How to fill out the latest application form for conversion from monthly declaration to quarterly declaration of taxes in Vietnam?

How to fill out the latest application form for conversion from monthly declaration to quarterly declaration of taxes in Vietnam?

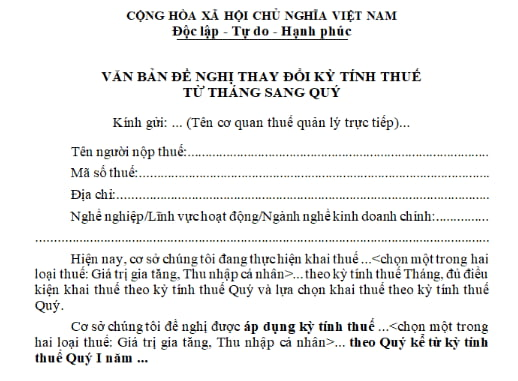

The application form for conversion from monthly declaration to quarterly declaration of taxes is Form 01/DK-TDKTT Appendix 2 issued along with Circular 80/2021/TT-BTC as follows:

>> Download Form 01/DK-TDKTT for conversion from monthly declaration to quarterly declaration of taxes: Download

How to fill out the latest application form for conversion from monthly declaration to quarterly declaration of taxes:

Name of taxpayer: fill in the name of the individual or organization

Tax Identification Number: fill in the tax identification number of the individual or organization

Address: The address of the individual or organization should match the address in the taxpayer registration information

Occupation/Field of Activity/Main Business Line: Provide the correct Occupation/Field of Activity/Main Business Line based on the taxpayer registration information

How to fill out the latest application form for conversion from monthly declaration to quarterly declaration of taxes in Vietnam? (Image from the Internet)

What should taxpayers do when changing their taxpayer registration information in Vietnam?

According to Article 36 of the 2019 Law on Tax Administration on this matter as follows:

- Taxpayers who register for taxpayer registration along with business registration, cooperative registration, or business licensing must notify the changes in their taxpayer registration information together with the changes in their business registration, cooperative registration, or business licensing according to the provisions of law.

In cases where taxpayers change their headquarters' address resulting in a change of tax authority, they must complete the tax procedures with the current tax authority before registering the change of information with the business registration, cooperative registration, or business licensing authority.

- Taxpayers who register for taxpayer registration directly with the tax authority must notify the tax authority of any changes in taxpayer registration information within 10 working days from the date of the change.

- For individuals who authorize organizations or individuals that pay income to them to register changes in taxpayer registration information, they must notify the organization or individual paying the income no later than 10 working days from the date of the change; the organization or individual paying the income is responsible for notifying the tax authority no later than 10 working days from the date of receiving the authorization.

When are the deadlines for tax payments declared monthly and quarterly in Vietnam?

According to Clause 1, Article 55 of the 2019 Law on Tax Administration, where the taxpayer calculates the tax, the deadline for tax payment is the last day of the tax declaration filing deadline.

According to Article 8 of the Decree 126/2020/ND-CP regarding taxes declared monthly, quarterly, annually, per occurrence of tax obligation, and tax finalization as follows:

Types of taxes declared monthly, quarterly, annually, per occurrence of tax obligation, and tax finalization

1. Types of taxes and other revenues belonging to the state budget managed by the tax authority and declared monthly include:

a) Value-added tax, personal income tax. In cases where taxpayers meet the criteria specified in Article 9 of this Decree, they may choose to declare quarterly.

....

According to Article 44 of the 2019 Law on Tax Administration specifying the deadline for tax declaration filing as follows:

Deadline for tax declaration filing

1. The deadline for filing tax declarations for taxes declared monthly or quarterly is regulated as follows:

a) No later than the 20th day of the following month for monthly declarations and payments;

b) No later than the last day of the first month of the following quarter for quarterly declarations and payments.

...

It can be seen that the deadline for monthly tax payment is the 20th day of the month following the month when the tax obligation arises;

The deadline for quarterly tax payment is the last day of the first month of the following quarter when the tax obligation arises.