How to fill out the personal income tax declaration for securities transfer in Vietnam? Which income is exempted from personal income tax?

How to download the personal income tax declaration for securities transfer in Vietnam?

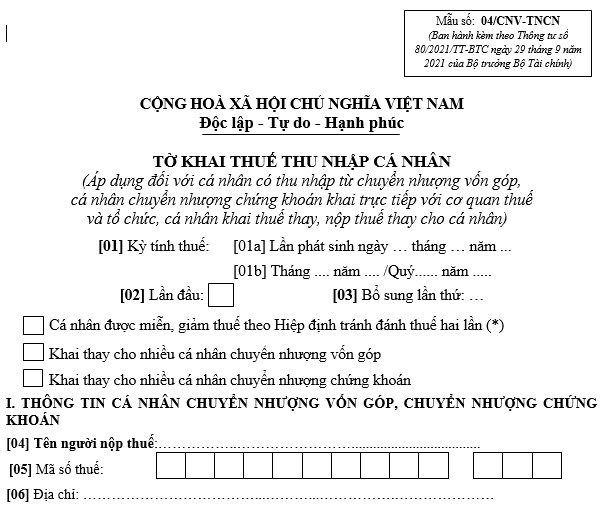

Based on Appendix 2 issued with Circular 80/2021/TT-BTC which stipulates the form for personal income tax declaration by individuals directly declaring securities transfer with tax authorities as Form No. 04/CNV-TNCN as follows:

Form No. 04/CNV-TNCN... Download

How to Fill Out the personal income tax declaration for securities transfer?

Below is the guide to filling out the personal income tax declaration by individuals directly declaring securities transfer with tax authorities as follows:

[01] Tax calculation period:

Enter the tax calculation period (in the format of year or month/year, for example: "2024" or "01/2024").

[02] First time:

Mark an X in this box if this is the first tax declaration for the tax calculation period.

[04] Name of the taxpayer:

Enter the full name of the individual or organization responsible for paying the tax.

[05] Tax code:

Enter the tax code issued to the taxpayer.

[06] Address:

Enter the detailed contact address of the taxpayer (including house number, street, ward/commune, district).

[07] District:

Enter the name of the district where the taxpayer resides or registers business.

[08] Province/City:

Enter the name of the province or centrally-administered city where the taxpayer resides or has headquarters.

[09] Phone:

Enter the accurate contact phone number of the taxpayer.

[10] Fax:

Enter the fax number (if available). If not available, leave it blank.

[11] Email:

Enter the official email address of the taxpayer for the tax authority to contact when necessary.

[12] Name of entity or individual declaring on behalf (if any):

If there is an entity or individual declaring on behalf, enter the name of that entity or individual.

[13] Tax code:

Enter the tax code of the entity or individual declaring on behalf (if any).

[14] Address:

Enter the contact address of the entity or individual declaring on behalf.

[15] District:

Enter the name of the district where the entity or individual declaring on behalf operates or resides.

[16] Province/City:

Enter the name of the province or city of the entity or individual declaring on behalf.

[17] Phone:

Enter the contact phone number of the entity or individual declaring on behalf.

[18] Fax:

Enter the fax number of the entity or individual declaring on behalf (if any).

[19] Email:

Enter the email address of the entity or individual declaring on behalf so the tax authority can contact.

[20] Name of tax agent (if any):

If using a tax agent service, enter the name of the tax agent in this section.

[21] Tax code:

Enter the tax code of the tax agent (if any).

[22] Tax agent contract:

Record the tax agent contract number that has been signed between the taxpayer and the tax agent.

Note: Information on how to fill out the personal income tax declaration for securities transfer is for reference only!

How to fill out the personal income tax declaration for securities transfer in Vietnam? Which income is exempted from personal income tax? (Image from the Internet)

Which income is exempt from personal income tax in Vietnam?

According to Article 4 of the Personal Income Tax Law 2007 as supplemented by Clause 3, Article 2 of the Law on amending Tax Laws 2014 and amended by Clause 2, Article 1 of the Amended Personal Income Tax Law 2012, the following personal incomes are exempt from personal income tax:

- Income from the transfer of real estate between spouses; biological parents and children; adoptive parents and adopted children; parents-in-law and daughters-in-law; parents-in-law and sons-in-law; paternal grandparents and grandchildren; maternal grandparents and grandchildren; siblings.

- Income from the transfer of residential houses, homestead land ownership, and assets attached to homestead land of individuals in the case where they own only one residential house or homestead land.

- Income from the value of land use rights assigned by the State to individuals.

- Income from inheritance or gifts which are real estate between spouses; biological parents and children; adoptive parents and adopted children; parents-in-law and daughters-in-law; parents-in-law and sons-in-law; paternal grandparents and grandchildren; maternal grandparents and grandchildren; siblings.

- Income of households and individuals directly involved in agricultural production, forestry, salt-making, aquaculture that is not processed into other products or only undergoes simple processing.

- Income from the conversion of agricultural land by households and individuals assigned by the State for production.

- Income from interest on deposits at credit institutions, interest from life insurance contracts.

- Income from remittances.

- Night shift or overtime pay that is higher than day shift or regular working hours pay as stipulated by law.

- Pension paid by the Social Insurance Fund; pension paid monthly by voluntary pension fund.

- Income from scholarships, including:

+ Scholarships granted from the state budget;

+ Scholarships granted by domestic and foreign organizations under their scholarship support programs.

- Income from indemnities for life insurance, non-life insurance contracts, labor accident compensations, state compensations, and other compensations as regulated by law.

- Income received from charitable funds allowed to be established or recognized by competent state authorities for charitable, humanitarian purposes, not for profit.

- Income received from foreign aid for charitable or humanitarian purposes in the form of governmental and non-governmental organizations approved by competent state authorities.

- Income from wages, salaries of Vietnamese crew members working for foreign shipping companies or Vietnamese shipping companies in international transport.

- Income of individuals who are ship owners or possessors, and individuals working on ships from providing goods and services directly serving offshore fishing activities.