and other characters issued by the tax authority to the taxpayer for tax administration purposes.

- A tax period is the duration for determining the amount of tax payable to the state budget as established by tax law.

- A tax declaration is a form document set by the Minister of Finance used by taxpayers to declare information for determining the payable tax amount.

- A customs declaration is a form document prescribed by the Minister of Finance used for tax declaration on import and export goods.

- Tax files include taxpayer registration files, tax declarations, tax refunds, tax exemptions, reductions, exemptions from late payment penalties, deferrals, installment payments of tax arrears, non-collection of tax; customs files; files for tax debt categorization; files for tax debt cancellation, late payment penalties, and fines.

- Tax finalization declaration is the process of determining the amount of tax payable for the tax year or from the beginning of the tax year until termination of activities giving rise to tax obligations or from the time of incurrence until termination of activities giving rise to tax obligations as stipulated by law.

Tax files are understood to include the following:

- Taxpayer registration files, tax declarations, tax refunds, tax exemptions, reductions, exemptions from late payment penalties, no late payment charges, tax payment deferral, installment payments of tax debt, non-collection of tax;

- Customs files;

- Files for debt categorization;

- Files for tax debt cancellation, late payment charges, and fines.